Most shorted ahead of earnings

We look at how short sellers are behaving towards companies announcing earnings in the week to come:

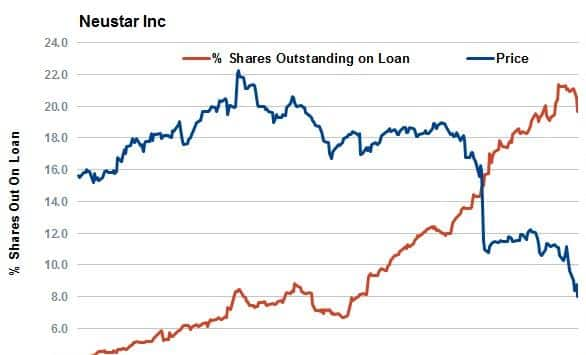

- Neustar is the most shorted company ahead of earnings

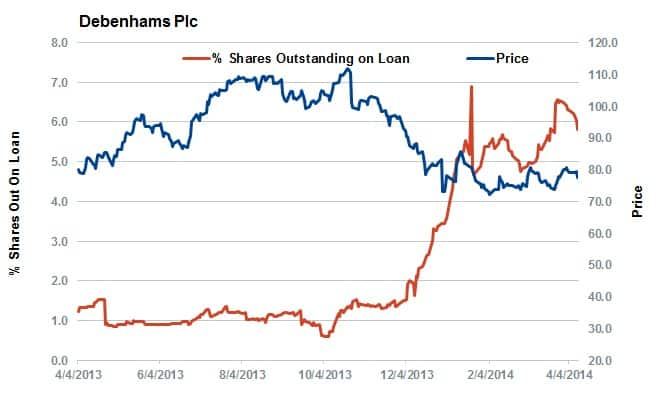

- In Europe, UK listed Debenhams has 6% shares out on loan

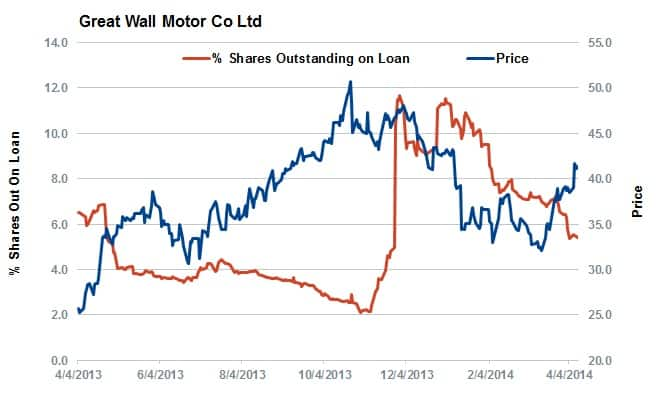

- Asian automobile manufacturer Great Wall Motor has seen shorts cover ahead of earnings

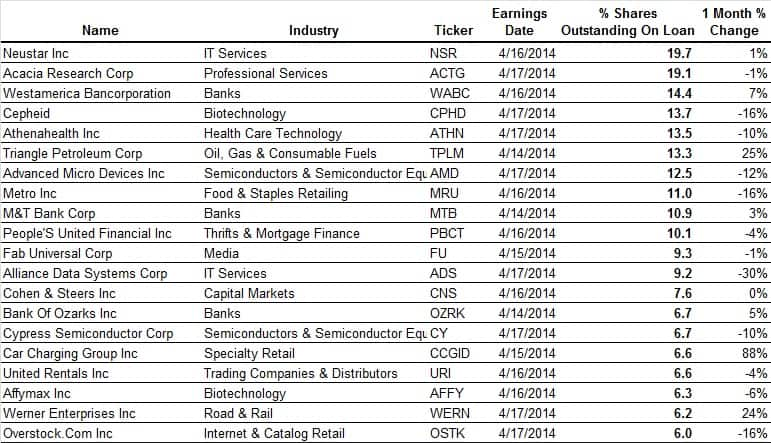

North American earnings

Alcoa’s first quarter earnings provided some welcome good news last week and though next week’s shortened trading week sees a lull in earnings releases, we nonetheless see plenty of companies with interesting short flow ahead of earnings. As such, there are 20 firms announcing earnings this week with 6% or more of their shares out on loan.

