Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 18, 2019

Utilization improved in 2019-Q2, with stable demand and pricing expected in the hydraulic fracturing market through 2019

Compared to the first quarter in 2019 (2019-Q1), IHS Markit estimates that for the second quarter, hydraulic fracturing demand in the US has increased; however, this is partly offset by an increasing US supply of around 700,000 HHP. Indeed, contrary to previous expectations, capacity additions have continued for several suppliers, even with the oversupplied market conditions, which is likely a result of supply already ordered in 2018.

Compared with the previous quarter, the greatest drivers of upward demand were the Permian, Eagle Ford, and Marcellus/Utica, while the Haynesville and Anadarko regions had the greatest drops in demand. Stronger utilization continues in the gas plays, at least temporarily, with the Haynesville currently replacing Denver-Julesburg (DJ) Basin as the fifth-largest region based on frac demand. However, this is not expected to continue, as IHS Markit estimates that dry gas production growth will slow in 2019.

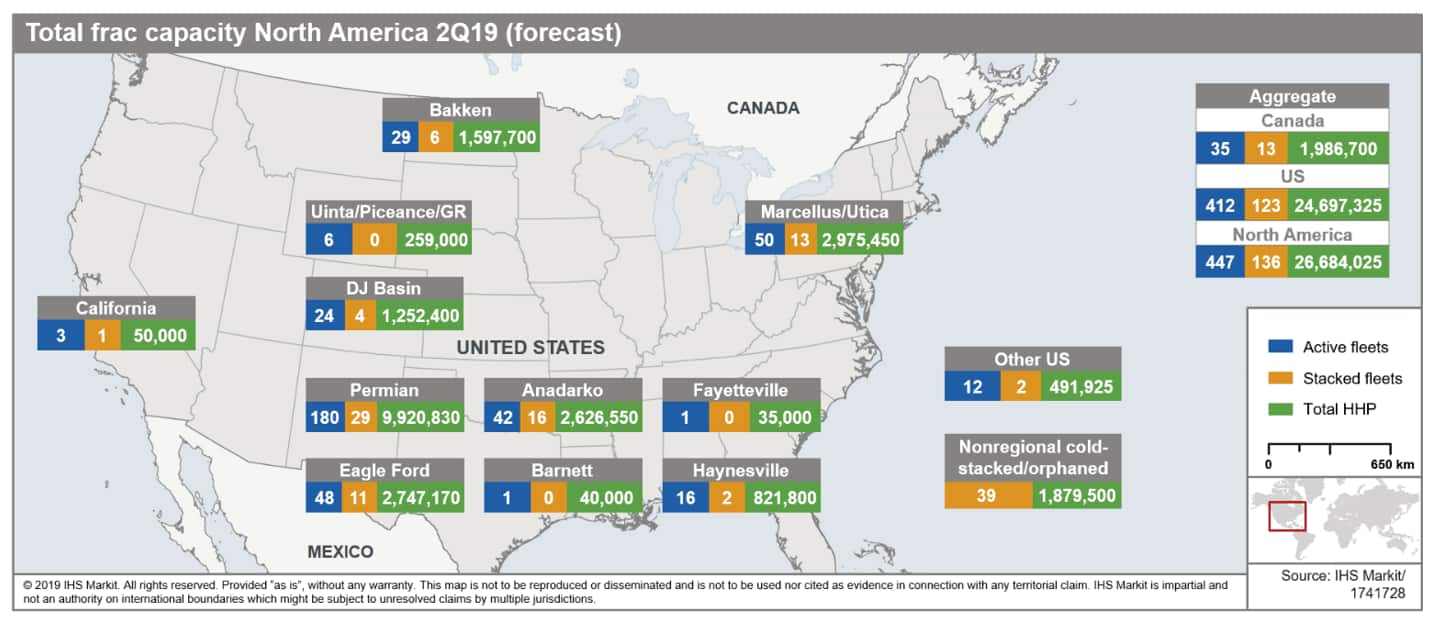

Figure 1: Total frac capacity in North

America 2019-Q2 (forecast)

Figure 1: Total frac capacity in North

America 2019-Q2 (forecast)

Late 2018 and early 2019 experienced significant price decreases compared to 2018-Q2; however, 2019-Q2 is expected to see stabilized pricing as many pumping suppliers have refused further price concessions in an attempt to protect profitability. Financially, as emphasized in this report's quarterly highlight, most pumping suppliers experienced varied financial performance in the first quarter, with a select few experiencing revenue increases when compared to the previous quarter; however, the majority saw shrinking revenues.

As noted by the latest update of IHS Markit's Operator-Pumper Hydraulic Fracturing Matrix, Halliburton, Schlumberger, BJ Services, and FTS International continue to be the preferred suppliers of choice for many operators, further indicating that market share has significant impact in the pumping market.

Finally, unchanged from the previous quarter and owing to a difficult mix of government regulation and low pricing, Canada continues to face a challenging 2019. IHS Markit projects that low demand will persist.

IHS Markit's Onshore Services & Materials' recent PumpingIQ report for the second quarter of 2019 monitors and forecasts hydraulic fracturing demand, supply, utilization, pricing, trends, and constraints across key North American frac markets. The report is available in its entirety on Connect™ for Onshore Services & Materials clients.

Learn more about our coverage of onshore materials, including proppant and water.

Emanuel Ozuna Vargas is a Principal Research Analyst, Senior Associate at IHS Markit

Posted 18 June 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2futilization-improved-in-2019-with-stable-demand-and-pricing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2futilization-improved-in-2019-with-stable-demand-and-pricing.html&text=Utilization+improved+in+2019-Q2%2c+with+stable+demand+and+pricing+expected+in+the+hydraulic+fracturing+market+through+2019+++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2futilization-improved-in-2019-with-stable-demand-and-pricing.html","enabled":true},{"name":"email","url":"?subject=Utilization improved in 2019-Q2, with stable demand and pricing expected in the hydraulic fracturing market through 2019 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2futilization-improved-in-2019-with-stable-demand-and-pricing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Utilization+improved+in+2019-Q2%2c+with+stable+demand+and+pricing+expected+in+the+hydraulic+fracturing+market+through+2019+++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2futilization-improved-in-2019-with-stable-demand-and-pricing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}