Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 05, 2016

Brexit attracts shorts to European banks

Short interest across European banks was trending higher in the weeks leading up to the recent UK referendum, and has since surged as these institutions feel the worst of the post Brexit uncertainty.

- Average short interest in European banks more than doubles year to date

- Shorts add almost $1bn to positions in UK banks since Brexit

- Struggling Italian banks currently make up two of the top three most shorted in Europe

Shorts bank on Europe

Europe's largest banking stocks included in the Stoxx 600 index have attracted an increasing amount of short interest in the wake of the UK's referendum on continued membership to the European Union.

European banks have remained under pressure since the financial crisis and have already endured Grexit fears, however the shock Brexit vote has created a possible Lehman moment for banks and short sellers alike.

The slide in stock prices seen since the 'exit' vote would have pleased those short sellers who had had already built up some significant positions in banks earlier in the year. But the recent vote to leave the EU was largely a missed opportunity for short sellers overall, as general covering was witnessed prior to the vote.

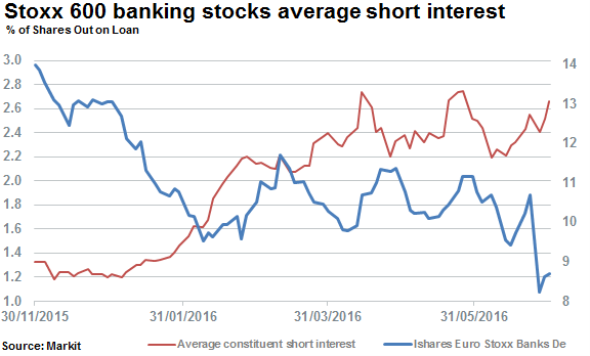

Meanwhile across European banking stocks, short interest has more than doubled year to date, with average short interest rising to 2.6% currently. The iShares Euro Stoxx Banks ETF has fallen by more than a third only just over half way through the year with the ETF is plummeting 18% since the Brexit vote.

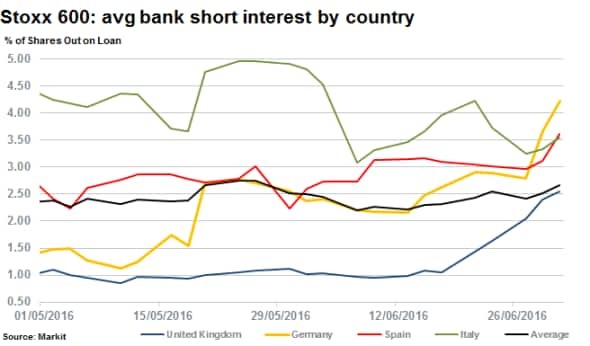

Major European countries have all seen a large increase in banking stocks' short interest in the past month. Levels in the UK and Germany have seen some sharp moves, rising 57% and 46% respectively since Brexit.

Germany's large spike has been driven by concentrated positions by key short sellers in Deutsche Bank and Commerzbank which are the only two German banking stocks forming part of the Stoxx 600. In the UK, fresh short positions in HSBC, Standard Chartered and CYBG have seen almost $1bn in net short positions added since Brexit - the majority of these in HSBC.

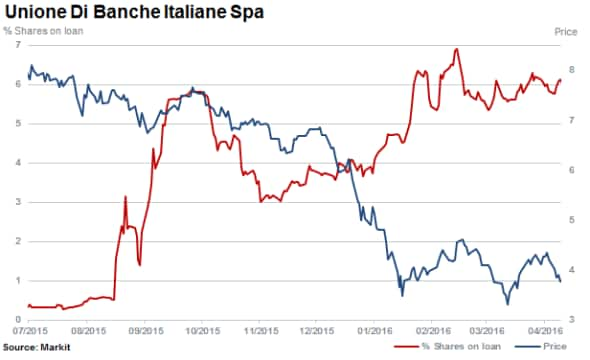

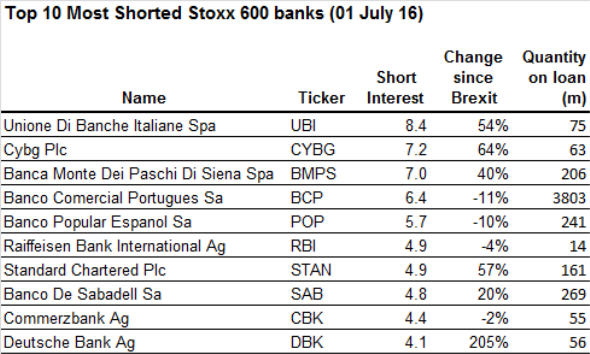

However leading European banking shorts currently are the Italian banks, including Unione Di Banche Italiane Spa with 8.4% of its shares outstanding on loan. The stock has fallen over two thirds in the past 12 months.

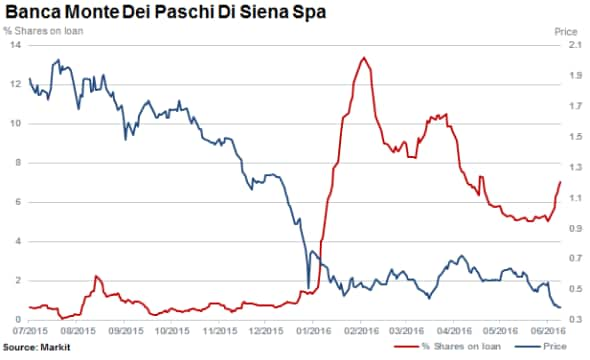

Joining Unione and falling by 78% in the last 12 months is Bance Monte Dei Paschi with 7% of shares outstanding on loan.

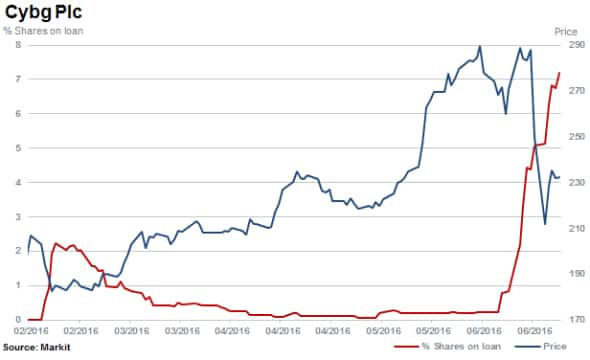

The most short sold UK bank post Brexit is newly listed CYBG, the holding company that owns Clydesdale and Yorkshire Bank.

Shares in the firm have fallen by a fifth since Brexit with short interest of 7.2% currently.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-brexit-attracts-shorts-to-european-banks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-brexit-attracts-shorts-to-european-banks.html&text=Brexit+attracts+shorts+to+European+banks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-brexit-attracts-shorts-to-european-banks.html","enabled":true},{"name":"email","url":"?subject=Brexit attracts shorts to European banks&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-brexit-attracts-shorts-to-european-banks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+attracts+shorts+to+European+banks http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-equities-brexit-attracts-shorts-to-european-banks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}