Neustar Inc comes in as the most shorted North American company announcing earnings this week. The data analytics company has seen its shares fall by more than 44% year to date after it announced weaker than expected revenue guidance. This has seen shorts increase their positions to an all-time high and there are now nearly 20% of the company’s shares out on loan, up from 12% at the start of the year.

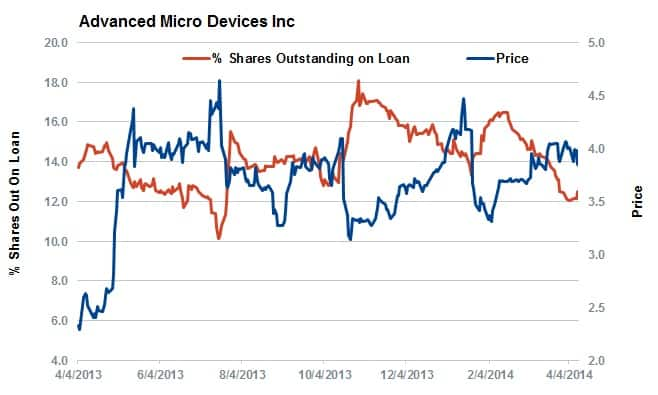

Also in the tech space is Advanced Micro Devices, which analysts are expecting to post a 30% increase in revenues from the same period last year. AMD has seen short covering in the last few months after putting a string of loss making quarters behind it. The company still sees heavy demand to borrow however with 12.5% of shares out on loan.

Financials also see several members make the heavily shorted list including Westamerica Bancorporation, M&T Bank, Cohen and Steers and Bank of Ozarks. The majority of whom have seen increased demand to borrow in recent months with the exception of Bank of Ozarks.

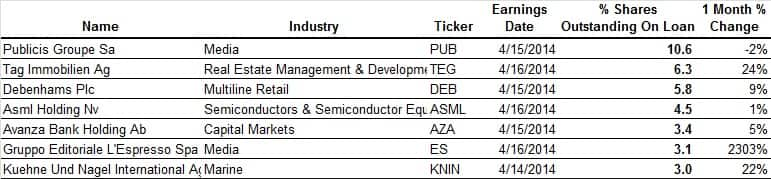

Europe

Europe also sees subdued earnings activity and therefore has only seven firms with more than 3% of shares out on loan ahead of imminent results.

Media names Publicis Groupe and Gruppo Editoriale L'Espresso stand out as the firms seeing largest demand to borrow and greatest surge in short interest in the last four weeks respectively. Yet this seems tied to recent merger actions.

Outside of the media space, struggling UK retailer Debenhams has continued to see demand to borrow climb in recent weeks despite attracting interest from UK retail entrepreneur Mike Ashley. The company now has just below 6% of its shares out on loan, four times higher than where that number sat six months ago.

The tech worries on the other side of the Atlantic have also been felt in Europe with semiconductor equipment manufacturer ASML having seen a resurgence in demand to borrow with 4.5% of the company’s shares now out on loan.

Asia

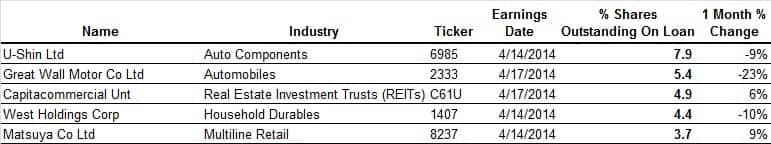

Asia sees much lower earnings flow next week with only five companies seeing more than 3% of shares out on loan.

Automobile parts manufacturer U-Shin sees the highest demand to borrow in the continent, though this seems tied to the company’s issuing of over $75m of convertible debt last August and is therefore not likely to be directional.

The second most shorted company announcing earnings this week is another car related play. Chinese company Great Wall Motor has seen its demand to borrow fall by nearly a quarter in the last four weeks as its shares rebounded from a recent low. Shorts had targeted Great Wall after doubts were raised about the state of the domestic Chinese economy, but many have called these fears overblown. This seems to be reflected in Great Wall’s analyst expectations as the company is forecasted to grow sales by 20% in the coming year.

In Japan, uncertainty around the recent hike in sales tax sees much doubt raised about the strength of the country’s consumers. To this extent, consumer-focused West Holdings and Matsuya have seen short interest climb in recent weeks.