Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 08, 2017

Short sellers let rally run

Short sellers are showing no signs of calling a top to the Trump election rally, as a unanimous wave of short covering sweeps US equities.

- Average short interest across US stocks down by 10% since last November

- Best performing 10% of US stocks see shorts retreat by a fifth since election

- Short sellers still manage to uncover worst performing stocks

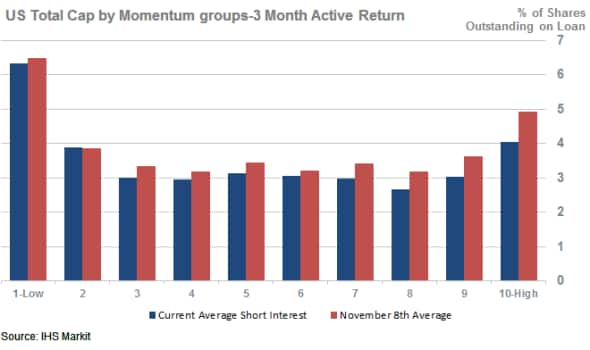

The bull market seen since the election has prompted short sellers to trim their sails as the current average demand to borrow shares across the constituents of the Markit Research Signals US Total Cap universe has fallen by over 10% since the November 7th vote. This covering means that the average demand to borrow the universe has fallen to less than 3.5% of shares outstanding.

Covering among US equities has also been fairly unanimous in the post-election market as over two thirds of the US total cap universe's constituents have experienced a decrease in demand to borrow their shares. Unanimous short covering indicates that investors are yet to see the need to crystalize the recent market wins by taking the other side of the rally through bearish short positions.

High flyers see largest covering

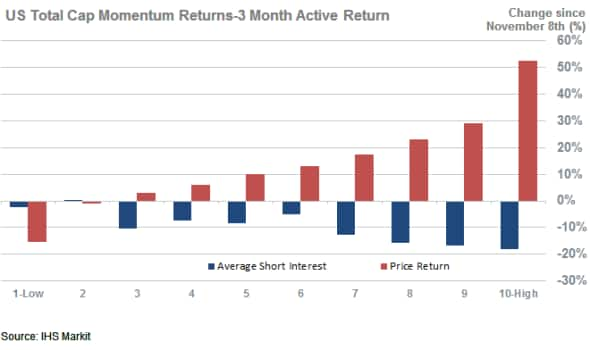

The lack of skepticism is most evident among the recent market's high flyers. The current 10% constituents of the US Total Cap universe which have the best recent price momentum according the 3 Month Active Return factor, those that have returned the most in the last three months, have seen their average demand to borrow fall by 20% since November 8th. This covering is over twice that seen in the overall universe and means that this minority of stocks has seen the largest fall in average short interest since the Trump election.

Whether this shrinking short interest represents a legitimate shift in sentiment or is simply shorts being forced to close positions in the wake of the massive 53% rally seen in high momentum names remains to be seen, but there's no escaping the fact that several of these names have seen their fortunes change materially over the last three months.

Chief among those is United States Steel whose short interest has fallen by over two thirds over the last three months. The market's belief that the new administration will live up to campaign pledges to boost infrastructure spending while supporting domestic US industries has seen analysts more than double their 2017 EPS forecast since the election, prompting a 60% rally in its share price.

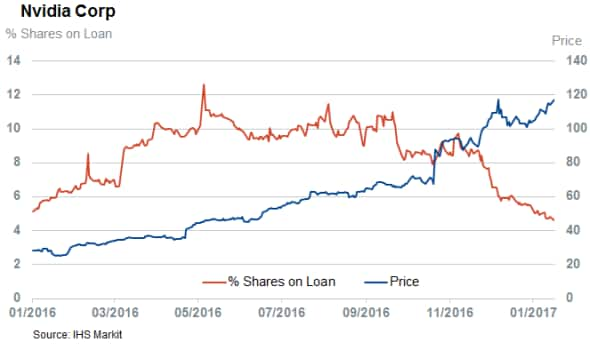

Tech firm Nvidia has been another painful short since the start of November as its shares have surged by 61% after the firm announced better than expected earnings. Short sellers have shown no appetite to short this rally as demand to borrow Nvidia has fallen to a new 18 month low.

Residual skepticism around high momentum stocks still exists however as the current average demand to borrow their shares, 4% of shares outstanding, is still somewhat higher than the universe average of 3.5%.

Not all bad for short sellers

The recent market hasn't been entirely bad news for short sellers however as the recent market laggards, the 10% of shares with the worst price momentum, had the highest average short interest among all ten momentum groups on the eve of the election. Demand to short these firms has by and large stood still as these firms posted average price declines of 15% from their pre-election close.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-equities-short-sellers-let-rally-run.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-equities-short-sellers-let-rally-run.html&text=Short+sellers+let+rally+run","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-equities-short-sellers-let-rally-run.html","enabled":true},{"name":"email","url":"?subject=Short sellers let rally run&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-equities-short-sellers-let-rally-run.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+let+rally+run http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-equities-short-sellers-let-rally-run.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}