Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 18, 2018

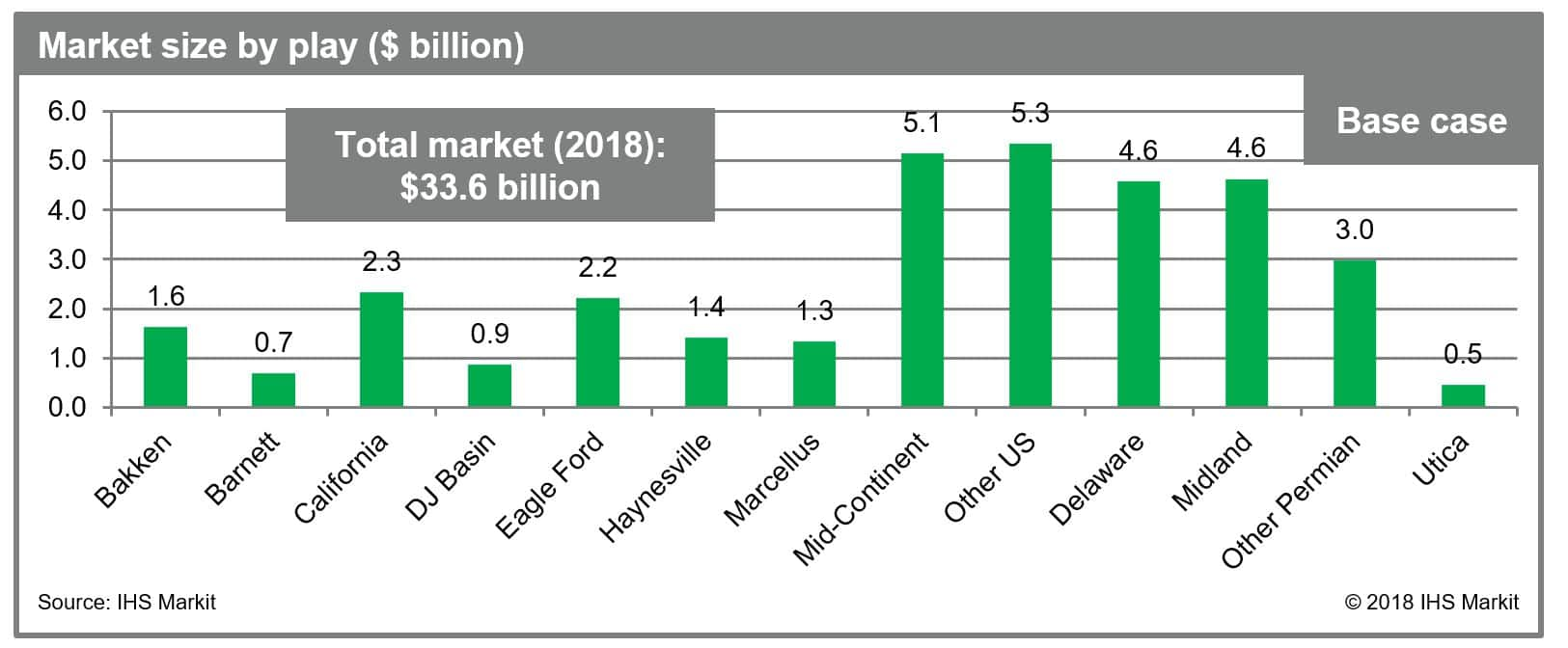

Water market for upstream oil and gas operations in the United States worth an estimated $33.6 billion in 2018

IHS Markit's Onshore Services & Materials team recently released our WaterIQ report for the second half of 2018. The semi-annual report tracks the market size and volumes for water used in drilling and completions operations, and ongoing produced water.

The report determines that the water management market for upstream oil & gas operations in the United States is worth an estimated $33.6 billion in 2018 and projected to grow at a 3.9% compound average growth rate (CAGR) through 2023. Due to a high number of legacy wells and intense levels of ongoing activity, the Permian Basin continues to produce and demand the largest volume of oilfield water among all US onshore regions; water spending in the region is estimated at $12.2 billion in 2018 under our base case assumptions.

Figure 1: Base case market size by play ($

billion)

Figure 1: Base case market size by play ($

billion)

