Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 04, 2017

Canadian bank short sellers hold fire

Investor sentiment in the wider Canadian banking sector has held up despite recent developments in Home Capital Group.

- TSX composite banks (ex HCG) see lowest short interest in over 2 years

- Equitable Group the only bank targeted by short sellers after HCG's collapse

- HCG short sellers have been forced to cover as lenders call back their loans

Negative investor sentiment stemming from the recent cratering in Home Capital Group's (HCG) shares has been constrained to the troubled lender as banks which make up the TSX composite index haven't experienced any significant increase in shorting activity over the last few weeks.

The average demand to borrow shares across the 10 banks which feature in the index was up significantly during the worst of last weeks' volatility; however the great majority of this negative sentiment was focused on Home Capital Group. The nine remaining banks haven't experienced any significant change in shorting activity over recent weeks as the average demand to borrow their shares has hovered around the 7% of shares outstanding mark.

There is no denying that Canadian banks are still very highly shorted relative to their peers in the TSX composite, however negative sentiment in the sector has been warming up in recent months. In fact the average short interest across the nine non HCP banks now stands at the lowest level in over two years after short sellers covered a third of their positions over the last 12 months.

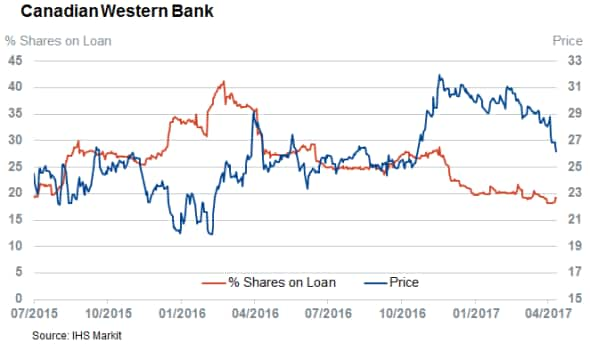

Recent covering is explained in part by the rebound seen in the commodities market as several of the country's banks were faced with a surge in non-performing loans during the depths of last year's commodity rout. Regional bank Canadian Western highlights this trend perfectly as over 40% of its shares were out on loan over the worst of last year's volatility. The majority of Canadian Western bears have since been placated as demand to borrow the Edmonton based lender's shares has halved. Since covering has come hand in hand with a sharp rebound in the company's share price.

Equitable sees shorts surge

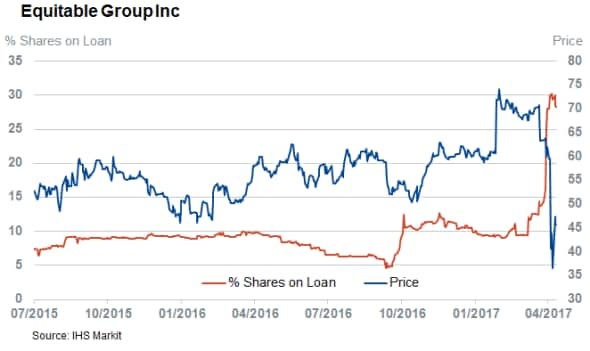

The only bank that looks to have been singled out by short sellers for a possible repeat of HCG's recent slump is Equitable Group which has seen demand to borrow its shares triple over the last month to a very high 30% of shares outstanding. Shorts have been spurred on in recent weeks as Equitable experienced the same depositor flight that forced its peer to seek prohibitively expensive emergency liquidity loans. Short sellers were in line to repeat their Home Capital success in Equitable however news that the company had secured a $2 billion emergency credit line, on much better terms than HCG, prompted a sharp rebound in its share price which has no doubt caught a few shorts out.

HCG short sellers forced to cover

Meanwhile, Home Capital Group has seen shorts cover over the last week as the number of its shares outstanding on loan has fallen from a high of 54.7% just before last week's collapse to 30% as of latest count.

This covering is deceptive however as it has been due to the fact that over half of the HCG shares that were in lending programs at the start of last week are now no longer available to lend. This is either because previous long holders have sold out of their positions or decided to stop lending their shares. The remaining HCG inventory in nearly fully lent which means that the remaining short sellers who wish to keep their positions open have had to pay an annualized fee of up to 80% to keep their borrows open.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-equities-canadian-bank-short-sellers-hold-fire.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-equities-canadian-bank-short-sellers-hold-fire.html&text=Canadian+bank+short+sellers+hold+fire","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-equities-canadian-bank-short-sellers-hold-fire.html","enabled":true},{"name":"email","url":"?subject=Canadian bank short sellers hold fire&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-equities-canadian-bank-short-sellers-hold-fire.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Canadian+bank+short+sellers+hold+fire http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-equities-canadian-bank-short-sellers-hold-fire.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}