To drill or not to drill: evaluating exploration licenses off Canada’s east coast

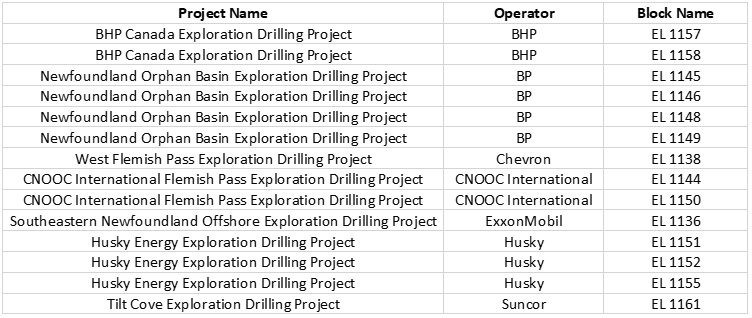

The Canadian Environmental Assessment Agency (CEAA) is currently overseeing the federal environmental assessments of seven proposed exploration projects for the Newfoundland and Labrador offshore region (see table below). In addition, other exploration projects not included in this article have either already received environmental approval but have not yet been drilled, or they are still in the early stages of the process and a determination has not yet been made whether an environmental assessment will be required.

Figure 1: Proposed exploration projects for Newfoundland and Labrador offshore region

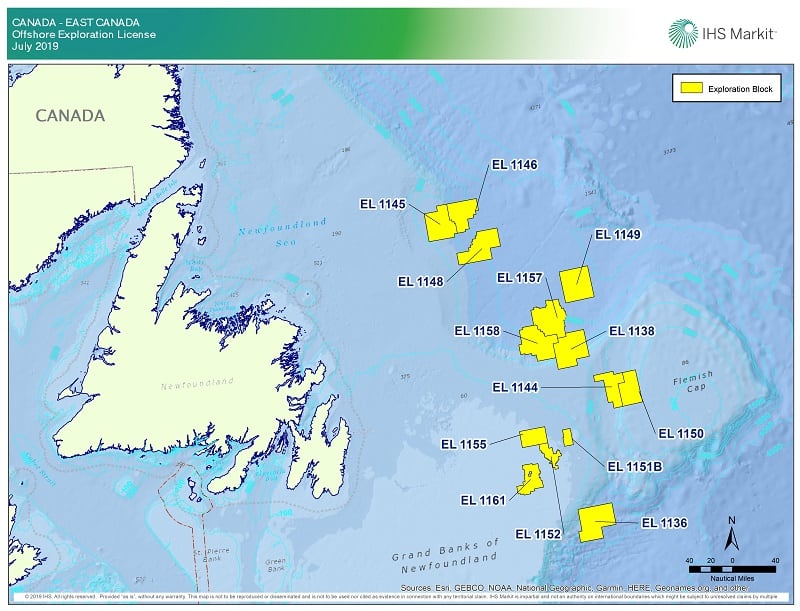

The operators with exploration programs undergoing environmental assessment are BHP, BP, Chevron, CNOOC International, ExxonMobil, Husky, and Suncor (see map for licenses). According to IHS Markit RigPoint, the projects currently have estimated start dates ranging from early 2020 through late 2021. These target start dates are subject to various regulatory approvals as well as, in most cases, securing a drilling rig. The seven proposed projects are located in water depths ranging from about 200 ft to 8,200 ft (61-2,499 m).

Figure 2: Offshore exploration license for East Canada

Thus far, only one rig has been chartered for these projects. CNOOC International has chartered drillship Stena IceMAX for a 100-day plus options charter that is scheduled to begin in the second quarter of 2020. The rig will mobilize to eastern Canada early next year from Northwest Europe. Only three floating rigs, all semisubmersibles, are currently positioned off eastern Canada - and all three are scheduled to roll off their current charters by the beginning of next year, pending the exercising of available options on one of the rigs. Given that these programs are likely to start out with only one or two wells drilled per charter, the existing Canadian units are good candidates to pick up most of the work. However, depending on the operators' timelines and the timing of ongoing and new development programs, it is possible another rig besides Stena IceMAX might be moved into the area, possibly as early as next year.

All deepwater (anything over 200 meters water depth in this analysis) exploration licenses are currently outside the maximum tie-back distance, which ranges from 20 km to approximately 60 km, depending on reservoir contents. This means they would have to be developed using a stand-alone facility, capable of processing oil and gas production. Conversely, all shallow (anything under 200 meters in this analysis) water exploration areas are within tie-back distance from existing facilities, meaning they can simply have their production processed at currently present infrastructure. These facts have a material impact on the minimum economic discovery size for the various blocks.

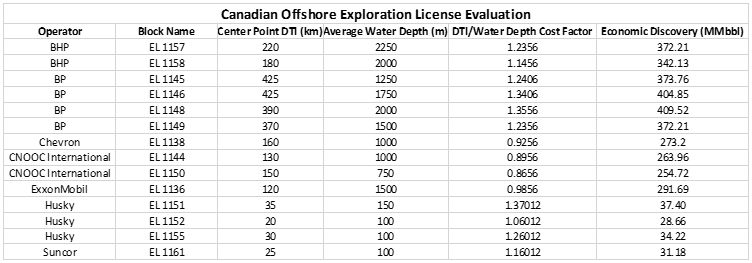

Using IHS Vantage® to relate analogs, we can identify discovery sizes that would be needed for an economic development to go forward. For the shallow water blocks, the Ben Nevis North asset was used for comparison, while Bay du Nord was used for estimating economics on the deepwater exploration licenses. The Bay du Nord project has a distance to delivery point of approximately 200 km, a water depth of approximately 1172 m, and a stand-alone production facility. The Ben Nevis North project has a distance to infrastructure (DTI) of approximately 17 km, a water depth of 99 m, and a subsea tie-back development concept. The two projects align quite nicely as analogs for the existing exploration licenses. Using a formula that adjusts the capital and operating expenses for changes in water depth and DTI, we are able to find a "cost factor". The cost factor allows us to adjust expenses and estimate production volumes within the fiscal model downloaded from IHS Vantage® for our analog projects.

Figure 3: Canadian offshore exploration license evaluation

Our analysis for the production volumes that will leave us with an NPV of 0, is summarized in the table above. The data points in the table are IHS Markit estimations, utilizing and adjusting existing models within IHS Vantage®. All analysis was done using a 10% discount rate and a base oil price of US$65 per barrel. The shallow water exploration blocks require a much smaller discovery for an economic development, as they are all within tie-back distance of existing facilities. For the isolated, deepwater blocks, the discovery size will need to be much larger (between 250 MMbbl and 400 MMbbl, depending on the variables). Ultimately, the blocks nearer to existing infrastructure have much greater flexibility and upside, should a discovery be made in the next few years.

Learn more about our upstream solutions.

Cinnamon Edralin is a Data Transformation Principal, Rigs at IHS Markit.

Isaac Nuti is a Senior Research Analyst, Vantage® at IHS Markit.

Molley Sheriff is a Senior Geospatial Analyst at IHS Markit.

Posted 1 August 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.