Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 11, 2017

Asian stocks miss out in global dividend surge

Dividend payments are set to rise across the world as commodities firms put last year's volatility behind them however Asian stocks lag behind as Chinese and Hong Kong banks trim payments.

- UK dividends top global league table with a 10% surge in payments forecast, driven by pound slump and commodities rebound

- Payments by European (ex UK) and North American firms predicted to grow by over 6.5%

- Asian payments expected to fall by 2.2% in dollar terms although only two countries, South Korea and Hong Kong, register falls in local currencies

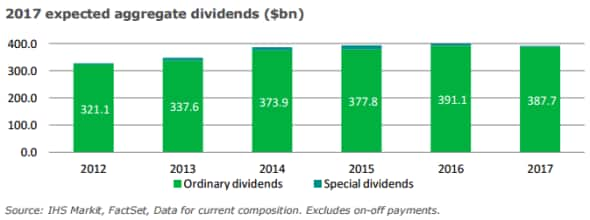

The global dividend picture for the coming year is looking much rosier than 12 months previously, as the calming commodities markets means that energy and materials firms are set to resume dividend growth after slashing payments across the world. This positive trend is further improved by the rising dollar which underpins many commodities related dividend policies.

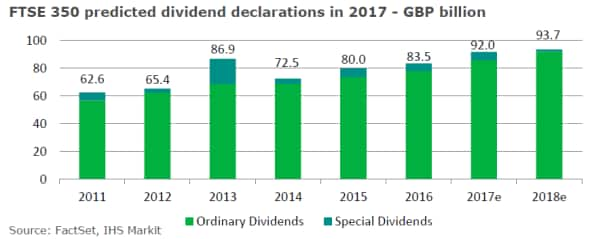

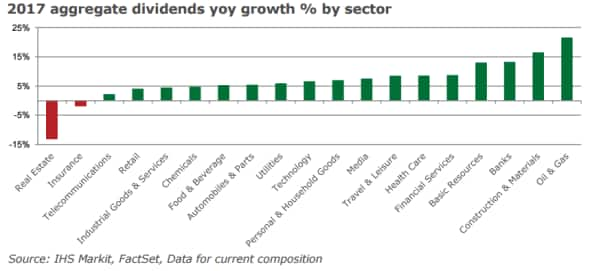

Nowhere are these two phenomenon felt more acutely than in the UK where FTSE 350 firms are expected to pay 10% more aggregate dividends over 2017 than the preceding year. The "92bn of payments expected by Markit Dividend Forecasting, which represents a record for the index, are led by oil majors BP and Royal Dutch Shell which are forecast to contribute 22% of the total.

Although both firms are expected to keep their dollar denominated payments flat, the fall in the pound since last year's Brexit referendum means that UK investors stand to see a healthy boost in income when these payments are translated back into pounds.

The same trend is evidenced in fellow "big five" payer HSBC which also pays its dividends in dollars meaning that investors will see an 11% rise in payments even though the company is also forecasted to keep payments flat.

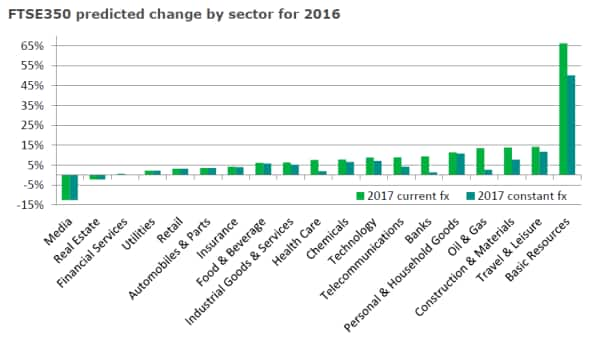

While the dividend boosts in HSBC and oil majors was entirely driven by FX moves, the 66% forecasted surge from the basic resources sector will largely be organic as Glencore stated that it intends to pay out $1bn to investors as it resumes its dividends, while BHP Billiton is expected to hike payments by 66%. Anglo American, Ferrexpo and Petra Diamonds, which all suspended payments over the last couple of years, are also expected to resume payments in the coming fiscal year.

North America and Europe

The calm in the commodities markets will also be felt in the wider European and US markets which are both forecasted to grow by more than 6.5% over the coming year. This marks a large reversal of fortunes for income investors across both regions as their dividends only saw payment growth of 3.5% and 3% in 2016.

