Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

STRUCTURED FINANCE COMMENTARY

Apr 19, 2017

Game of Phones: The Emergence of Smartphone-Backed Securities

A Carrier Always Pays its Debts

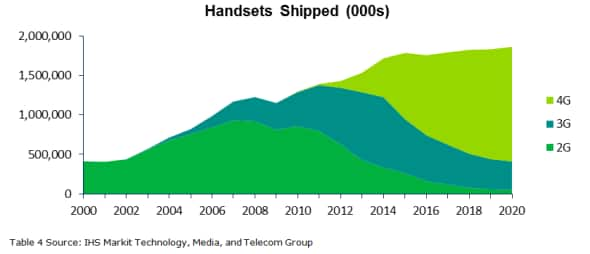

The securitization of device payment receivables comes amid the termination of carrier-subsidized phone plans. Historically, consumers would purchase mobile phones at deep discounts in exchange for signatures on multi-year contracts - ultimately binding individuals to telecom providers. This arrangement worked well during the age of flip phones on slower (2G) wireless networks, as inevitable price deterioration made subsidization sustainable. However, the proliferation of smartphones drove the average sale price of mobile devices to prohibitively expensive levels - consequently forcing carriers to shift full market prices onto consumers. Carriers are now looking to leverage receivables from cell phone instalment plans to tap a cheaper source of debt financing.

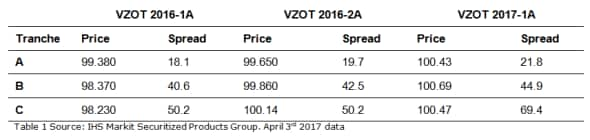

Verizon came to market with its third device securitization this past March, further cementing the presence of the budding consumer ABS sector. The deal, comprised of three investment-grade debt tranches, priced 60-100 basis points wider across the capital structure than the carrier's initial securitization offering. Still, the issuance garnered relatively low coupons down the stack, pricing in-line with similarly-rated prime auto loan ABS. Akin to the existing Verizon deals, which closed in July and November of 2016, respectively, last month's offering bore an original balance exceeding $1 billion.

The nascent asset class is composed of bonds backed by receivables from cell phone payment plans, which amortize interest-free over a two-year period. Due to the inherently short lives of the underlying assets, deals have built-in reinvestment periods where cashflows are continuously diverted from tranche principal payments to purchase additional receivables. The debt tranches, which pay down sequentially following termination of the reinvestment period, benefit from structural credit enhancement, material overcollateralization, a reserve fund, and performance-based early amortization triggers.

Device ABS has seen enthusiastic reception in the secondary, with significant dealer sponsorship in first- and middle-cashflow bonds. Earlier Verizon senior tranches have liquidity scores of '1', while second-pay subordinate tranches have liquidity scores of '2'. IHS Markit liquidity scores, which are calculated on a 1 to 5 scale using a multi-factor merit-based methodology, indicate IHS Markit recently observed meaningful market activity on a given bond, including dealer bids, offers, two-way markets, BWIC activity, TRACE prints, and/or trade tickets.

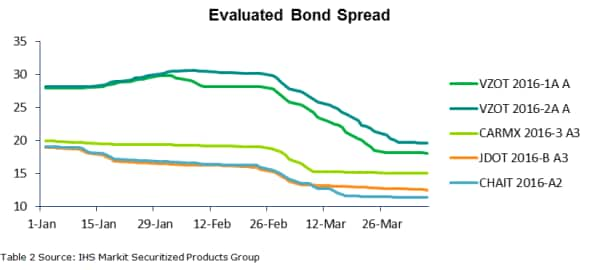

Payment plan sector spreads pushed moderately wider in January 2017, against the flow of comparable consumer credit and general market sentiment. This came as collateral underlying Verizon's July and November deals deteriorated modestly within the first few months of issuance, with cumulative loss and delinquency rates ticking gradually higher. While both metrics currently remain well-below early amortization limits, reinvestment period performance has illustrated the sensitivity of the underlying asset pools. Around one-third of outstanding collateral is considered to be of subprime quality, and over 50% of borrowers carry FICO scores below 700.

