Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 01, 2017

Too early to declare victory in war on high oil stocks

The move by OPEC and certain non-OPEC countries to reduce oil supply, by 1.8 MMb/d starting in January 2017, is making inroads in shrinking global oil stocks. However, a declaration of mission accomplished is premature-especially since the third quarter typically records a seasonal decline in stocks. IHS Markit balances suggest that OECD commercial oil stocks are unlikely to return to the five-year average until around the end of 2019. Therefore, the pressure will remain on OPEC to keep the production restraint in place for a far longer period than was originally planned in late 2016.

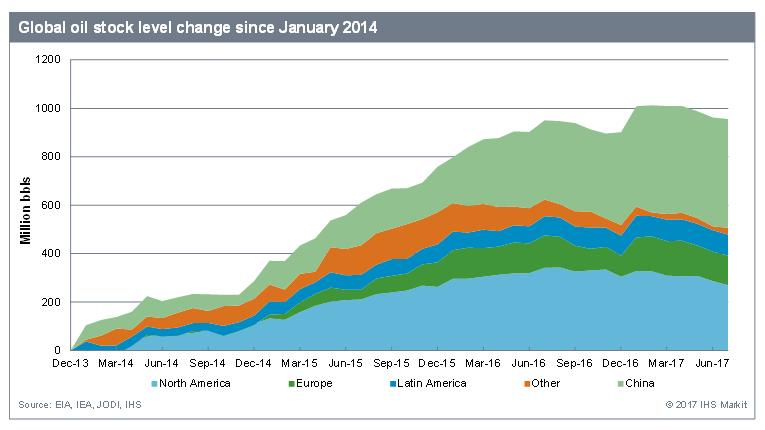

From the start of 2014 through to the storage peak in mid-2016, the oil supply glut and accompanying contango price structure-with future prices higher than near-term prices-fueled a global oil stock build of almost 1 billion barrels, including about 350 million barrels added to government-controlled strategic inventories. Since mid-2016, global oil stocks have declined slightly but still remain high.

Figure 1: Global oil stock level change since January 2014

At the November 2016 OPEC meeting, OPEC and some non-OPEC countries, in a historic decision, stepped back into a market balancer role, pledging to reduce their combined production by about 1.8 MMb/d. OPEC announced that the primary purpose of the supply cuts was to "accelerate the ongoing drawdown of the stock overhang."

In mid-2017, on behalf of OPEC, the Saudi oil minister, Khalid A. Al-Falih, said, "Our joint declaration with Russia concluded that while the rebalancing goal is on its way to being achieved, more needed to be done to draw inventories towards the five-year average."

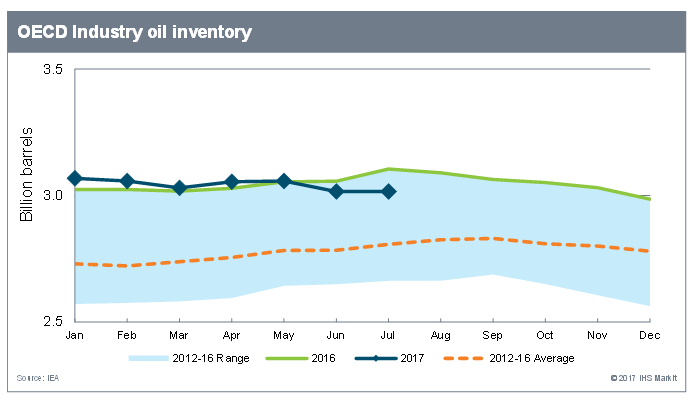

To be sure, ultimately, OPEC and other producers want to bring about higher prices, and they have indicated that the OECD commercial/industry oil stock five-year average is the target. Commercial oil stocks have fallen by about 50 MMbbl in 2017 but remain 150-200 MMbbl above the five-year average.

Figure 2: OECD Industry oil inventory

Our expectation is that global oil inventories will resume growth in 2018, increasing by 100 MMbbl through 2018-19. However, most of these builds may be in strategic stocks and so some reduction in commercial oil stocks may still happen. Even so, getting commercial inventories down to the five-year average remains a significant challenge unlikely to be achieved in 2018.

This blog is a summary of a detailed report published on the IHS Markit Crude Oil Markets service. Learn more by contacting the author, Spencer Welch at spencer.welch@ihsmarkit.com.

Spencer Welch is Director, Oil Markets and Downstream in IHS Markit based in London.

Posted 2 November 2017

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftoo-early-to-declare-victory-in-war-on-high-oil-stocks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftoo-early-to-declare-victory-in-war-on-high-oil-stocks.html&text=Too+early+to+declare+victory+in+war+on+high+oil+stocks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftoo-early-to-declare-victory-in-war-on-high-oil-stocks.html","enabled":true},{"name":"email","url":"?subject=Too early to declare victory in war on high oil stocks&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftoo-early-to-declare-victory-in-war-on-high-oil-stocks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Too+early+to+declare+victory+in+war+on+high+oil+stocks http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ftoo-early-to-declare-victory-in-war-on-high-oil-stocks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}