Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

Sign-up to receive our monthly energy insights from our blog today!

The global oil industry are adjusting rapidly as the world deals with current turns of events. As we enter 2021, the oil market faces various key concerns about demand, supply and prices. In particular, how might demand improve as COVID-19 vaccines are deployed? Furthermore, how will OPEC+ manage supply as the energy transition gains momentum?

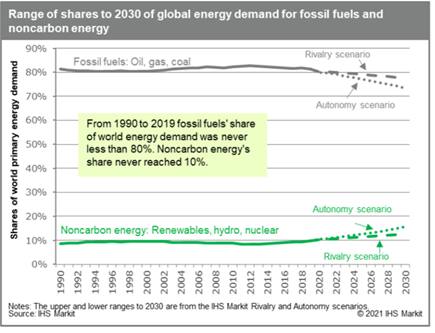

In 2020, world energy demand dropped by 6%, but wind and solar demand increased by 9% and oil demand fell by 10%. It was a crucial point for the energy transition as it moves beyond slow motion to a faster pace of change in 2020 as well.

Why was 2020 a pivot point?

On 20 January 2021, Joe Biden assumes office but sharp divisions in the United States remain. The risk remains of further instability and violence that could unsettle financial markets, the economy, and international affairs. Furthermore, new drilling permits for federal lands and waters that currently account for 20 percent of US crude production could be prohibited by the Biden administration.

