Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 05, 2016

Sterling fall counteracts '1bn Brexit dividend hit

Markit Dividend Forecasting expects the recent EU referendum to have wide ranging implications for dividend payments; however the recent fall in the value of the pound has lifted aggregate payments to be received by UK investors.

- 55 companies forecast to reduce 2016 and 2017 payments in the wake of referendum

- Dividend cuts are expected to total "1bn over the coming two years

- Dividend downgrades outweighed by weak GBP which will lift FTSE 350 payments higher

The Brexiteer dividend

Markit Dividend Forecastinghas released a report outlining dividend expectations for FTSE 350 companies following the Brexit vote. To gain access to the full report, please contact us.

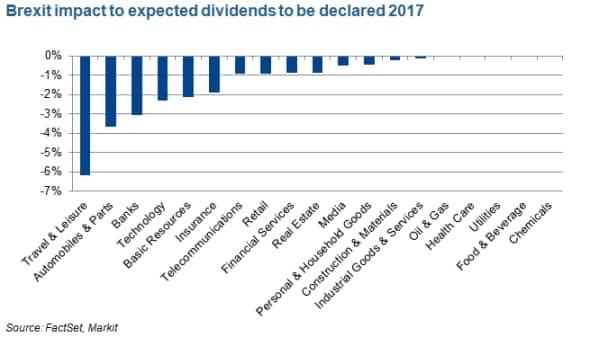

Since the UK's vote to leave the European Union, dividend expectations for 55 UK companies have been lowered by Markit Dividend Forecasting. Travel & leisure firms are at the forefront of the dividend upheaval with total forecasted payments for the 2016 and 2017 trimmed by over 6% in the week and a half since the referendum. Automobiles & parts and banking stocks are also expected to feel the impact as the vote has seen the forecast for the next two years fall by over 3%.

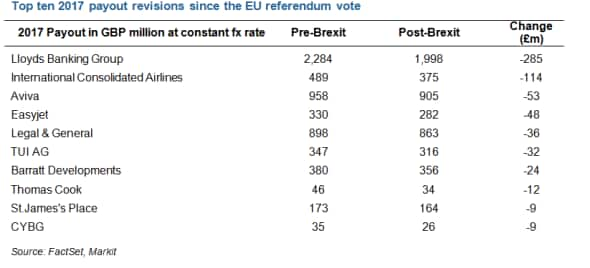

Leading payout revisions is Lloyds banking Group, whose dividend commitments now outstrip earnings by almost double. Dividend growth at the bank is now expected to decline 10% and 17% in FY16 and FY17 respectively.

Banking stocks are expected to suffer the most from Brexit repercussions with the possibility of further declines in economic activity leading to lower payouts. However, also coming under increased pressure in recent days are UK homebuilders.

Forecasts for UK homebuilders have also been lowered and the sector has seen sharp share price declines since the vote, as well as unprecedented outflows seen from property funds.

FTSE 100 lifts dividends in GBP

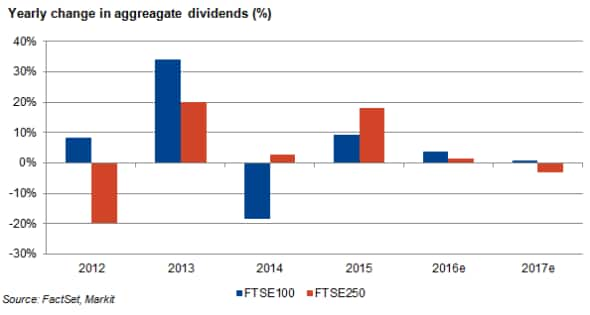

Overall, on a sterling basis and incorporating currency moves post the Brexit vote, FTSE 350 companies' dividends are expected to increase overall; by +3% in 2016 and maintain that level in 2017. This is compared to 1% growth and a -2% decline previously expected for the two coming years.

Due to the weakness in the currency, companies with large foreign earnings are set to convert the best rate in decades with the sterling hovering at 30 year lows. These companies feature predominantly among the largest FTSE 100 firms.

But this growth is not mirrored for FTSE 250 firms with smaller companies' dividend growth now set out underperform. In 2017 FTSE 250 firms are expected to post a decline in aggregate payments for the first time since 2012.

Expectations of higher dividends across FTSE 100 companies have yet to be fully priced in by investors however, with the forward yield of the FTSE 100 currently at 4.1%, almost a third higher than that of the FTSE 250 currently.

Meanwhile, while short sellers may have missed out on a 'Brexit bonanza' the FTSE 250's possible negative exposure to a Brexit vote looks to have been targeted by investors through ETFs.

The iShares FTSE 250 ETF witnessed a ramp up in shorting levels the weeks leading to the referendum vote. Short interest has continued to jump higher, reaching 9.6%, the highest level seen since 2010.

'Uplifts' to UK companies' dividends which earn foreign income have pulled dividend expectations higher overall as the largest multinational companies are set to benefit in the short term from the initial market reactions to the referendum vote.

To receive more information on Securities Finance, Research Signals, Exchange Traded Products, Dividend Forecasting or our Short Squeeze model please contact us

To read this article on our commentary website please click here.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-sterling-fall-counteracts-1bn-brexit-dividend-hit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-sterling-fall-counteracts-1bn-brexit-dividend-hit.html&text=Sterling+fall+counteracts+%271bn+Brexit+dividend+hit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-sterling-fall-counteracts-1bn-brexit-dividend-hit.html","enabled":true},{"name":"email","url":"?subject=Sterling fall counteracts '1bn Brexit dividend hit&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-sterling-fall-counteracts-1bn-brexit-dividend-hit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sterling+fall+counteracts+%271bn+Brexit+dividend+hit http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-sterling-fall-counteracts-1bn-brexit-dividend-hit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}