Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 21, 2023

What impact will the market developments from last year have on smaller South Asian countries’ energy and power sector trajectory in 2023

For the smaller South Asian countries - Sri Lanka, Pakistan, and Bangladesh— 2023 is going to be a crucial year following one of their worst economic crises in 2022 owing to lock down, supply chain-induced fuel market shocks, GDP growth slowdowns (decline of a staggering 8.7% in Sri Lanka's case), a worsening foreign exchange (forex) balance, rising unemployment, and fuel and electricity price hikes. Pakistan and Sri Lanka faced double-digit inflation, with Sri Lanka facing the worst impact in South Asia. Pakistan's currency declined by 20% against the dollar and was the worst performing South Asian currency in 2022. Pakistan's China-Pakistan Economic Corridor engagements caused Chinese debt to exceed $25 billion in 2022. Its forex reserves fall below $5 billion in Jan 2023; worth about only two months of essential imports. Sri Lanka's fiscal mismanagement also led to shrinking reserves, to the extent it had to announce a preemptive default on at least $26 billion worth of foreign debt repayment obligations. As a result, Pakistan and Sri Lanka went through significant political disturbances. Pakistan's incumbent PTI government was removed in a no-confidence motion in April 2022, while popular protests led to the collapse of the Mahinda Rajapaksa government in Sri Lanka.

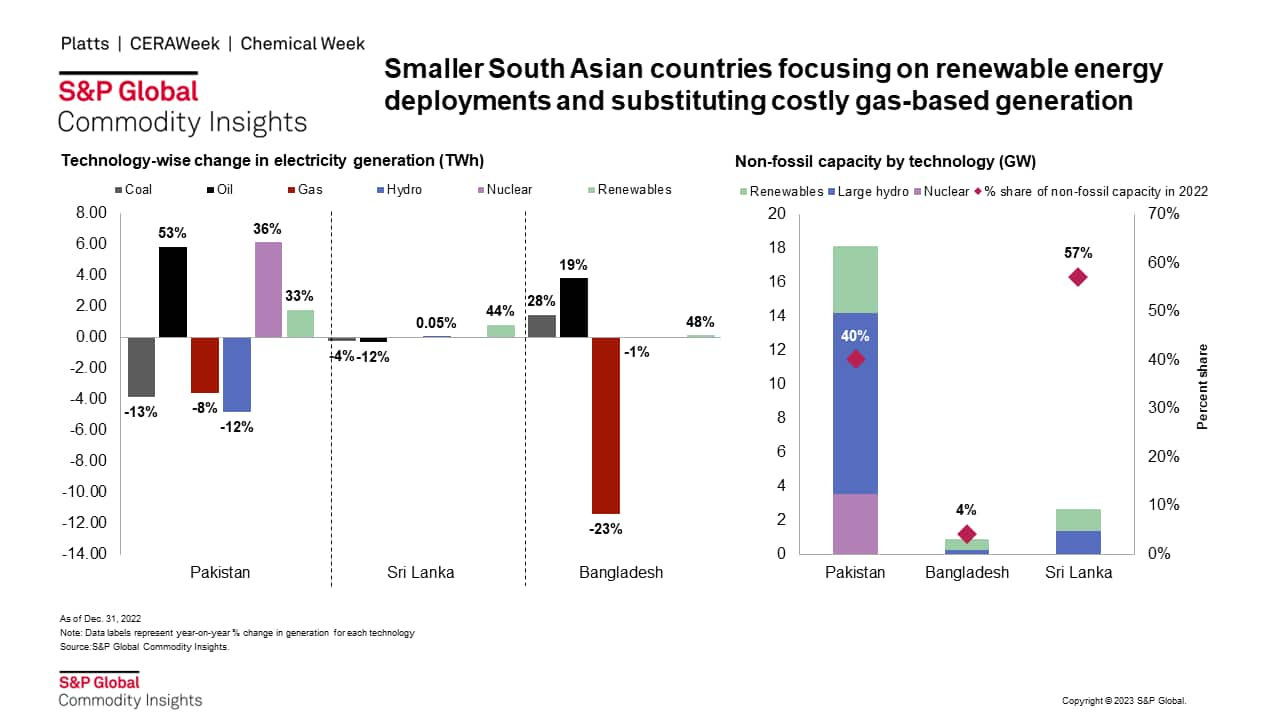

More than half the electricity produced in Bangladesh, Pakistan, and Sri Lanka comes from imported fuels, primarily oil and natural gas. High reliance on imported fuel amid supply shocks was worsened by shrinking domestic fuel reserves. Being largely import dependent, the three markets continued to economize their fuel purchases as commodity prices remained high throughout 2022—a trend that began mid-2021. In the face of supply constraints, both Pakistan and Bangladesh resorted to substituting oil for gas in electricity generation and power cuts. Bangladesh hiked the gas prices to 179% and 150% to power and industry, respectively from 1 February 2023. Sri Lankan imported oil and coal generation declined by 12% and 9% as rolling power cuts increased up to 13 hours per day toward the latter half of 2022.

As a long-term strategy to tackle the above-mentioned issues, these countries remain focused on energy transition policies and climate compatible development plans to accelerate renewable energy deployments albeit with limited success. In 2022, the three markets reached 5.5 GW (8% of total generation capacity) of renewable energy capacity from 4.9 GW (7%) in 2021. About 1.5-2 GW of renewables pipeline capacity is expected to be deployed in the next year across these markets. Issues of land acquisition, affordable financing, lack of domestic experience and policy transparency/ stability, delays in implementing reverse bidding mechanisms, and political instabilities continue to plague the horizon. Regional energy trade partnerships are being strengthened in the backdrop of global supply uncertainties, with Bangladesh and Sri Lanka signing fuel and power purchase agreements with India.

South Asian resilience will be tested in 2023 as economies remain vulnerable to internal and external disturbances. The three countries remain particularly vulnerable to global recessionary pressures, continuation of political hostilities including armed conflicts that may affect fuel markets, infectious outbreaks including pandemics, cyber threats, adverse weather, and natural disasters. Due to their poor financial health, fuel imports could be restricted, leading to intensified load shedding in the coming weeks and months, especially during peak summers. Furthermore, investment delays and execution challenges may lead to another unimpressive year in terms of renewable capacity additions. A timely influx of International Monetary Fund (IMF) tranches, especially in the case of Pakistan and Sri Lanka is needed. Bangladesh will need to strike a balance between fuel price reforms and growing public discontent. (Customers can read the full report here).

For more information on this research and the service it comes from, please visit the Asia Pacific Regional Integrated Service page.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-impact-will-the-market-developments-from-last-year-have-o.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-impact-will-the-market-developments-from-last-year-have-o.html&text=What+impact+will+the+market+developments+from+last+year+have+on+smaller+South+Asian+countries%e2%80%99+energy+and+power+sector+trajectory+in+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-impact-will-the-market-developments-from-last-year-have-o.html","enabled":true},{"name":"email","url":"?subject=What impact will the market developments from last year have on smaller South Asian countries’ energy and power sector trajectory in 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-impact-will-the-market-developments-from-last-year-have-o.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=What+impact+will+the+market+developments+from+last+year+have+on+smaller+South+Asian+countries%e2%80%99+energy+and+power+sector+trajectory+in+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-impact-will-the-market-developments-from-last-year-have-o.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}