Russia, which is heavily reliant on energy dividends, is the driving force among European dividends as the country's firms are set to grow their dividend payments by a massive 22% over the coming year. Ironically this stunning dividend growth is attributed to the fact that oil is still way off levels registered over the last few years despite its recent stability which has forced Russian lawmakers to rely on dividends from partly state owned companies in order to make up for lost revenue. This means that investors in Gazprom, Novatek and Sberkank are forecast to see their aggregate dividends grow by 50% or more compared to 2016.

German dividends are also set to post a better than average increase with an 8% boost in aggregate forecast payments to total "41.3bn. This is mostly due to return to calm in Volkswagen as the company resumes some normality 18 months after news of its emissions scandal first came to light. France, the largest contributor to Europe's dividends total, is expected to register a more prosaic 5% increase in dividend payments despite the fact that its largest banks, BNP Paribas, Societe Generale and Credit Agricole are all forecast to grow payments by 11% or more.

The only laggard in Europe is Sweden which is expecting to register a 3.5% fall in aggregate payments due to a 53% forecasted reduction in Ericson payments as well as a 35% fall in payments made by telecom firm Telia.

Oil & gas is also the top contributing factor for US dividends growth with our analysts forecasting a 22% lift in aggregate payments across the sector. It's worth noting that the vast majority of the forecasted oil & gas dividend lift in the sector hinges on the completion of the GE/Baker Huges merger deal which would trigger a $7.4bn payment to investors. The other commodities sector, basic materials, is also set to snap a three year streak of declining payments with a 13% lift in aggregate dividends.

The post-election rally is also set to lift dividends as construction and materials firms are forecasted to see a 17% lift in payments over the coming year. The sector's fortunes are led by Vulcan Materials which is expected to lift its quarterly dividends payment by 25% off the back of positive revenue and pricing momentum which has lifted its forecasted earnings.

Banks, which have also been benefiting from the recent improving economic picture, are set to disproportionally contribute to the growth in dividends payments with a 13% rise in payments. This is led by large jumps from Citigroup which is forecasted to increase its aggregate 2017 payment by 83% year on year. Banks of America and KeyCorp are other strong performers with a 47 and 34% lift in payments respectively.

Asia lags

The dividend landscape is looking relatively less buoyant out east as overall payments made by the region's firms are set to shrink by 2.2% in dollar terms over the coming fiscal year. Most of this fall can be attributed to the rise in dollar as only two markets - Hong Kong and South Korea - are forecasted to register a fall in locally denominated payments.

Japan, the largest contributor to the region's dividend haul, exemplifies this trend as yen denominated aggregate payments across the country are set to rise by 5%.

Dollar strength isn't the sole factor contributing to Asia's relatively anemic dividend growth area however as Hong Kong, which contributes a fifth of the region's dividends, is forecasted to see a 5.9% fall in HKD denominated aggregate dividends. This significant fall in payments is driven by the banking sector where Markit Dividend Forecasting is expecting 15 of the 21 covered companies to trim payments. Falling bank dividends are likely to be further exacerbated by the large special dividends paid by BOC Hong Kong and Hang Seng Bank last year.

South Korean investors are also set to see aggregate dividend income fall by a tenth in won terms over the coming year. This fall is mostly technical however as many firms, including the country's top dividend payer Samsung Electronics, brought forward dividend payments.

China, the third largest contributor to the total, is also set to register weak dividends growth as payments are only set rise by 1.5% in the coming year. Banks again play a large role in this trend as all four of the country's "big four" banks are forecasted to trim payments as their profits face headwinds from falling net interest margins and rises in souring loans. While aggregate payments across the sector is only forecasted to fall by 0.8%, this decline is significant as it represents the second straight year which Chinese banks have registered a fall in aggregate locally denominated dividends.

Australian dividends, which are relatively more exposed to commodities, are forecasted to be the best performing among the four largest dividend contributing countries with a 7.6% lift in forecasted payments. Not surprisingly the basic resources, oil & gas and chemical sector are the largest contributing factor as combined payments across these three sectors are forecasted to jump by a third over the coming year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Equities-Asian-stocks-miss-out-in-global-dividend-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Equities-Asian-stocks-miss-out-in-global-dividend-surge.html&text=Asian+stocks+miss+out+in+global+dividend+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Equities-Asian-stocks-miss-out-in-global-dividend-surge.html","enabled":true},{"name":"email","url":"?subject=Asian stocks miss out in global dividend surge&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Equities-Asian-stocks-miss-out-in-global-dividend-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+stocks+miss+out+in+global+dividend+surge http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Equities-Asian-stocks-miss-out-in-global-dividend-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}