Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 22, 2017

A Valeant Effort: Pharma Giant's Struggles Continue to Linger in CLO Market

Despite a shift in industry exposure focus towards the retail sector this February, healthcare still poses a risk to collateral performance in the current political environment. The Trump Administration has already taken the first steps to repeal the Affordable Care Act (ACA) by issuing an executive order on January 20th. Most of the concern over the repeal surrounds the shape of policy that would replace the ACA. Fed Chair Janet Yellen expressed additional apprehension in her recent meeting on Capitol Hill last week, citing the potential impact policy shifts could have on monetary policy and the overall outlook of macroeconomic health.

President Trump has criticized the pharmaceutical industry and rising drug prices in the U.S. Parts of his plans include introducing price bidding into the Medicare program, which may put immediate pressure on financial performance in the pharmaceuticals industry. Congressmen Bernie Sanders and Elijah Cummings also targeted Marathon Pharmaceuticals last week over drug price hikes. Similar congressional scrutiny has also impacted Valeant, Mylan, and Turing.

The landscape amongst the major insurance providers has also shifted since large-scale consolidation following the Supreme Court's upholding of the ACA in the summer of 2015. A federal judge blocked the Aetna-Humana merger for antitrust violations, and Cigna is seeking to break up its merger with Anthem. Molina Healthcare and Humana also announced their intentions to exit coverage under the Obamacare program, which poses major obstacles to the fundamental components of replacement legislation.

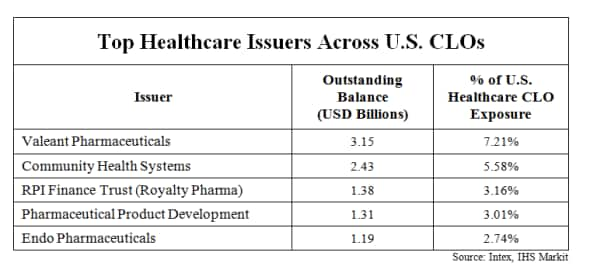

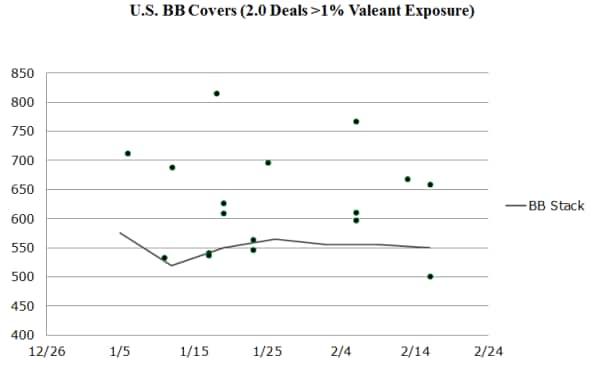

Valeant remains the top issuer across all industries with over $3 billion currently outstanding amongst U.S. CLOs. Despite announcing a divestiture program and plans to address over $30 billion in leverage, the BB tranches of deals with high exposure to its debt continue to trade wide of the rallying BB stack in 2017. Valeant shares remained grounded throughout January while the iShares Nasdaq Biotechnology (IBB) approaches double-digits gains for 2017.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-credit-a-valeant-effort-pharma-giant-s-struggles-continue-to-linger-in-clo-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-credit-a-valeant-effort-pharma-giant-s-struggles-continue-to-linger-in-clo-market.html&text=A+Valeant+Effort%3a+Pharma+Giant%27s+Struggles+Continue+to+Linger+in+CLO+Market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-credit-a-valeant-effort-pharma-giant-s-struggles-continue-to-linger-in-clo-market.html","enabled":true},{"name":"email","url":"?subject=A Valeant Effort: Pharma Giant's Struggles Continue to Linger in CLO Market&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-credit-a-valeant-effort-pharma-giant-s-struggles-continue-to-linger-in-clo-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+Valeant+Effort%3a+Pharma+Giant%27s+Struggles+Continue+to+Linger+in+CLO+Market http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-credit-a-valeant-effort-pharma-giant-s-struggles-continue-to-linger-in-clo-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}