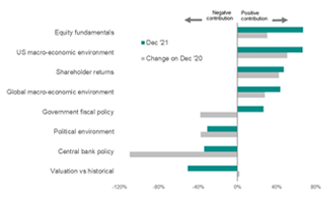

Introducing IMI – A forward-looking view on risk outlook and market sentiment of active investment managers on US equities

With the expertise you expect from S&P Global, our Investment Manager Index™ (IMI™) is a survey-based indicator of market sentiment derived from active fund managers at institutional investment firms. IMI is designed to provide insights into what’s driving markets as well as the forward-looking investment appetite and risk outlook for U.S. equities. The monthly survey asks respondents for their subjective view on a range of topics over the next 30 days including: Investment Manager Index benefits all market participants and is used by financial and corporate professionals to better understand where the market is headed and to uncover opportunities. Whether you are a corporate issuer looking at investor appetite or on the buy side or sell-side looking at peer comparisons, the insights from IMI will help shape your perspective.