Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 11, 2017

Will Italy emerge as the volatility catalyst?

2017 was widely touted to be the year of volatility. The UK government started the fraught process of leaving the EU, while the Dutch and French elections were scheduled with populist far-right parties riding high in the polls.

But here we are, in the middle of Q2 and volatility is at rock bottom. The Markit VolX Europe index, which measures realized volatility, is at 26% over 60 days - close to its lowest level since the heady days of 2007. Implied volatility is at 33% on at-the-money 3-month options, according to Markit data.

Each of the potential catalysts has barely caused a blip, particularly in comparison to the Brexit referendum and US election last year. Political risk has yet to deliver the shock of uncertainty that many feared. The latest hurdle cleared was the French presidential election, where centrist Emanuel Macron won a comfortable victory. This has eliminated the threat of a National Front Presidency and a referendum vote on EU membership. French sovereign CDS rallied to 30bps, significantly tighter than the 68bps see in late March. The basis between 2003 and 2014 contracts shrunk to 10bps, a far cry from the 40bps only a few weeks ago. However, 10bps is still materially larger than the 2-3bps last year and other countries also show higher basis, perhaps suggesting a repricing of redenomination risk amid additional scrutiny of the definitions.

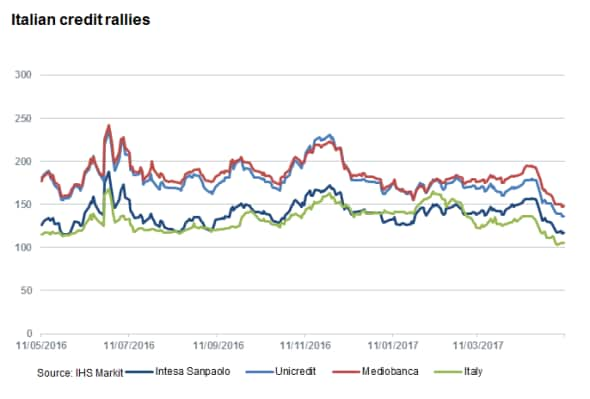

Italy's ISDA basis is still well over 50bps, indicating that market participant see a possible Eurozone exit as a possibility. But it cannot be ignored that Italian credit has rallied considerably in recent weeks. The Italian sovereign hit 103bps and is threatening to dip below 100bps for the first time since January 2016. Italian banks have rallied in tandem, no doubt helped by signs that balance sheet deterioration has been arrested. Unicredit, Intesa Sanpoalo and UBI Banca all reported a slowdown in bad loans, the millstone around the neck of the Italian banking sector.

Even Monte dei Paschi, by far the weakest of the country's banks, saw its provision for bad loans decline. But its subordinated CDS are trading at 64 points upfront, indicating a very high probability of default. Credit investors are expecting a bail-in of subordinated bondholders if the Italian government's rescue package is approved by the EU.

Italy may now become the focus of political risk given that the populist Five-Star Movement is ahead in the polls. An election has to be held by spring 2018 at the latest, and a snap poll would certainly have the capacity to reignite volatility.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-credit-will-italy-emerge-as-the-volatility-catalyst.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-credit-will-italy-emerge-as-the-volatility-catalyst.html&text=Will+Italy+emerge+as+the+volatility+catalyst%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-credit-will-italy-emerge-as-the-volatility-catalyst.html","enabled":true},{"name":"email","url":"?subject=Will Italy emerge as the volatility catalyst?&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-credit-will-italy-emerge-as-the-volatility-catalyst.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Will+Italy+emerge+as+the+volatility+catalyst%3f http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052017-credit-will-italy-emerge-as-the-volatility-catalyst.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}