Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 17, 2021

What if Venus comes in?

TotalEnergies is at it again, and this time it's Namibia's deepest water exploration well to date. The Orange Sub-basin Venus-1 well follows the world record setting Ondjaba - 1 well (for water depth), which targeted a frontier play within the Congo Fan. The company's strategy "to target large deep-water prospects in frontier plays" although high risk, is also high reward - the 2019 basin-opening Brulpadda discovery, followed by the 2020 Luiperd discovery, is evidence enough. IHS Markit estimates Luiperd alone has a NPV in excess of USD 4 billion.

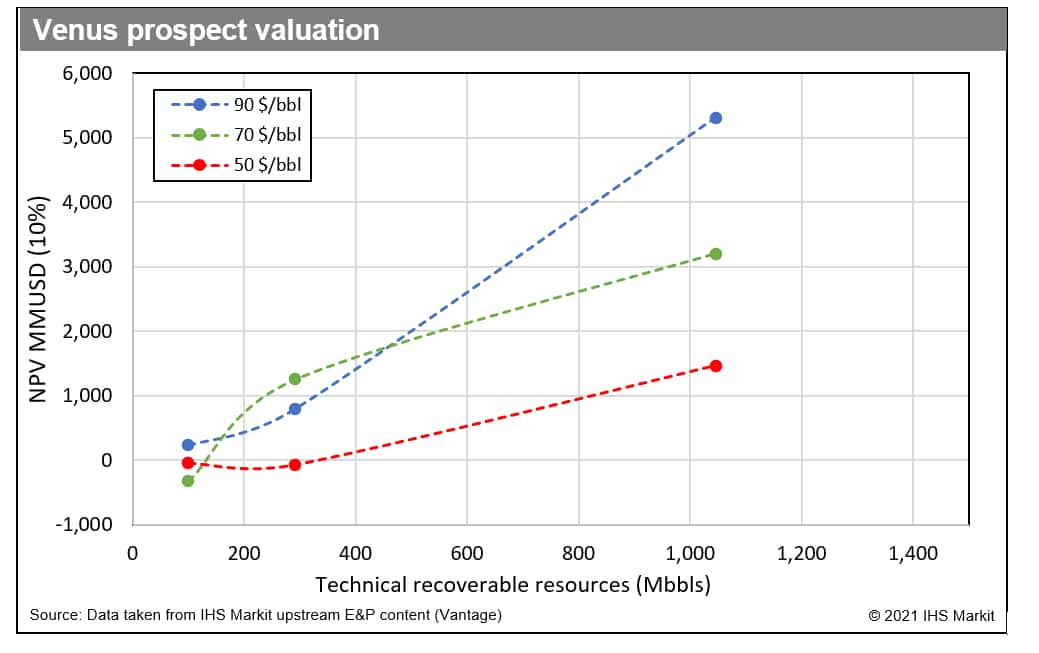

So, if Venus is a success, what reward could TotalEnergies and the partners be chasing? Targeting a prospect with an area of roughly 600 km², Venus is one of the most anticipated wells worldwide for 2021. The Maersk Voyager spudded the well in early December, targeting a basin floor fan that the partners compare to the offshore East Campos Sub-basin Marlim field. For reference, the Marlim field was estimated to hold 2P reserves of 3 billion barrels and reached a peak production rate of over 200 MMbbls/d. Analysis of the Venus prospect suggests a minimum economic field size of around 120MMbbls at 70$/bbl. The favourable fiscal regime in the region suggests that a discovery equal to 300 Mbbls could have an NPV of around 1 billion MMUSD with a break-even below 50$/bbl.

The Namibian fiscal regime includes additional profit tax that is tied to the project internal rate of return (IRR). As the return rate increases, the additional profit tax rate also increases in tranches of 20%. This can cause an unexpected behaviour as both the cost to profit ratio, and timing, have a direct impact on the tax rate. This may be seen in the below NPV sensitivity chart where the 291 MMbbl development is less profitable at 90 $/bbl than 70 $/bbl. At $90 the rate of return is higher, breaching an APT IRR% threshold, which results in a 20% higher effective tax rate.

Figure 1: Venus prospect valuation

For more information regarding well, field & basin summaries,

please refer to EDIN.

For more information regarding asset evaluation, portfolio view, and production

forecasts, please refer to Vantage.

For more information regarding our country activity coverage, please

refer to GEPS.

For more information regarding E&P costs please refer to IHS

Markit Que$tor.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-if-venus-comes-in.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-if-venus-comes-in.html&text=What+if+Venus+comes+in%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-if-venus-comes-in.html","enabled":true},{"name":"email","url":"?subject=What if Venus comes in? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-if-venus-comes-in.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=What+if+Venus+comes+in%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-if-venus-comes-in.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}