Argentina finally settles

Argentina's credit event auction was held on Wednesday, with a final price of 39.5 in line with expectations

- Argentina's CDS finally settles

- Draghi springs another surprise

- Markit iTraxx Europe trades through Markit CDX.NA.IG

Argentina's interminable struggle with bondholders continues, but at least one element of the saga reached a resolution this week. The credit event auction was held on Wednesday, and the final price was determined as 39.5. As we can see from the chart, this was in line with market expectations. Markit's composite recovery rate was around 40% in the days prior to the auction.

However, the chart also shows that the market had a different view only weeks before the settlement. Until the end of June, the consensus recovery rate was about 25%, the standard assumption for emerging market CDS. It then started to increase as it became clear that a near-term default was a real possibility. By the time Argentina's bondholders failed to receive their payments on July 30, the sovereign's recovery rate was 45%. It then declined to 40% as the auction came into view.

Much of the volatility was due to uncertainty around which bonds were deliverable, particularly notes denominated in Yen. ISDA initially declared that the Yen bonds wouldn't be deliverable because of a dearth of necessary documentation. This decision was subsequently reversed when the prospectus was produced, but that wasn't the end of the matter as ISDA's ruling was challenged.

It was eventually resolved with ISDA deciding that Yen par bonds would be deliverable, but the delay to the auction and the uncertainty over the deliverability of the Yen bonds no doubt caused fluctuations in the composite recovery rate.

The 39.5 final price may have been in line with market expectations, but it seems likely that the Yen bond had an influence on the settlement level. There was significant net buy interest in the first round of the auction, and someone may well have ended up buying a Yen bond at 39.5 that was trading at around 24 before the auction.

Draghi springs another surprise

Argentina will probably fade from view for most investors, though the country's problems with its bondholders will surely extend into next year. The focus for the broader market this week was the ECB, and its surprise decision to cut rates even further. The central bank also announced a bond purchase programmes for ABS and covered bonds, which some are calling "private QE".

The ECB is aiming to increase the size of its balance sheet from the current €2 trillion to €3 trillion, its magnitude back at the beginning of 2012. Whether the combination of bond purchases and the impending TLTROs is capable of achieving this is debateable, which leaves the question of will the ECB eventually take of the step of buying government bonds. There are considerable legal and political obstacles to this policy, notably in Germany, and there are differing views on the ECB's intentions.

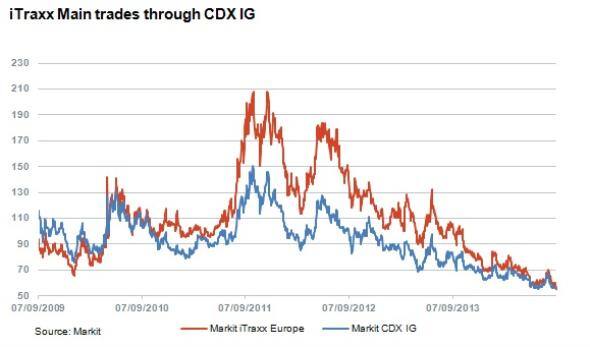

Nonetheless, the markets welcomed the prospect of a massive liquidity injection. The Markit iTraxx Europe tightened to 55.25bps, and traded through the Markit CDX.NA.IG (57bps). Apart from a brief period in June, this was the first time that the indices had reversed their typical positions since May 2010. Given the differing trajectories of US and European monetary policy, this trend could accelerate over the rest of the year.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.