Investor flock to Korea after tax law

In an effort to pry open corporate cash coffers, South Korean lawmakers have recently announced a series of tax measures aimed at encouraging companies to pay more dividends.

- KOSPI 200 companies are forecast to grow payouts by 13% in the current fiscal year

- This has helped reverse two quarters of international ETF outflows

- Local investors are not convinced and continue to pull assets from domestic exposed funds

Frustrated with growing corporate cash piles and falling dividend payments, South Korean lawmakers have taken steps to encourage companies to lift their dividend payments. Should the proposed scheme go ahead, companies would see their profits face an additional 10% tax if wages, dividend payments and investments fail to pass a certain threshold of gross profit.

While it's still too early to gauge the impact of these regulations, foreign ETF investors have been encouraged by the steps taken by the country's lawmakers and have increased their exposure in South Korean equities for the first time this year.

Dividends set to rise

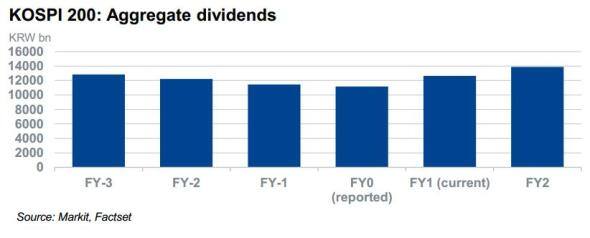

It is too early to say whether the recent developments have had much of an impact on corporate dividend policy. South Korean firms seem to have responded to recent shareholder pressure to lift their aggregate payments with current fiscal year forecasts across KOSPI 200 constituents set to increase for first time over three years according. Markit forecasts that firms across the index will issue KRW 12.7t of aggregate dividend payments, a 13% increase on last year's total.

While the current average yield for the coming 12 month is still relatively low at 1.2%, the increase is a step in the right direction after three years of aggregate dividend cuts across the index.

The government looks to be setting the example here as the six government controlled constituents of the KOSPI are set to triple their aggregate payment from last year's total of KRW 480bn.

Chaebols still to take the bait

While the improved payments in the government controlled space are a step in the right direction, the country's large conglomerate "Chaebols" are yet to fully embrace to the dividend message, with two thirds of them expected to make flat payments from the previous fiscal year.

International investors encouraged

The recent developments in the dividend space looks to have captured ETF investors' imagination as South Korean focused ETF's listed outside of the country have seen strong inflows over the last two and a half months. These 22 products have seen $450m of inflows in the third quarter to date, reversing a bearish streak which saw $165m of net withdraws in the first half of the year.

This was mostly driven by US investors with the iShares MSCI South Korea Capped ETF experiencing $364M of inflows in the third quarter to date.

Domestic investors remain to be swayed

Domestic listed South Korean Equity ETFs have yet to see the benefit of the recent developments. The 98 product which invest in the country's local market continued to see outflows over the third quarter amounting to $255m. This has taken the year's aggregate outflow past the $2bn mark which makes 2014 set to be the first time South Korean investors have trimmed their exposure in domestic shares since the economic crisis.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.