Still, the proliferation of the new asset class and healthy primary market interest seem to be allaying any qualms over collateral, as spreads have compressed materially following the closing of Verizon's third deal on March 14. TRACE market data shows a $10 million current face piece of VZOT 2016-1A A trading at 99.148 (E+22) on March 10 and a $1.8 million current face piece of the bond later trading at 99.383 (E+18) on March 23.

How We Got Here

Upon the introduction of the iPhone 3G in 2009, AT&T and Apple worked in tandem to formulate a device subsidy program that proved successful for general market consumption of both smartphones and data usage. The unintended consequence of this move, however, was to highlight the tenuous nature of the carrier business model - especially as mobile phones rapidly evolved from traditional "user equipment" into essential consumer products. Smartphone features and capabilities were shifting to meet the needs of consumers as opposed to network providers, and the rush of manufacturers to provide larger screens, superior camera quality, and over-the-air services (streaming music/video) had a material impact on the average sale price (ASP) of mobile devices.

Instead of gradually deteriorating over time, cell phone prices were rising - consequently debilitating operators utilizing the device subsidy model. The unsustainability of locking up cash under the existing business practice forced all major carriers to do away with legacy subsidization programs and adopt the cashflow-neutral instalment plans we see today.

Looking Forward

The issuance of bonds backed by instalment plan receivables serves to benefit carriers in a myriad of ways. Beyond liquidating prolonged cashflow streams through the sale of receivables to securitization trusts, the utilization of device ABS allows network providers to reduce their cost of debt in primary markets. The isolation of assets underlying bond issuance from the performance of overarching corporate entities, in conjunction with debt tranching and other internal credit enhancements, allows carriers to command superior credit ratings on receivables-backed bonds relative to corporate debt. The $1.1 billion front-pay tranche of Verizon's March securitization, which accounts for 85% of the deal's original balance, was issued with a AAA-rating despite the low investment-grade status of the carrier's vanilla corporate bonds.

According to IHS Markit's Technology, Media, and Telecom group, reducing financing costs to liberate cashflow has become critical for telecom providers as wireless networks continue to grow in scope and complexity. Whereas 2G and 3G networks ran on a fixed allotment of licensed spectrum, 4G networks require additional spectrum to scale capacity and data throughput. Consequently, in order to remain competitive, carriers are forced to invest constantly in network infrastructure.

At the same time, network operators are rapidly transforming into content providers to stimulate consumer demand - using capital assets to purchase content and offer more value to subscribers. Such themes will likely drive device ABS issuance among the major carriers as they seek to leverage billions in outstanding receivables for more favourable financing terms.

IHS Markit's Securitized Products Pricing service provides independent evaluated pricing, sector level time series and transparency metrics across Agency Pass-Through, Agency CMO, Non-Agency RMBS, Consumer ABS, European ABS, CMBS, TruPS, CDO and CLO asset classes. For further information please email: USABSPricing@Markit.com

Matthew Daly, Associate, Securitized Products

Tel: +1 212 205 1246

matthew.daly@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042017-Structured-Finance-Game-of-Phones-The-Emergence-of-Smartphone-Backed-Securities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042017-Structured-Finance-Game-of-Phones-The-Emergence-of-Smartphone-Backed-Securities.html&text=Game+of+Phones%3a+The+Emergence+of+Smartphone-Backed+Securities","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042017-Structured-Finance-Game-of-Phones-The-Emergence-of-Smartphone-Backed-Securities.html","enabled":true},{"name":"email","url":"?subject=Game of Phones: The Emergence of Smartphone-Backed Securities&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042017-Structured-Finance-Game-of-Phones-The-Emergence-of-Smartphone-Backed-Securities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Game+of+Phones%3a+The+Emergence+of+Smartphone-Backed+Securities http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042017-Structured-Finance-Game-of-Phones-The-Emergence-of-Smartphone-Backed-Securities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}