The Roebuck Basin – Over 40 years of patience

Introduction

The Roebuck Basin, located on Australia's front line of hydrocarbon exploration and development, is a province turning a lot of heads. The basin, with over 40 years of exploration drilling but no significant success until 2014, is situated on the North West Shelf, sandwiched between the prolific North Carnarvon and Browse basins. Amongst the four discoveries in the Roebuck's history, three of which made in the last five years, was Dorado 1 in 2018. It is one of the largest oil discoveries found on the North West Shelf. With this sudden surge in success, what do we know and what might be out there?

Facts and Figures

Area- 93,000 sq km (27,000 sq km shelf, 66,000 sq km deep water)

First Well- Bedout 1, dry, 1971, Woodside.

First Discovery- Phoenix 1, oil, 1980.

Well count as of October 2019 (exploratory and appraisal)- 24

Discovered fields- 4

3D seismic data coverage- ~30%

(IHS Markit data)

Dorado 1 Exploration Summary and Block Ownership History

Dorado is situated in the WA-437-P exploration permit. It was discovered in July 2018 via the Dorado 1 new field wildcat, drilled by Quadrant (later acquired by Santos) and Carnarvon Petroleum (see Figure 2). The well encountered oil, gas and condensate, with success in the Caley, Baxter, Crespin and Milne sandstone members of the Middle Triassic Lower Keraudren Formation, opening up the unconformity play in the basin. It was the Caley Member that was of greatest interest with light oil recovered, and 79.6 m of net pay encountered in the reservoir member. Following the discovery, appraisal wells Dorado 2 and Dorado 3 were drilled in 2019, both successful, with Dorado 3 flowing oil and gas, and gas and condensate on test at significant rates from the Caley and Baxter reservoirs respectively between September and October 2019. Volumes have since been reevaluated, and as of October 2019, IHS Markit estimated recoverable volumes are at 126 MMbo, 36 MMbc and 748 Bcf.

The WA-437-P exploration permit was awarded in August 2009 to Finder Exploration (100% and operator). In December 2009, Carnarvon took a 50% stake as a part of a swap deal involving a number of exploration permits. In February 2013, Finder and Carnarvon farmed out some of their stakes to Apache and JX Nippon, resulting in the ownership being Apache (40% + operator), Finder (30%), Carnarvon (30%) and JX Nippon (20%). In June 2015, the Apache stake was transferred to Quadrant as a part of the sale of Apache's Australia assets to a consortium comprising Brookfield Asset Management and Macquarie Capital. Quadrant increased their stake in the permits to 80% through the acquisition of Finder's stake in March 2016 and JX Nippon's stake in April 2016. In November 2018, Santos acquired Quadrant with the current right holdings for the permit being Santos (80% + operator) and Carnarvon (20%).

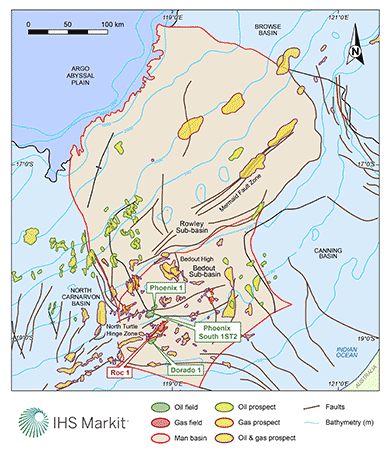

Figure 1: Roebuck Basin Structural Framework Map

Basin History and Evolution

The Roebuck Basin is a north-south oriented basin with a northeast structural grain located on Australia's North West Shelf. The basin is made up of 2 sub-basins; the Rowley Sub-basin in the north, and the Bedout Sub-basin to the south (see Figure 1). It's the smaller, shelfal Bedout Sub-basin within which all the basin's discoveries reside. Sub-provinces of the Canning Basin extend below the Roebuck.

In the Late Carboniferous to Early Permian, basin formation began as part of the break-up of Australia's northwest margin. Northeast-southwest intracratonic extension changed to north-northwest to south-southeast extension resulting in deposition of Permian and Triassic shallow marine and deltaic sediments (Horstman & Purcell, 1988; Smith, 1999; O'Brien et al., 1993). In the Rowley Sub-basin, this orientation of extension created southeast to east-southeast dipping normal faults, causing asymmetric half grabens. In the Bedout Sub-basin, syn-rift sedimentation progressed along Paleozoic fractures formed from the original northeast-southwest extension (Smith, 1999).

