Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 29, 2020

Article: Combination of uncertain consumption outlook and accelerated automation for cashews

This article is from our food commodities coverage dated 16/06/20.

Lockdowns have led cashew trends in Q1 and Q2, favouring the acceleration of previous changes in the two key global processors: Vietnam and India.

This new scenario was unfolding in 2019 and the Covid-19 pandemic has accelerated the change, according to the International Nut and Dried Fruit Council (INC).

First, African suppliers are experiencing stagnant or falling supply due to a combination of unfavourable weather and weak exports to Vietnam and India, whose processors decided to slow orders after low prices last season.

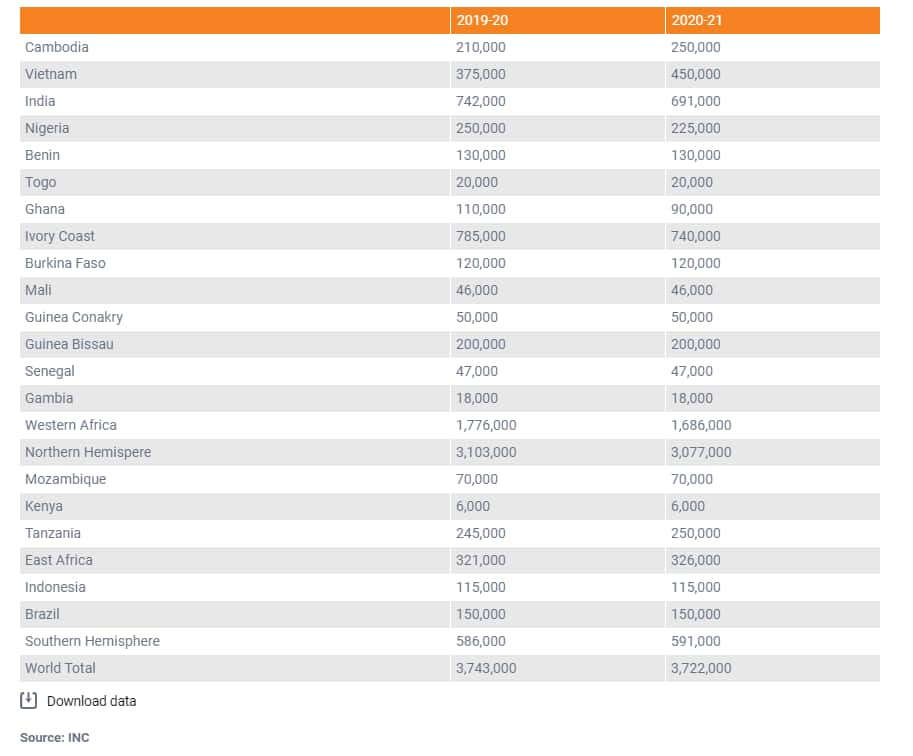

Ivory Coast, the main West African origin, is expected to fall by 5.7% year-on-year to 740,000 tonnes of raw cashew nuts (RCN). Meanwhile, Tanzania, the main East African supplier, may grow by 5,000 tonnes to 250,000 tonnes although its carry-over stock halved to 117,000 tonnes after its massive sale to Vietnam in 2019 led by the African government and the Vietnamese company T&T.

In addition, African processing capacity is still at minimum levels. It reached around 110,000 tonnes of RCN in 2019, very far from 3.7 mln tonnes processed by Vietnam and India.

Vietnam cut its imports of African RCN due to several factors. First, falling prices of processed cashews in H2 2019 meaning a slow digestion of stocked product as the Asian industry is a huge machiner dependent on external supply to maintain a regular path. Lockdowns in Q1 led to irregular exporting trends. International sales fell by 20.8% y-o-y to 26,240 tonnes in January 2020, rose by 91%, 43% and one quarter, respectively, in February, March and April to 27,870 tonnes, 47,240 tonnes and 45,940 tonnes and slightly fell by 3% to 40,480 tonnes this May.

The US, mainly and the EU led these irregular trends. The Middle East markets cut their imports during all the period as their Q1 and Q2 sales rely on the Ramadan festival campaign and pilgrimage to Mecca, lockdowns leading to a sudden change also. The fall in oil price has also played a key role.

This trend was led by the unexpected Chinese lockdown and a sharp rise in US demand after concerns about sudden supply shortage and panic-buying. May data reveals a hangover after huge orders… In addition, Vietnamese and neighbouring Cambodian crops may reach record volumes. Vietnam production is expected to be 450,000 tonnes, 29% more y-o-y, in 2020. Cambodian output continues its gradual growth, encouraged by the Vietnamese processors and may reach 250,000 tonnes of RCN, 19.0%.

As a result, the Vietnamese processors have succeeded in reducing the country's dependency on the African outputs in Q2.

India is the largest global consumer of cashews and its domestic market traditionally offsets negative global trends. However, the domestic lockdown changed that.

Cashew is the key nut in the Indian market, used for all the possible categories: snacking, sweets, Horeca, health food and beverages, etc. However, small and medium processors have been suffering a financial squeeze since H2 2018, slowing its much-needed modernisation. The lockdown has accelerated investment in automation by large and medium processors.

Conclusion

INC's panel of experts were unable to forecast a clear outlook because Covid-19 and its consequences (lockdowns, halted processing activity, sudden fall in purchasing parity, etc.) are leading to a completely unknown scenario.

However, they were optimistic because the US, the EU and India, the main global consumers are working to secure a robust consumption strength as they are developing health products, new savoury flavours, etc., following a trend similar to almonds, hazelnuts or walnuts.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funcertain-consumption-outlook-cashews.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funcertain-consumption-outlook-cashews.html&text=Article%3a+Combination+of+uncertain+consumption+outlook+and+accelerated+automation+for+cashews+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funcertain-consumption-outlook-cashews.html","enabled":true},{"name":"email","url":"?subject=Article: Combination of uncertain consumption outlook and accelerated automation for cashews | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funcertain-consumption-outlook-cashews.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Article%3a+Combination+of+uncertain+consumption+outlook+and+accelerated+automation+for+cashews+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2funcertain-consumption-outlook-cashews.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}