Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 07, 2014

Failure to Converge

M&A is back with a vengeance in 2014. The flurry of activity has seen a resurgence of deal arbitrage, with mixed success.

- The spread between Comcast’s offer and the current price of Time Warner Cable is the same as the day of the announcement,

- Early bets that Questcor’s current price will converge with Mallinckrodt’s offer are significantly underwater

- Merger arb ETFs have attracted new assets, despite the strategy not performing last year

After several years of anaemic corporate M&A activity, 2014 looks set to be a strong year for takeovers. Companies have warmed up to large strategic deals which fell out of favour after several years of economic uncertainty.

Global deals announced in the first quarter were up 54% from the same period last year according to Thomson Reuters. The deal momentum continued in April with the global year to date deals announced topping $1.1 trillion.

Resurging arbitrage

The flurry of M&A activity in 2014 has attracted arbitrageurs betting on consummation of the deals. To do so, they will purchase shares of the firm being acquired and short the shares of the acquirer.

Two sectors have seen a large share of recent M&A headlines, pharma/biotech and cable TV providers. Here we review activity around Comcast Corp’s bid for Time Warner Cable Inc and Mallinckrodt PLC’s bid for Questcor Pharmaceuticals Inc.

The increased M&A activity has provided opportunities for merger arb trades, but have they been profitable?

Comcast/Time Warner arb flat

On February 13th Time Warner Cable announced that their board of directors had accepted an offer from Comcast Corp which valued each share of TWC at 2.875 shares of CMCSA. As of the close on Feb 13th, the spread between Comcast’s offer price and the current price of Time Warner Cable was $7.46 per share. Last Friday’s close saw the spread at…$7.46.

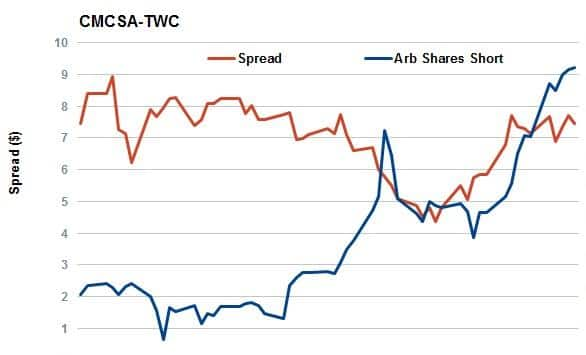

The unchanged spread belies the likelihood that arbitrageurs have already realized profits on the trade. The chart above shows the number of shares short related to the arbitrage (subtracting the CMCSA shares on loan prior to the announcement from the current total) compared with the spread between the offer price and TWC’s price.

There was relatively little activity during the first month following the announcement, however as the spread started to collapse in late March, the arb’s made their move, increasing the shares related to arbitrage to 27m on April 2nd.

During the first three weeks of April, arbs covered short positions as the spread continued to fall. Since then, the spread has returned to the level it was at on the day the deal was announced, while shorts in CMCSA are at a 52-week high. Given that CMCSA is easy to borrow, this trade was easy to put on and had an inexpensive carry.

Questcor pain

Arbitrageurs in the Questcor/Mallinckrodt tie-up have seen the spread between the two companies run away as the Questcor’s discount to the price offered by its acquiring rival has tripled in the last month to the highest level since the deal came to light on April 7th.

On April 7th Questcor Pharmaceuticals announced that they had accepted an offer from Mallinckrodt PLC which valued each share of QCOR at 0.897 shares of MNK plus $30 in cash. It represented an offer price of $86.5, $18.2 more than the QCOR share price on the April 4th. Despite the spread narrowing to $4.1 on the day of the deal coming to light, it has since grown back to $13.18, putting of the recently placed arbs under water.

The shorting in MNK related to the announcement hit 6.5m shares on April 10th, but has since declined to 4.8m shares as the spread has moved relentlessly higher on the back of MNK’s strong performance.

With MNK’s active utilization at 33% there is plenty of supply to put this trade on, however the borrow cost has increased since the announcement, adding further pressure on the arbitrageurs.

Mixed YTD performance for merger arbitrage ETPs

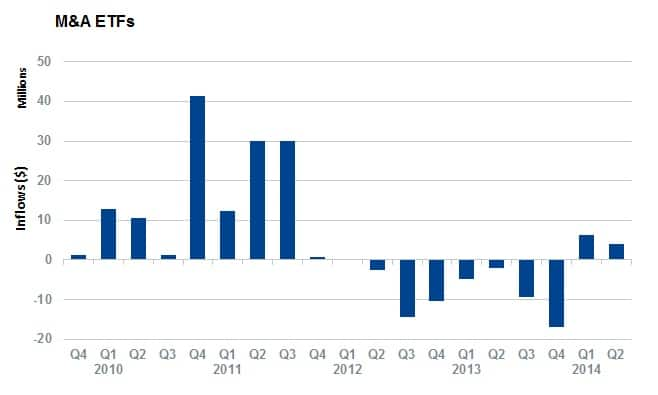

On the ETF side, the deal drought which, saw many hedge funds turn their back on merger arb, also saw large outflows out of merger arb products. The outflow out of the asset class saw assets under management fall by nearly 40% from their peak at the end of 2011.

The recent flurry of activity has seen the four listed ETPs which aim to play merger arbitrage strategies snap a seven quarter net outflow streak. The first quarter of the year saw $6.4m of inflows. This positive mood continued in April when the four funds managed to pull in nearly $4m of new assets.

While assets managed by merger arbitrage ETPs are still relatively low (≈$100M), their returns can be used to gauge the efficacy of the strategy.

In 2013 the two largest funds, the Credit Suisse Merger Arbitrage Liquid Index and the Index IQ ARB Merger Arbitrage ETF returned 7.9% and 6.5%, respectively, well below the returns posted by passive index funds.

Year-to-date, the strategy has still to perform as the CSMA down -2.0%, while MNA is up 2.6%. The relative underperformance is not as bad as last year though as the markets have largely traded sideways

Samuel Pierson, Analyst, Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052014120000Failure-to-Converge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052014120000Failure-to-Converge.html&text=Failure+to+Converge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052014120000Failure-to-Converge.html","enabled":true},{"name":"email","url":"?subject=Failure to Converge&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052014120000Failure-to-Converge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Failure+to+Converge http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052014120000Failure-to-Converge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}