Extension continued in the Late Permian, with the basin undergoing implications of the Bedout Movement, which ended deposition within the basin (Forman & Wales, 1981). Uplift, erosion, faulting, tilting and volcanism all occurred due to this early rift phase event (Forman & Wales, 1981; Colwell & Stag, 1994) before continental break-up. Due to the movement, the basin transitioned from fault controlled subsidence to thermal subsidence (Smith, 1999), which is marked by a regional unconformity distinguishing Late Paleozoic and Mesozoic stratigraphy (Forman & Wales, 1981). During thermal subsidence and the resulting marine transgression, sag sedimentation occurred across the North West Shelf in the Early Triassic. The rapid transgression caused deposition of fine siliclastics of the Locker Shale (Smith 1999), with its transgressive mudstones considered a potential source of hydrocarbons in the Bedout Sub-basin. In the late Early Triassic, sea level regression caused vertical gradation of the Locker Shale into fluvio-deltaic sediments of the Middle to Late Triassic Keraudren Formation (Bradshaw et al., 1988). The Lower Keraudren Formation is a proven reservoir, hosting 100% of the basin's oil and gas reserves within its informally defined members.

Transpressional tectonics took over in the Triassic, lasting until the Early Jurassic. The northwest-southeast transpression, named the Fitzroy Movement (Forman & Wales, 1981), caused folding and faulting of Late Carboniferous to Triassic strata. The Fitzroy Movement was also a rift event, prior to break-up and sea floor spreading, which occurred in the Middle Jurassic (Argo Land). Smith (1999) broke the movement into stages, with formation of transpressional flower structures and anticlines in the Middle Triassic during the initial movement, transitioning from thermal subsidence to extension in the Late Triassic, with thermal subsidence resuming in the Early Jurassic. The Cossigny Member, a proven seal to Lower Keraudren reservoirs, was deposited after the first stage where Ladinian marine transgression occurred.

During subsidence in the Early to Middle Jurassic, the Depuch Formation was deposited across the Roebuck (progradational fluvio-deltaics). The formation, although not yet a proven reservoir in the basin, is a primary target, especially in the Rowley Sub-basin where it is thickest due to greater subsidence rates at time of deposition. The formation also has intraformational sealing potential.

Post Callovian, thermal relaxation occurred locally in the Roebuck after break-up of Argo Land and formation of the Argo Abyssal Plain outboard of the basin (Veevers et al., 1991; Muller et al., 1998; Smith, 1999). This caused rapid transgression, creating a condensed section of claystones of the Baleine Formation and glauconitic sands of the Egret Formation (Smith, 1999). These formations form secondary reservoir targets within the basin as well as holding source lithologies.

Onset of break-up between India and Australia began in the Valanginian, causing an influx of siliclastic deposition into the basin due to the source area being uplifted (Smith et al., 1999), including the deposition of the reservoir target Broome Sandstone.

After break-up, the basin assumed a passive margin setting, and by the Aptian, full oceanic circulation had been established (Smith, 1999).

At the Albian-Cenomanian boundary, the spreading direction changed between India and Australasia occurred. Northwest southeast spreading changed to a north south orientation which caused inversion and oblique-slip of Paleozoic structures (Muller et al., 1998; Smith, 1999).

From the Cenozoic to Recent, deposition of progradationial carbonates reflected the shelfal conditions. In the Middle Miocene, the Australian and Eurasian plates collided and caused transtensional wrenching in the footwalls of northeast-southwest Paleozoic half grabens within the Rowley Sub-basin (Smith, 1999).

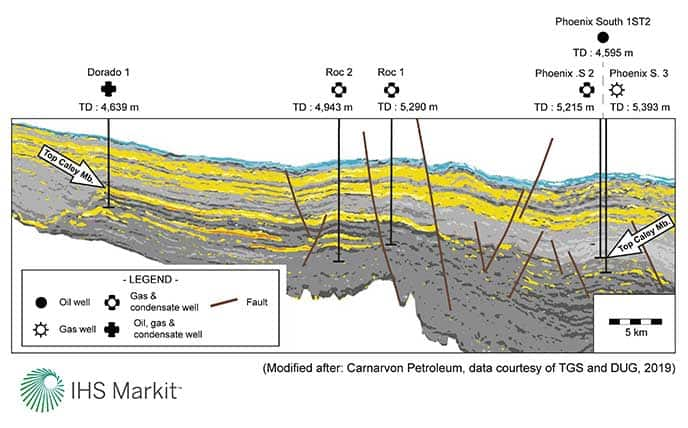

Figure 2- Regional Inverted 3D Seismic Line

Successful Plays

The Roebuck Basin is home to three proven and six prospective plays, highlighting its immature status in terms of exploration. Drilling has occurred since the 70's, but it's only till recently that commercial volumes have been found bringing the 3 plays into the spotlight (see Figure 3). The proven plays revolve around just the Lower Keraudren Formation, involving structural, unconformity and combination traps. The Lower Keraudren is made up of numerous sandstone and shale members, including the Barret, Hove, Caley, Baxter, Crespin and Milne members, all of which have been successful as reservoirs in at least one of the 4 finds of the basin (see Figure 1).

