Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 14, 2021

Volatilities in South Korea's future wholesale power prices: Driving renewable profitability in the coming years

The renewable energy market in South Korea is at last on a firm path to solid growth. The capacity additions of solar PV reached a record high last year with 4.1 gigawatts coming online - equivalent to 28% of total solar PV capacity. The country's largest solar PV plant with 100 megawatts PV plant and 312MWh battery storage capacity was built on the abandoned salt field in Younggwang area, which will generate electricity enough to cover more than the entire region. The 60 megawatts demonstration offshore wind project off the Southwest coast also came online in November 2020, the first commercial-scale offshore wind project after nearly 10 years of back and forth in resolving local residents opposition and obtaining permits. With the renewables market finally gaining momentum, the key question remains whether the forthcoming solar PV and wind projects will continue to generate attractive returns to project developers and financiers alike.

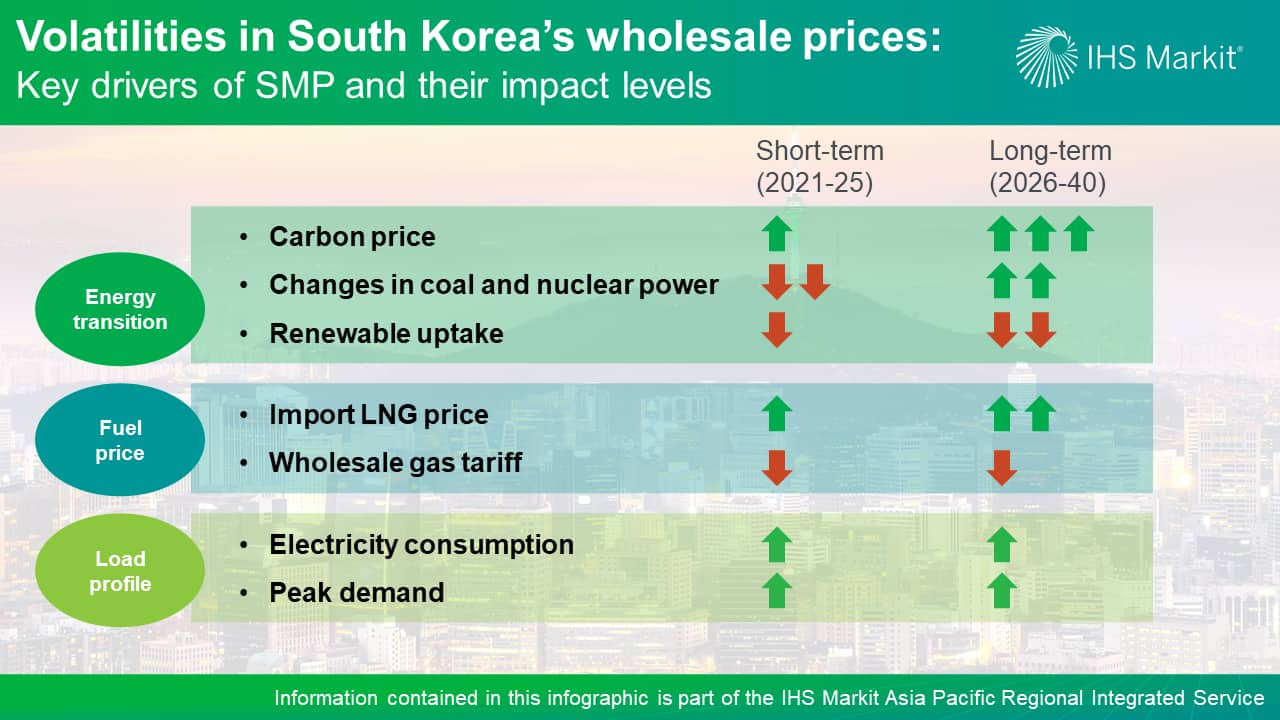

IHS Markit simulated the wholesale market via a plant-level hourly dispatch model to provide the power price outlook. The power price, or system marginal price (SMP) in South Korea's cost-based pool market, is an instrumental set of data needed in determining the long-term contract price of solar PV and wind projects. The outcome from our model revealed that three factors remain key input variables in driving the future power price: fuel price, energy transition progress and load profile dynamics. All these input variables represent a combination of regulatory and market factors ranging from a carbon price to changes in coal and nuclear power, which will drive the power price up or down.

First, the fuel price, especially the imported LNG price, will continue to guide the future power price, as gas-fired power generators are the main price-setters in South Korea's power market. Moving forward, a different set of LNG benchmark prices such as the US Henry Hub and Asian spot LNG will set the delivered LNG price because LNG importers diversify their portfolio to hedge oil price risks. The changes in the domestic wholesale gas tariff of the country's monopoly gas supplier, Korea Gas Corporation (KOGAS), are also expected to put downward pressure on the SMP. However, its impact is likely to be minor.

Second, the country's energy transition in the next two decades will also significantly impact the SMP. The changes in the energy mix triggered by decommissioning of coal and nuclear power will push up the power price in the long run, although its impact will be partly offset by a surge in renewables. The rise in carbon prices is also expected to drive up the SMP, as they will be added to the short-run marginal cost of all the thermal generators in the merit dispatch starting in 2021.

Lastly, the load profile of electricity consumers in the future will also influence the direction of the power price. While the country's overall electricity consumption is expected to be relatively flat, rising volatility in peak demand caused by increasing extreme weather events such as heatwaves or a long cold winter could always shake the short-term power price.

Incorporating all of the above factors, IHS Markit's inaugural South Korea long-term power price outlook will help provide an insight into investing in future renewable projects in the country.

For more on our energy research in Asia Pacific, visit our Asia Pacific Regional Integrated Energy Service page.

Vince Heo (Yoonjae Heo) is an associate director at IHS Markit, managing the Gas, Power, and Energy Futures team in Seoul.

Posted on 14 June 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fvolatilities-in-south-koreas-future-wholesale-power-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fvolatilities-in-south-koreas-future-wholesale-power-prices.html&text=Volatilities+in+South+Korea%27s+future+wholesale+power+prices%3a+Driving+renewable+profitability+in+the+coming+years+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fvolatilities-in-south-koreas-future-wholesale-power-prices.html","enabled":true},{"name":"email","url":"?subject=Volatilities in South Korea's future wholesale power prices: Driving renewable profitability in the coming years | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fvolatilities-in-south-koreas-future-wholesale-power-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Volatilities+in+South+Korea%27s+future+wholesale+power+prices%3a+Driving+renewable+profitability+in+the+coming+years+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fvolatilities-in-south-koreas-future-wholesale-power-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}