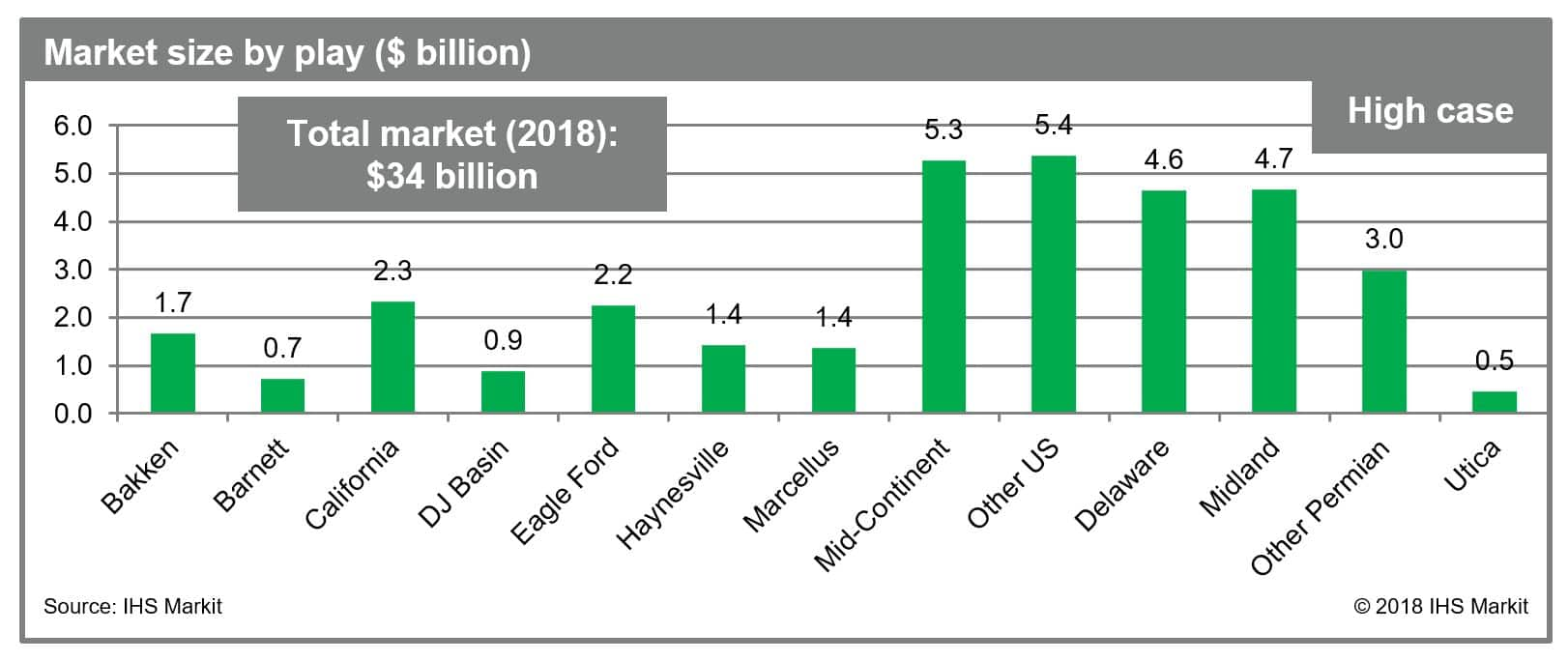

Figure 2: High case market size by play ($

billion)

Figure 2: High case market size by play ($

billion)

Particularly, US land drilling and completions water demand increased robustly in 2018. Frac water use is expected to grow in the future owing to an intensification of completions design, proppant intensity, and longer lateral lengths.

Within the cycle of water acquisition to disposal, the water logistics segment (hauling, disposal, and transfer) drove over 65% of spending in 2018. In this sense, the water disposal market displayed some parallels with the proppant market to the extent that beyond the challenges of procurement, getting the product in the right quantities and on-time to the destination remains difficult.

Just as the proppant market has made compromises in sand quality to reduce transportation distance, the water market is looking to mitigate logistics costs in various ways. Presently, reinjection is the primary method to manage produced water. However, rapid advancement of treatment technology and quick adoption of recycle/reuse methods will contribute to this area having the largest growth potential at a 15.9% CAGR through 2023.

Looking ahead, the water midstream sector will heavily impact the industry: many E&P companies are looking at water management as an integral part of their business model and are looking to choose between internal or external water management options. Furthermore, consolidation continues to be a strong industry trend within the water management service sector. In 2018, there were various M&A and partnership deals targeting companies that provide integrated water solutions and flowback/completion services; with water an ongoing issue in upstream operations, this activity should continue in 2019.

Please contact Nathaniel Julien if you would like additional information on the latest WaterIQ report. Learn more about our coverage of onshore materials, including water.

David Vaucher is Associate Director at IHS Markit.

Laura Sanchez is Senior Research Analyst at IHS

Markit.

Posted 18 December 2018

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-market-for-upstream-oil-gas-operations-in-us.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-market-for-upstream-oil-gas-operations-in-us.html&text=Water+market+for+upstream+oil+and+gas+operations+in+the+United+States+worth+an+estimated+%2433.6+billion+in+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-market-for-upstream-oil-gas-operations-in-us.html","enabled":true},{"name":"email","url":"?subject=Water market for upstream oil and gas operations in the United States worth an estimated $33.6 billion in 2018 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-market-for-upstream-oil-gas-operations-in-us.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Water+market+for+upstream+oil+and+gas+operations+in+the+United+States+worth+an+estimated+%2433.6+billion+in+2018+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwater-market-for-upstream-oil-gas-operations-in-us.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}