Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 15, 2016

Shorts' covering continues as US equities surge

The rally seen in US stocks from lows in February has not been felt evenly across large and mid-cap companies; these uneven effects have also been mirrored in shorting activity.

- Shorts cover a quarter of positions across the largest 200 US firms by market cap

- Midcap stocks see short sellers hold on despite their recent outperformance

- Demand to short Tesla at a three year high as Under Armour short interest approaches all-time high

Shorts cover 10% of mid-rift

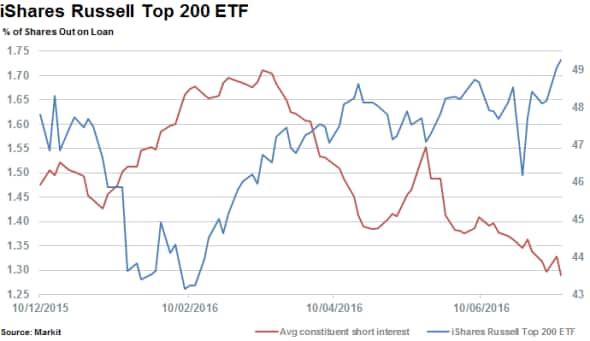

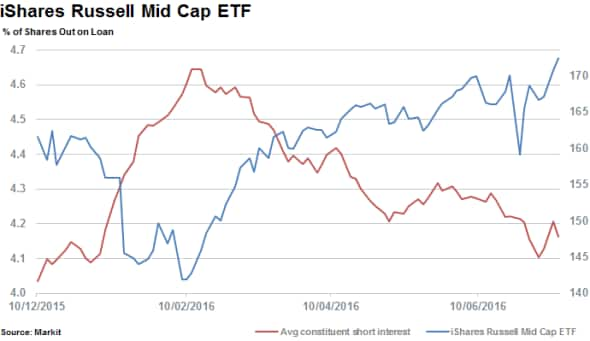

US equities have continued to rally after briefly touching recent lows in February. According to the performance of the iShares Russel Mid Cap ETF and the iShares Russel Top 200 ETF, midcap and large cap stocks have rallied by 21% and 14% respectively from their yearly lows.

Despite midcap stocks outperforming, short sellers have covered more than twice the percentage of positions across large cap names.

Average short interest of the constituents of the iShares Russel Top 200 has declined by 25% from 1.7% to 1.3% as of latest count. Meanwhile average short interest of the relatively high constituents of the iShares Russel Mid Cap ETF (the next 800 largest companies by market cap) has declined by relatively less, falling 11%, from 4.6% to 4.1%.

Perhaps short sellers (on average) expect that large caps have more to run in order to 'catch up' to the performance of midcaps or alternatively that the midcaps have scope to moderate lower. A few key names however, have continued to see strong short demand and high levels of shorting activity.

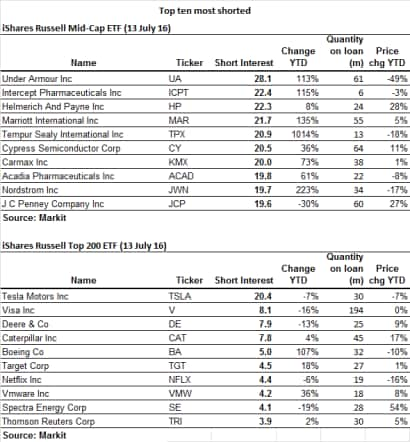

The most shorted firm across the iShares Russel Top 200 ETF, which consists of the largest 200 companies in the US, is Tesla Motors, which has in fact seen short sellers cover positions.

After reaching a record high level of short interest in March, shorts have covered 7% of Tesla positions year to date. The company is currently battling reactions to the first self-driving car death, and the firm has also come under scrutiny around the potential acquisition of SolarCity. Additionally, demand to short Tesla stock, as gauged by the benchmark fee or cost to borrow has surged to a three year high.

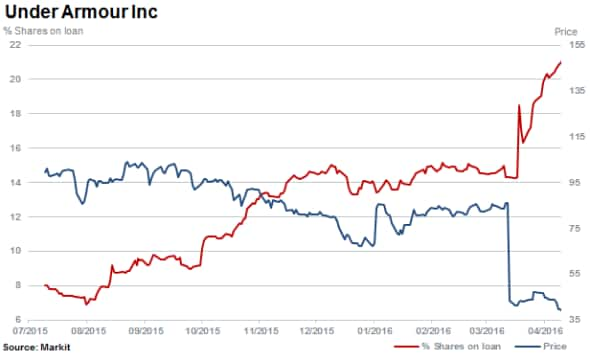

The 'most shorted' stock across the midcaps currently is 'athleisure' clothing retailer Under Armour with 28.1% short interest which has surged higher by almost double since the beginning of April. Short interest has risen and shares have plummeted on slower growth concerns.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-Equities-Shorts-covering-continues-as-US-equities-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-Equities-Shorts-covering-continues-as-US-equities-surge.html&text=Shorts%27+covering+continues+as+US+equities+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-Equities-Shorts-covering-continues-as-US-equities-surge.html","enabled":true},{"name":"email","url":"?subject=Shorts' covering continues as US equities surge&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-Equities-Shorts-covering-continues-as-US-equities-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts%27+covering+continues+as+US+equities+surge http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-Equities-Shorts-covering-continues-as-US-equities-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}