Best shorts of 2014 so far

Halfway through the trading year we look back at the best performing shorts of the year so far.

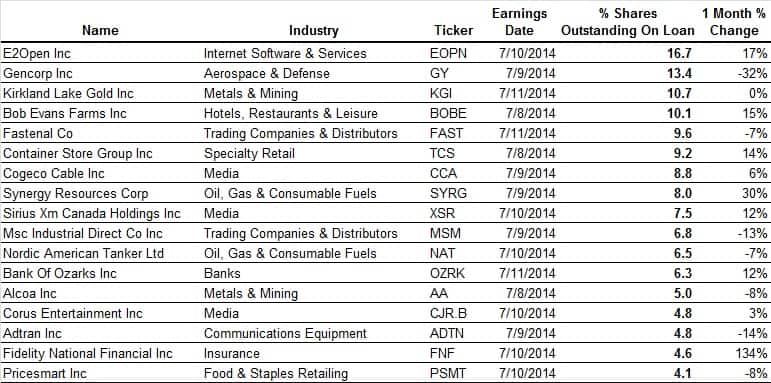

- Materials, Energy and Software & Services companies account for half of the top 20 North American shorts

- Europe has proved less fertile for short sellers, as the best performing shorts in the Stoxx 600 index have seen smaller share price declines than their North American peers

- Sainsbury’s has seen shorts continue to add to their positions, something the other poorly performing UK shares have not seen

Top Shorts

Methodology: In our quest to identify the best shorts so far this year, we looked at the performance of companies since they recorded a fresh annual high in short interest to the end of June, above a threshold of 3% of shares on loan.

Summary: Short sellers have been able to uncover plenty of underperforming shares over the last six months. The 20 best performing shorts fell by over 38.67% after short interest hit an annual high.

In North America, this list of 20 best performing shorts does not throw out many surprises given these stocks entered the year with an average of 14.5% of their shares on loan, a number that has since climbed as shorts added to their positions.

As for the timing of the best performing shorts, the fact that the combined average year to date performance of the top shorts is worse than that of the average performance return since these companies saw new highs indicates that these firms saw follow on short selling after initial underperformance.

Highlights

Nii Holdings tops the list as the best performing short so far this year after seeing new short interest highs in the early part of this year. The percentage of shares outstanding on loan was a lofty 30.5% before the one day price decline of over 50% in late February, following disappointing earnings. Nii is down 80% year to date.

Low prices for rare earth metals have continued to put pressure on the shares of Molycorp. Year to date the price has declined 54% and clearly short sellers believe there is further room to fall. The percentage of outstanding shares on loan peaked at 19% in early February and has recently returned to 16%, where it stood at the beginning of the year.

Itt Educational services recorded 10 new weekly short interest highs in the first six months of this year. Although short interest did not reach its final peak until late May, the price declined 40.42% on average from each new high and is down over 50% year to date. Much of ESI’s angst is the result of multiple claims concerning possible violations of federal securities laws which saw the company delay its first quarter results. Clearly short sellers believe there is still pain ahead as short interest remains extremely high.

Walter energy experienced seven new weekly short interest highs in the first six months of 2014. Short interest started the year at 27% then surged to a high of 38% in late April. The average decline in stock price from each new short interest high is -40.24% and year to date WLT has slumped 67.23%.

Cliffs Natural Resources continues to battle falling iron ore prices and was removed from the S&P 500 in April. CLF was previously the most highly shorted stock in the S&P 500 and saw six new weekly short interest highs in the beginning of this year. CLF is one of the four material companies to make the top 20 short list this year and is down 42.58% year to date.

During the first three months of the year short sellers loaded up on bets against Potbelly Sandwich Works as the share price fell. The percentage of outstanding shares on loan peaked at 17% on April 2nd. Since then shorts have covered short positions, perhaps believing the worst is behind the Chicago based sandwich makers. The percentage of shares outstanding on loan currently stands at 8%, down from a peak of 17% on April 2nd. With the share price down 34% year to date, short sellers appear to be moving away from a profitable trade.

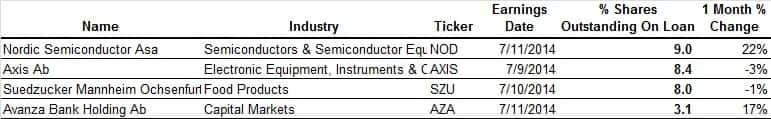

Europe

Europe makes for less fertile ground for shorts selling as the ECB’s recent action has seen the STOXX 600 post a 14% return since the start of the year. This has seen shorts cover their positions across the board, mirroring the US market of last year.

This strong performance has seen only 13 constituents fall by more than 10% since seeing a new annual high in demand to borrow. The average return for these best performing shorts stands at 18%, less than half of that seen across North America.

Interestingly, shorts have taken their profit from their best performing positions. The current demand to borrow across the 13 best performing shorts is currently lower than where it was at the start of the year.

By far the best performing short of the year across the constituents of the STOXX 600 has been Banco Espirito Santo, which has seen its shares fall by 45% since it saw a fresh high in demand to borrow in February. While much of the demand to borrow was driven by the company’s various capital raising activities, the recent run on the company’s shares showed that there was ground for directional shorting as well.

Also joining BES amongst the best performing shorts are fellow banks Raiffeisen and Julius Baer which have both seen their shares fall by more than 17% since seeing fresh annual highs in demand to borrow.

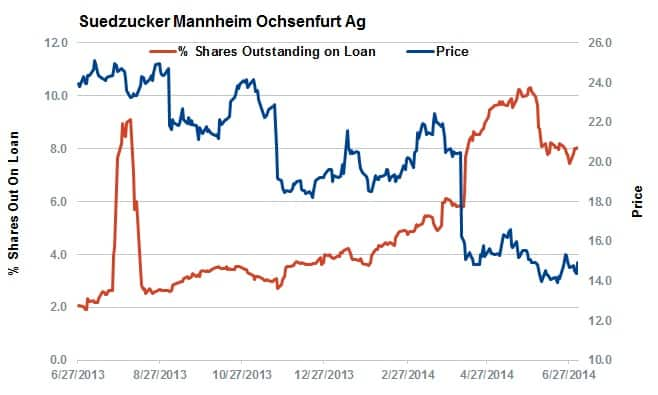

Sugar firm Suedzucker rounds out the top three best performing short as its shares have fallen by a third since its saw a new high in demand to borrow in the second week of January. Shorts have continued to pile into the name and it now sees twice the demand to borrow it had at the beginning of the year.

As for the UK, the country’s strong recent economic numbers has not made it a barren land for short sellers as five British firms make the best performing shorts list.

Croda International is the best performing UK short after its shares fell by 13% since shorts redoubled their attention in May, only to cover most of their positions in the following weeks.

This trend was seen in the other three top performing UK shorts with the exception of grocer, Sainsbury’s whose short interest has continued to climb as it faces tough competition discount firms looking to muscle in on the UK retail space.

Sainsbury’s shares are down by 11% since they shorts started adding to their positions in the opening weeks of the year.

Andrew Laird, Analyst, IHS Markit