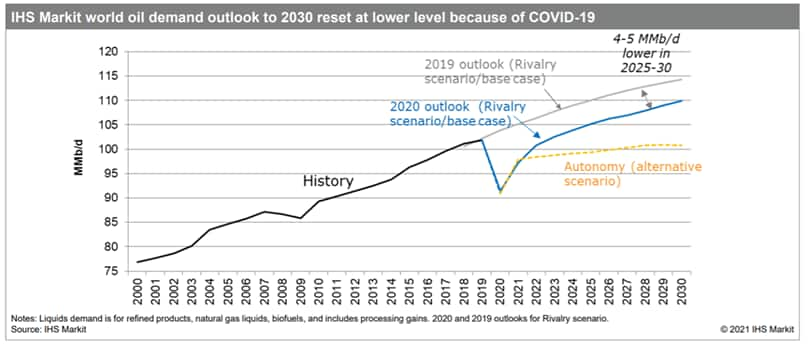

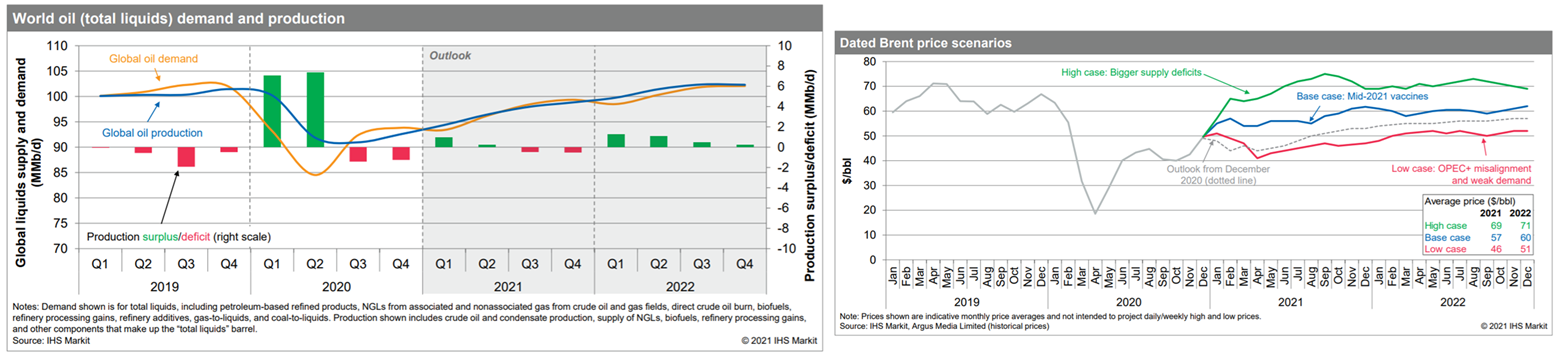

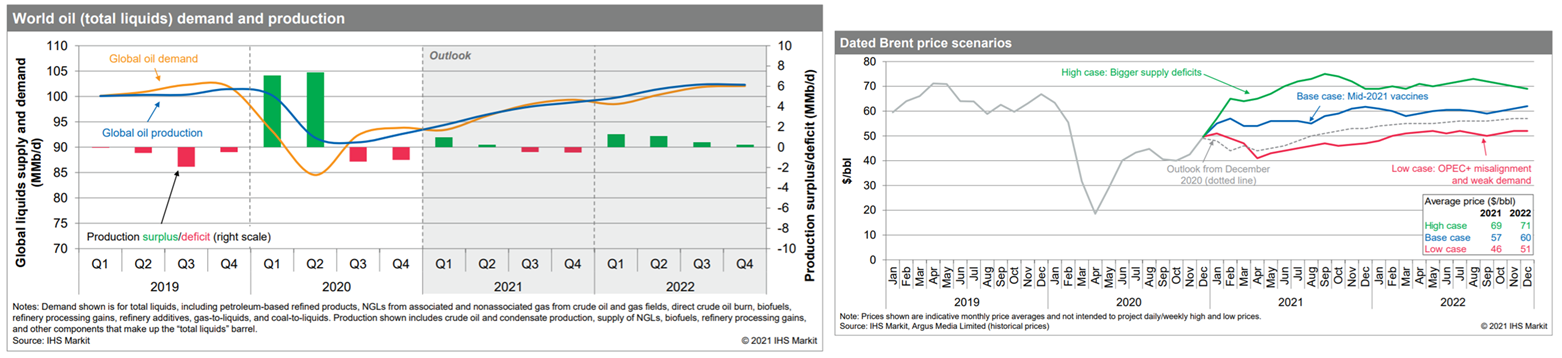

The COVID-19 repercussion has led to lower level of world oil demand. However, the vaccination programs support our view that by late 2021, the world oil demand will increase to 99 MMb/d —up from 93 MMb/d in January—and reach pre–COVID-19 levels in 2022. COVID-19 repercussion: Lower level of world oil demand

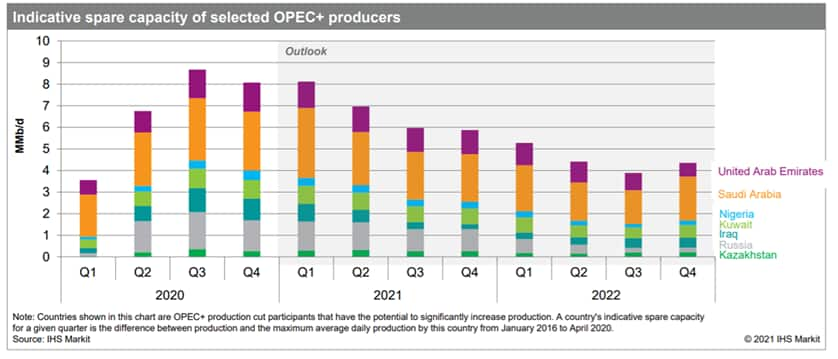

The unilateral production decreased drastically in Saudi Arabia drastically decreased the surplus for the first quarter of 2021. Without the cut, the surplus would be 700,000 b/d higher. The unilateral 1 MMb/d production cut by Saudi Arabia, announced on 5 January 2021, significantly reduces the first-quarter supply surplus. In less than a year, this cut represents Saudi Arabia's third sudden and far-reaching shift in oil policy. A willingness to intervene suddenly in markets—much as central banks do—highlights the precariousness of a key assumption in our price outlook—that Saudi Arabia will continue to act to support prices above $50/bbl.

The 2021 annual average forecast for Dated Brent has been increased to $57/bbl, up from $48/bbl in the December outlook. There are risks to this outlook as a weaker demand recovery and more supply from OPEC+ could reverse price. However, as COVID-19 is contained, strong pent-up demand could make the market tighter than anticipated and drive prices to $70/bbl.

Are sharply higher oil prices on the horizon as upstream spending is slashed?

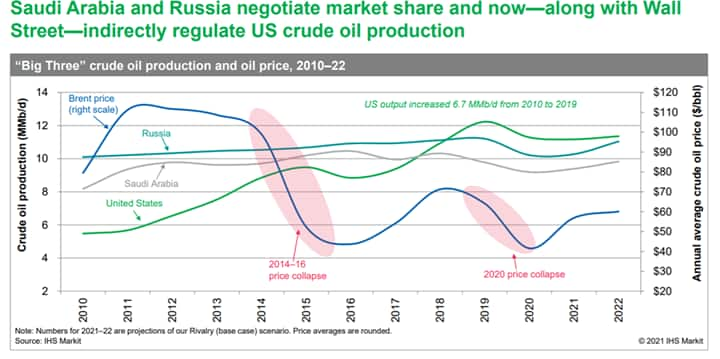

We understand Saudi Arabia is defending $50/bbl oil and aims for $65/bbl. Russia is comfortable with $45–55/bbl oil and will seek to increase its production at price levels within that range. OPEC+ participants in aggregate hold about 8 MMb/d of unused crude oil production capacity in early 2021.