ETF investors flow past the Fed

ETF equity investors in the US were ambivalent to an eagerly anticipated rate decision by the FOMC last week, which saw the largest weekly inflows year to date into US equity ETFs.

- Last week saw $22.7bn of inflows into US equity ETFs, the largest year to date

- $16bn flowed into US fixed income ETFs in the five weeks leading up to the FOMC meeting

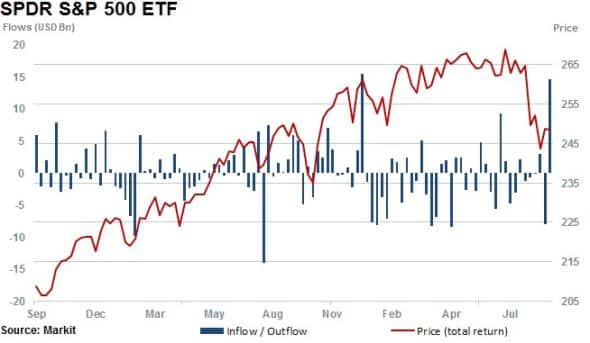

- The SPDR S&P 500 ETF saw its second largest weekly inflow in over five years with $14.6bn

Investors add to US exposure

The Federal Reserve held interest rates unchanged last week with market commentators viewing the call as appropriate considering recent weak economic data releases. The decision not to raise rates over uncertainty on the sustained strength of the American economy is in step with an increase in the negative perceptions of short sellers. Average short interest across the S&P 500 has increased to a three year high.

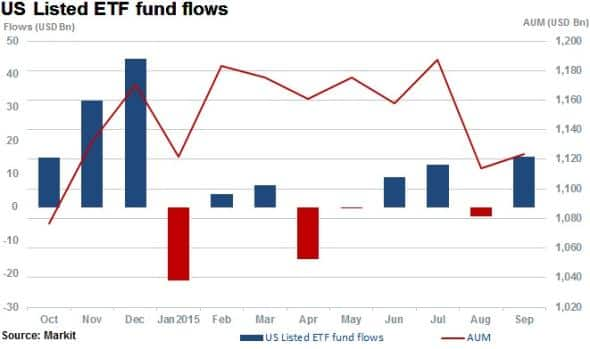

ETF investors have however shrugged off signs of weak sentiment and indicated their bullishness in US equities this past week. Inflows into US domiciled and US focused ETFs in September were the largest recorded inflows of 2015 thus far.

Strong month to date inflows of $15.2bn have been bolstered by large inflows of $22.7bn in the past week, with four weeks of consecutive outflows previously.

Investors bulk up on SPDR

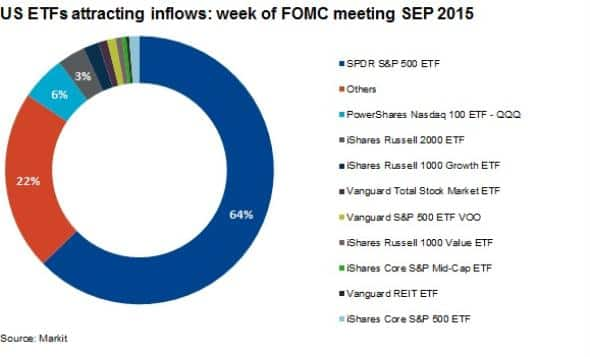

US ETFs represent 38% of global ETFs in terms of AUM, which is currently worth $2.8trillion. Attracting the largest inflows this past week was the largest ETF in the world: the SPDR S&P 500 ETF with $174bn in AUM. $14.6bn of inflows flowed into the ETF, representing 64% of total flows.

The top ten US ETFs by market cap, out of a total 493 listed in the US, accounted for 78% of inflows during the last week.

The strong inflows occurred after the S&P 500 posted the worst weekly performance returns of the year in August. This suggests that investors have been enticed to take advantage of lower prices and are more concerned about catching a market dip than the Fed's decision on interest rates.

Uncertainty and growth in fixed income

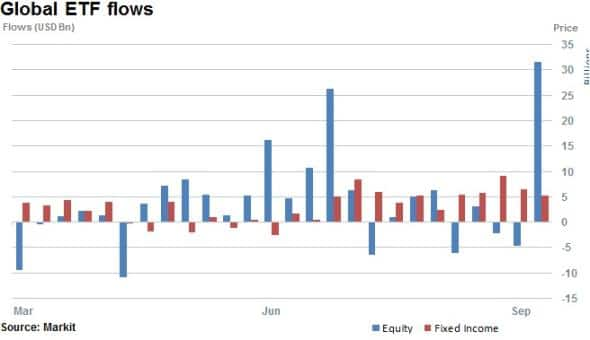

Globally, ETF fund flows across all asset classes attracted $37.3bn of inflows in the past week, with 85% of those funds focused on equities.

However, fixed income ETFs have continued to see strong inflows over the past 13 weeks, with $65bn worth of total consecutive inflows globally. $20bn of these reported net inflows flowed to US fixed income ETFs.

In the five weeks leading up to the rate decision, US investors directed $16bn of funds towards fixed income ETFs. So while some investors are seemingly bullish on equities, some are still putting their money into fixed income.

Large inflows into fixed income ETFs have occurred in Apac, where there have been signs of investors in Chinese markets using fixed income ETFs to gain shelter from increasingly volatile equity markets.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.