Supply chain constraints and fuel shortages increase costs for all power generation technologies in South Asia

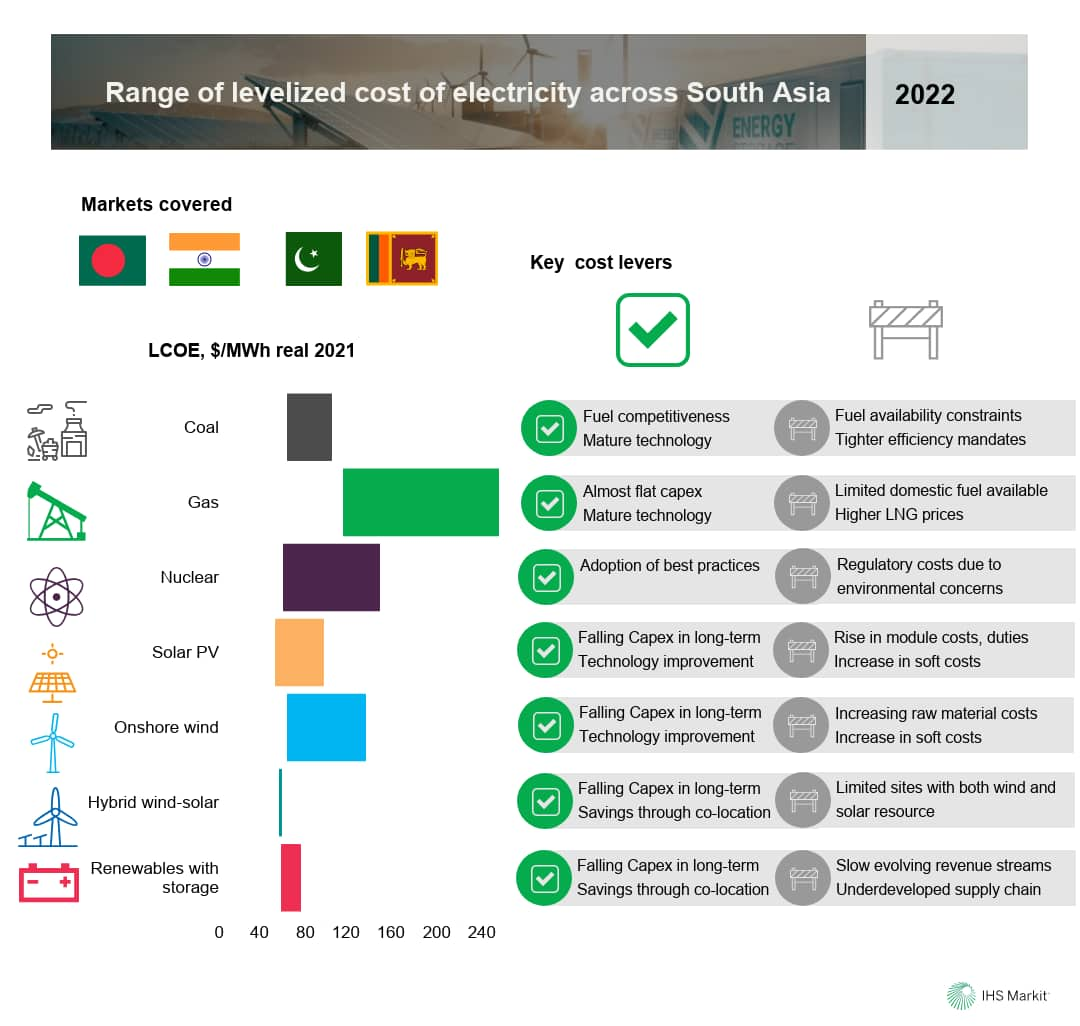

The levelized cost of electricity (LCOE) for conventional technologies—coal, gas, hydro, and nuclear is primarily driven by capital costs, fuel prices, and utilization rates. Higher fuel prices in the short term and higher weighted average cost of capital results in increase of LCOE for coal and gas power projects in 2022.

The LCOE of coal-fired projects across South Asia ranges between $35/MWh to $90/MWh, primarily driven by the differences in costs of domestic versus imported fuel, supporting infrastructure, and the financing costs. India has the cheapest coal generation for a supercritical project in the region at $53/MWh, whereas Bangladesh, Pakistan and Sri Lanka have 33% to 50% higher cost of coal generation for a similar plant.

On the other hand, cost of gas generation in South Asia ranges between $80 to $100/MWh driven by LNG prices. India has the highest LCOE for combined cycle gas turbine (CCGT) technology in comparison to other markets in South Asia due to higher gas prices. While in Bangladesh and Pakistan natural gas prices are subsidized making it competitive.

Solar PV is the cheapest source of electricity generation in utility-scale applications in India and Pakistan in 2022 despite the supply chain constraints and trade barriers which are resulting in increase in the capex for solar and wind in the short term.

India and Sri Lanka have lowest onshore wind LCOE in the region at about US$ 50/MWh. Divergence in onshore wind LCOE in South Asia is mainly due to difference in resource type and competitive maturity of markets. Onshore wind projects also facing cost increase due to rising inflation post-pandemic resulting in a reversal of the trend of falling costs.

Similarly, battery storage levelized costs are also higher by more than 10% since 2021 due to a rise in raw material costs and supply chain challenges. However, in the long-term it is expected that an 8-hour battery will be competitive versus other flexible sources of electricity, such as CCGT by the early 2030s. Meanwhile, energy storage in collocated applications for peak as well as round-the-clock (RTC) supply is already cost competitive with CCGT.

To learn more about our Asia Pacific

energy market research, visit our

Asia Pacific Regional Integrated Service page.

To learn more about our Asia Pacific

energy market research, visit our

Asia Pacific Regional Integrated Service page.

Ankita Chauhan is an associate director at S&P Global Commodity Insights, focuses on renewable energy research for South Asian markets.

Rashika Gupta, Ph.D., is a Senior Director on the APAC Climate & Sustainability team at S&P Global Commodity Insights, responsible for Power & Renewables research and analysis for the South Asian markets.

Posted on 31 August 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.