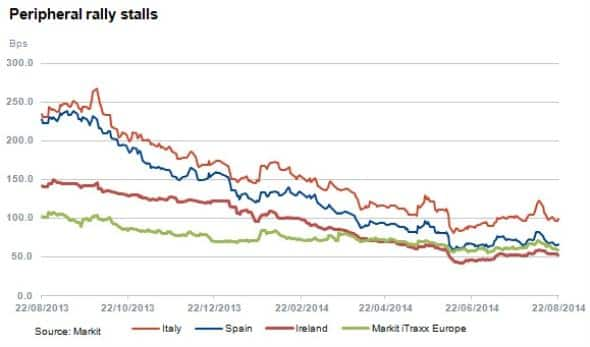

Peripheral rally stalls

CDS on peripheral sovereigns have outperformed the corporate market over the past year, but the rally has ground to a halt in recent months.

- Peripheral CDS have widened during the summer

- PMIs show persistent economic stagnation in the eurozone

- Spreads remain tight amid expectations of ECB QE

CDS on peripheral eurozone countries are no longer the closely watched indicators they were a few years ago. A combination of Mario Draghi's commitment to the irreversibility of the euro in 2012 - "whatever it takes" - and the EU ban on naked positions has seen sovereign CDS fall out of favour, if only in western Europe.

Peripheral CDS is active

But they are still among the most active names in the CDS universe, even if much of the activity is driven by CVA desk hedging of interest rate exposures. Recent spread movements, therefore, shouldn't be overlooked.

Italy, Spain and Ireland have tightened significantly over the past 12 months and outperformed the corporate market, as measured by the Markit iTraxx Europe. Spain's rally was the most impressive, tightening from 239bps in September 2013 to 59bps in June 2014.

However, the rally has stalled in recent months and entered a modest reversal. Italy was trading at 81bps on June 9th - two months later it was quoted at 123bps, though it has since recovered to 99bps.

The slump continues

Such credit deterioration is rare in this era. Perhaps it can be explained by the periphery's economic performance. The Markit Flash Eurozone PMI this week indicated that the periphery's recent improvement is waning, and recent figures showed that the region's weaker economies face significant problems.

Spain's GDP is growing, but it is some way of recovering the lost output from the recession. Deflation is on the horizon across the eurozone, which is worst case scenario for debt-laden countries, such as Italy and Ireland.

Monetary policy is king

But economic data has had a minimal impact on eurozone sovereign CDS since the ECB's threat to intervene, so it is likely that there are other factors at play. Volatility has picked up slightly across asset classes in recent weeks, though it remains very low by historical standards. Geopolitics have a part to play, with tensions in the Middle East and, in particular, Ukraine affecting sentiment in Europe.

Monetary policy is still the main driver of spread direction, and the worse the economic data is in the eurozone, the more likely the ECB will ease policy further. The targeted longer-term refinancing operations will be conducted in September and December, and the ECB may well wait to see the stimulatory effects of extra bank lending. If these are disappointing, as many expect, then the probability of QE will increase sharply. We know that QE is positive for risk assets, though the impact may be dampened if spreads stay at tight levels.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.