Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come.

- Jakks Pacific is the most shorted company announcing results this week

- Nordic firms make up the majority of heavily shorted European names announcing earnings

- In Asia, Singapore Press Holdings is the only non Japanese firm to see high short interest

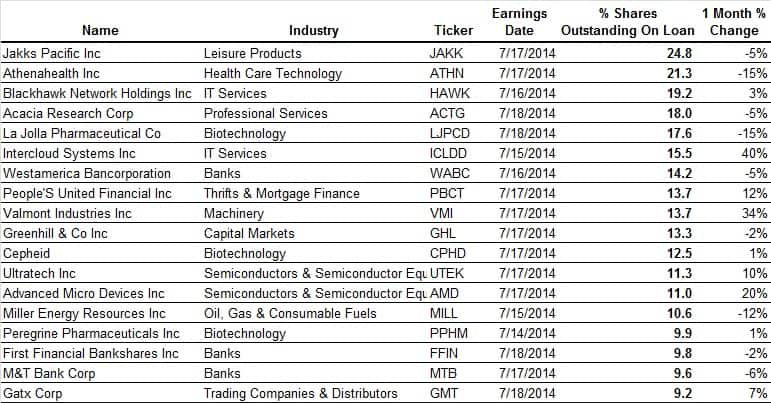

North American earnings

The second quarter earnings season starts to gather pace this week in the wake of Alcoa’s recent results announcement. On the heavily shorted side, there are18 firms seeing more than 9% of their shares out on loan ahead of announcing results this week.

Leading the way as the most shored company announcing results this week is toy manufacturer Jakks Pacific which sees nearly a quarter of its shares out on loan. The firm, whose shares are still recovering from a disastrous second quarter last year, has seen shorts surge in the wake of its first quarter results and recently saw an all-time high demand to borrow. It’s also worth noting that the company does have several convertible bond issuances outstanding which means that a portion of the borrow could be to cover non directional shorting.

The second most shorted company, medical record solution firm Athenahealth, has also seen a surge in short interest over the last few months after disappointing results last time around. The company now sees 21.3% of its shares outstanding on loan after seeing its shares slump by more than a third after failing to live up to analyst expectations.

Also seeing heavy short interest in the health space are biotech firms La Jolla Pharmaceutical, Cepheid and Peregrine Pharmaceuticals.

Intercloud Systems takes the honours as the firm seeing the largest surge in demand to borrow ahead of results after seeing a 40% increase in shares out on loan. Analysts are forecasting the firm to announce its third lossmaking quarter in a row.

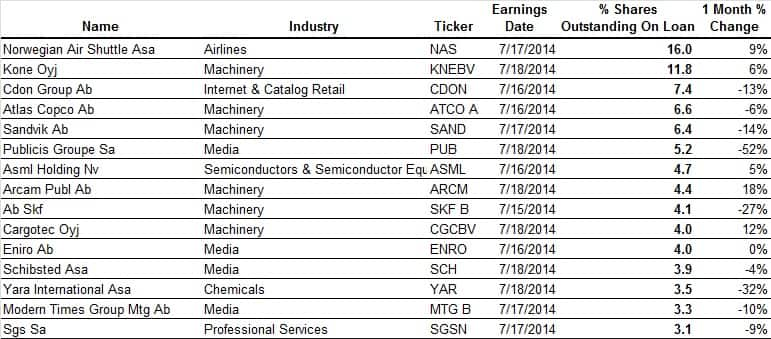

European earnings

Europe also sees its earnings season gather pace, with 15 firms seeing heavy demand to borrow in the lead-up to results.

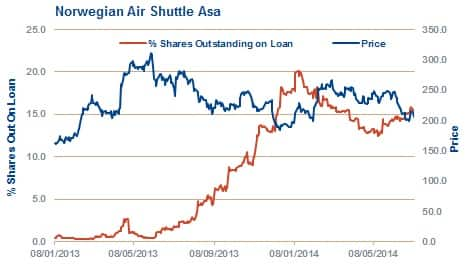

Airline Norwegian Air Shuttle (NAS) sees the most demand to borrow with 16% of its shares out on loan as it fights its local rival SAS for dominance in the region. While NAS, which operates on a lower cost base than its rival, looks set to have the upper hand in the struggle. The main unknown holding NAS shares down is whether or not its foray into long haul discount trips to North America will be successful as it faces an uphill regulatory battle. In the interim, short sellers seem willing to stay the course, although current demand to borrow is somewhat off the highs seen in the closing weeks of last year.

Nordic firms make up the majority of heavily shorted names in the list of 12 of the 15 most shorted firms. Sector wide, machinery firms are the best represented with seven firms in the most shorted rankings.

Leading the way in the is elevator firm Kone which has nearly 12% of its shares out on loan, no doubt led by China’s slowing growth which could dent sales in the firm’s second largest market. Demand to borrow Kone shares is up three fold in the last 12 months.

Outside of the Nordic region, French advertising firm Publicis has 5% of its shares out on loan although demand to borrow shares in the firm looks to have collapsed in synch with its recent abandonment of a proposed merger with American peer Omnicom.

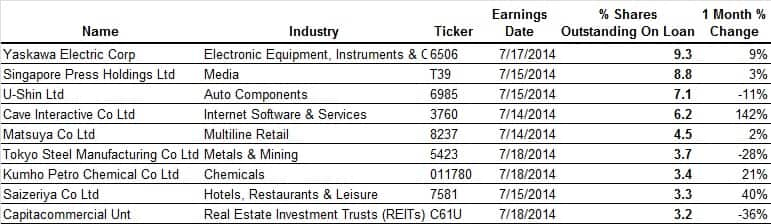

Asian earnings

Asia also sees a pickup in earnings activity with nine firms seeing more than 3% of shares out on loan ahead of earnings.

Japanese firms again make up the majority of the heavily shorted names with seven of the nine. Leading the way is Yaskawa Electric Crop which has 9.3% of shares out on loan. Demand to borrow shares in the electric component company has steadily climbed over the last month to make it the fourth most shorted constituent in the Nikkei 225 as analysts forecast it to see a 10% fall in profit from the previous year.

Other Japanese firms seeing high demand to borrow in the lead up to results include U-Shin, Cave Interactive and Matsuya.

Looking beyond Japan, we continue to see heavy demand to borrow shares in Singapore Press Holding. Although the demand seems to have waned over the last few months, the current 8.8% of the firms shares out on loan is roughly a third lower than the all-time high seen 12 months ago.