NOCs and the climate challenge

Assessments of the energy future are increasingly dominated by the twin uncertainties of government climate initiatives and the speed of the market transition away from oil and gas.

While much of the focus has been on how governments and international oil companies (IOCs) are reacting and adapting, the continued dominance of national oil companies (NOCs) makes them critical to the speed and outcome of transition efforts. NOCs hold over 60% of oil and gas reserves globally, supply 50% of production, and account for 40% of investment overall.

Thus far, actions and preparations to address these challenges are still at an early stage, with many NOCs focused on surviving current low prices and unsure about what course to pursue and with what urgency. But two questions are pressing:

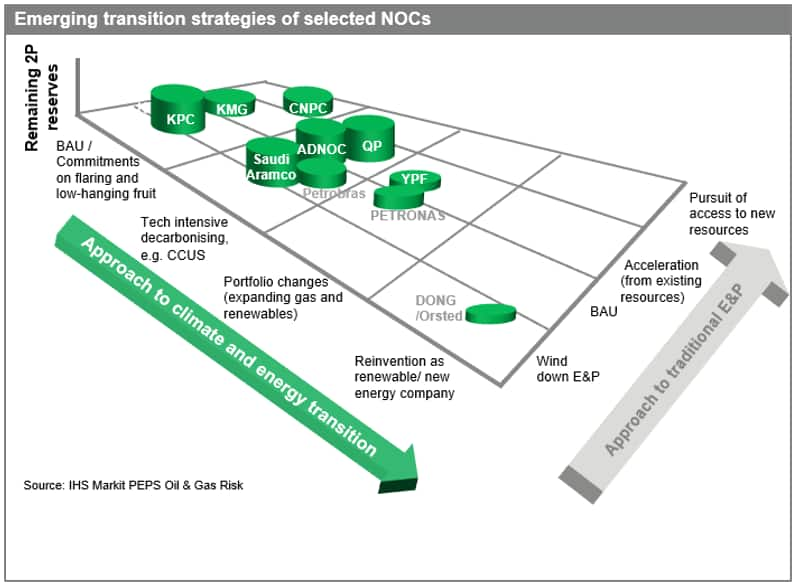

- What to do about emissions? Options range from business as usual (BAU) with minimal "green" commitments such as reducing gas flaring - to the decarbonisation of oil and gas production where remaining resources are significant - to reinvention as a renewable energy company where remits allow. Gulf state NOCs ADNOC, QP and Saudi Aramco are amongst those looking to proactively decarbonise ongoing oil and gas production, conscious that technical-intensive decarbonisation may offer a means to prolong the relevance of the hydrocarbon sectors that still dominate economic life.

- What to do about traditional E&P resources? The primary remit of many NOCs is to safeguard and exploit home country reserves. However, reserve life is no longer always an advantage, and, in cases, NOCS may look to bring forward and accelerate development rather than face the uncertainties of a declining global demand trajectory where low costs and lower carbon profiles are likely to be key to maintaining market relevance.

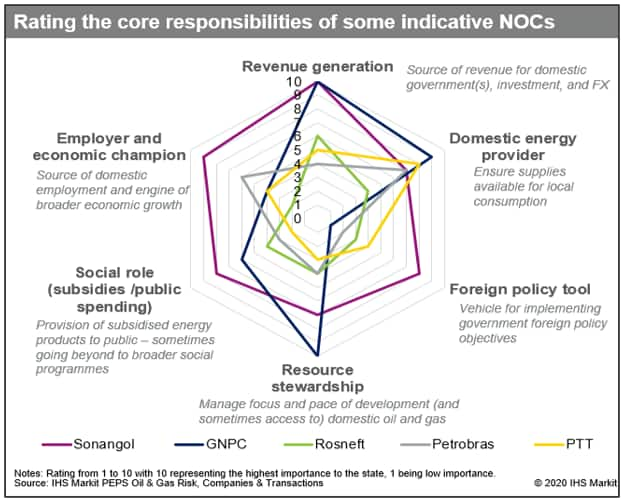

How NOCs proceed will be a function of their respective mandates; domestic and external drivers for action, where exposure to zero carbon markets and finance will be key; and their scope to adjust given technical capacity, spending power and the asset mix. Domestically-focused NOCs will largely be constrained in making sharp shifts given mandates to maximise the value of remaining local resources, generate revenues and foreign-exchange earnings, and often, fulfil social spending roles. By contrast, NOCs with fewer domestic resources to manage - and/or less importance to the economy - will tend to have greater latitude to act. It is no surprise that Asian importer NOCs are amongst those leading the charge on climate and transition approaches - Petronas and CNPC both now have zero carbon ambitions.

These decisions in turn carry risks and costs, along with implications for home country governments, partners, buyers and global balances. Gauging the confluence of pressures and opportunities for NOCs and understanding their strategies will thus remain critical to determining industry trajectory.

For more information about IHS Markit Petroleum Economics and Policy Solutions, visit ihsmarkit.com/PEPS

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.