Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 03, 2017

US and Europe divided

It is no secret that a divide - maybe a chasm - has opened up between the US and Europe. Donald Trump's mercantilist views put his presidency at loggerheads with the globalist EU, though a post-Brexit UK may yet turn out to be an ideological bedfellow.

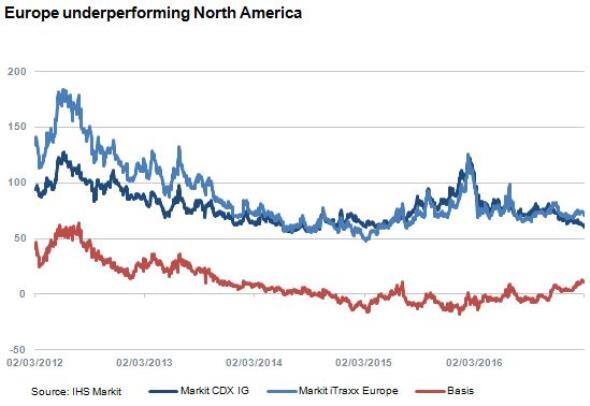

But this week we saw signs that a division is manifesting itself in the credit markets. The Markit CDX.NA.IG has rallied steadily in recent months - since Trump's election victory on November 8 2016, the index has tightened from 75bps to 60bps. Over the same period the Markit iTraxx Europe was just 2bps tighter at 71bps. The 11bps basis between the two on-the-run indices is the largest for more than three years.

Is the advent of Trump the sole reason behind the outperformance of US credit? There is little doubt that the US markets like the sound of his rhetoric. He has promised lower taxes for corporations and the middle class, as well as a massive infrastructure programme and higher military spending, policies that should fuel growth. How Trump will reconcile Congress to the inherent contradictions in his fiscal policies - the 104% federal debt to GDP ratio would rise significantly - will be interesting to observe.

But the evidence shows that the US economy has been on a higher trajectory than Europe for some time before the Trump victory, while the increase in index basis only occurred in the last month. This suggests that there are other factors at play, and we should look beyond North America. Europe has several important elections this year, and the French presidential vote in April is causing particular consternation in the markets. We have noted in previous columns that volatility has been subdued, but the political uncertainty can still prevent momentum building behind a rally.

One can then point to drivers from both the US and Europe that are potentially causing the divergence in the indices. Perhaps the most important factor, however, is in the composition of the indices. The Markit CDX.NA.IG contains no banks among its constituents, while the Markit iTraxx Europe has a 17% weighting of banks and 24% of financials (including insurers). Banks are affected by the credit standing of sovereigns, and the presence of financials mean that the Markit iTraxx Europe (as well as the senior financial index) is often used as a macro hedge against sovereign risk. This usage probably increased after the decline in the SovX indices following the EU ban in 2012.

Political uncertainty may not be triggering volatility - yet - but its existence and the composition of the European index is certainly affecting relative value across the Atlantic.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Credit-US-and-Europe-divided.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Credit-US-and-Europe-divided.html&text=US+and+Europe+divided","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Credit-US-and-Europe-divided.html","enabled":true},{"name":"email","url":"?subject=US and Europe divided&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Credit-US-and-Europe-divided.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+and+Europe+divided http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Credit-US-and-Europe-divided.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}