Of the three plays, the Lower Keraudren Unconformity play is one of greatest significance. The play is represented by just Dorado 1. Although proven at just one field, the play accounts for 84% of basin oil recoverable resources and 46% of gas recoverable resources, with 126 MMbo and 748 Bcf recoverable respectively (as of October 2019, subject to change, pending Dorado appraisal resource estimates). The trapping style of the play as seen exclusively in Dorado 1 is a sub-crop trap where reservoirs are subject to three-way truncation by the extensive Dorado-Apus erosive channel/canyon system (see Figure 2). The channel is filled with sealing lithologies of the Hove Shale Member providing an up-dip barrier. Intraformational shales within the stacked sands also act as vertical barriers. Source is provided by intraformational mudstones, with the Locker Shale providing additional source potential.

The second play of significance is the Lower Keraudren Structural play which is proven at the Phoenix South 1 (2014) and Roc 1 (2016) discoveries, and the sub-commercial Phoenix 1 discovery in 1980. The play accounts for 13% of basin oil recoverable resources and 54% of gas recoverable resources with ~20 MMbo and ~890 Bcf recoverable respectively. Trapping styles of the play are fault blocks, as seen in the three discoveries. Other potential structures include horsts, faulted dip closures and fault controlled positive transpressional features. Seal is provided by the Cossigny Limestone, as well as intraformational units. Source is again provided by Lower Keraudren intraformational mudstones.

The third and final proven play of the basin is the Lower Keraudren Stratigraphic Structural play which is considered minor. The play was proven within a sandstone interval of the Hove Shale Member at the Phoenix South 1ST2 discovery. The play takes into account structural and stratigraphic influences, as well as source and seal seen in previous plays. The play accounts for 3% of basin oil recoverable resources and <1% of gas recoverable resources.

Figure 3- Cumulative Resources Creaming Curve

Global Analogues for Dorado

Dorado was quite the discovery, not just changing the outlook for the basin, but also the region itself. With the North West Shelf seen predominantly as a gas dominant region, this large oil discovery has grabbed the industry's attention.

With this basin play opener, it is important to be aware of natural analogues. As documented by Carnarvon Petroleum, the Dorado structure has a strong likeness to elements of trapping in some of the Gippsland giant fields such as Marlin and Halibut-Cobia due to the erosive Marlin Channel.

Using the new IHS Markit reservoir analogue tool, a few other global analogues have been identified with parameters set to match Dorado's trapping style and reservoir lithology.

The first analogue that came to attention was Brazil's Ubarana field in the Potiguar Basin, with its Alagamar and Pendencia formation reservoirs. The terrestrial-transitional sandstones lie within tilted fault blocks which are partly eroded by the Ubarana Canyon, trapping hydrocarbons against it, thus very similar to the Dorado canyon trap. The producing field has field reserves of over 200 MMbo, with over 110 MMbo produced to 2018 since coming online in 1976. With canyon trapping playing a key role, it only gives confidence to Dorado and its play's future.

Another analogue that showed similar canyon truncation was the Carapebus Formation of the Bicudo field within the Campos Basin, also in Brazil. The reservoir was primarily controlled by pinch out together with truncation by a submarine canyon (Enchova Canyon). Although having some differing aspects like reservoir facies and pinch out, the producing reservoir at Bicudo is part of a field that has ~170 MMbo 2P recoverable, thus again outlining the potential of these canyon/sub crop plays. Along the Enchova Canyon are other successful producing analogue fields relying on reservoir truncation from the canyon , such as Bonito and Enchova, all heightening the excitement for the play at Dorado and the prospects that lie on the same channel/canyon system.

Exploration Potential and Outlook

With the recent surge of success in the basin, and the Lower Keraudren Formation as the basin's only success story to date, it now leaves the question, what else is out there?

Looking at Figure 1, numerous prospects have been mapped outlining the potential in both sub-basins. Of the 9 plays in the basin, 6 remain prospective, made up of Lower Triassic to Lower Cretaceous structural and stratigraphic plays. Structures include horsts and tilted fault blocks, faulted and fault derived anticlines, as well onlap, pinch out and combination traps. Of note is the Upper Keraudren play, where the Cuvier Member was found by Phoenix South 3 to contain oil. The interval was not tested and is the only well known to have oil at this level to date but outlines the potential in the younger stratigraphy.

Outlining undiscovered potential is important, but one must also look at the additional potential of discovered plays. Further excitement exists in Phoenix, Phoenix South and Roc plays<span/> , but more so at Dorado. For the Dorado play, numerous prospects have been mapped by the Santos-Carnarvon JV along the Dorado-Apus channel/canyon system. The key question and risk which remains is if effective seal is present along this channel network, like seen in Dorado. As demonstrated at Roc South 1, a direct analogue and near neighbour of Dorado, the picture could be more complex, with the well failing to encounter producible hydrocarbons. Dry hole analysis was ongoing, but at present it was thought to be a consequence of either a migration shadow or a lack of seal or a combination. The result does suggest more analysis is needed, but if it's merely a stutter in the history of the play, Dorado might only be the start of play and basin success.

As of October 2019, in the Roebuck, if all current contract commitments reach expiry up to 2025, there are 14 commitment wells scheduled within 7 contracts.

The Roebuck Basin has taken a while to unlock, but it seems the key is finally beginning to turn on this immature basin.

Exploration Entry Opportunities

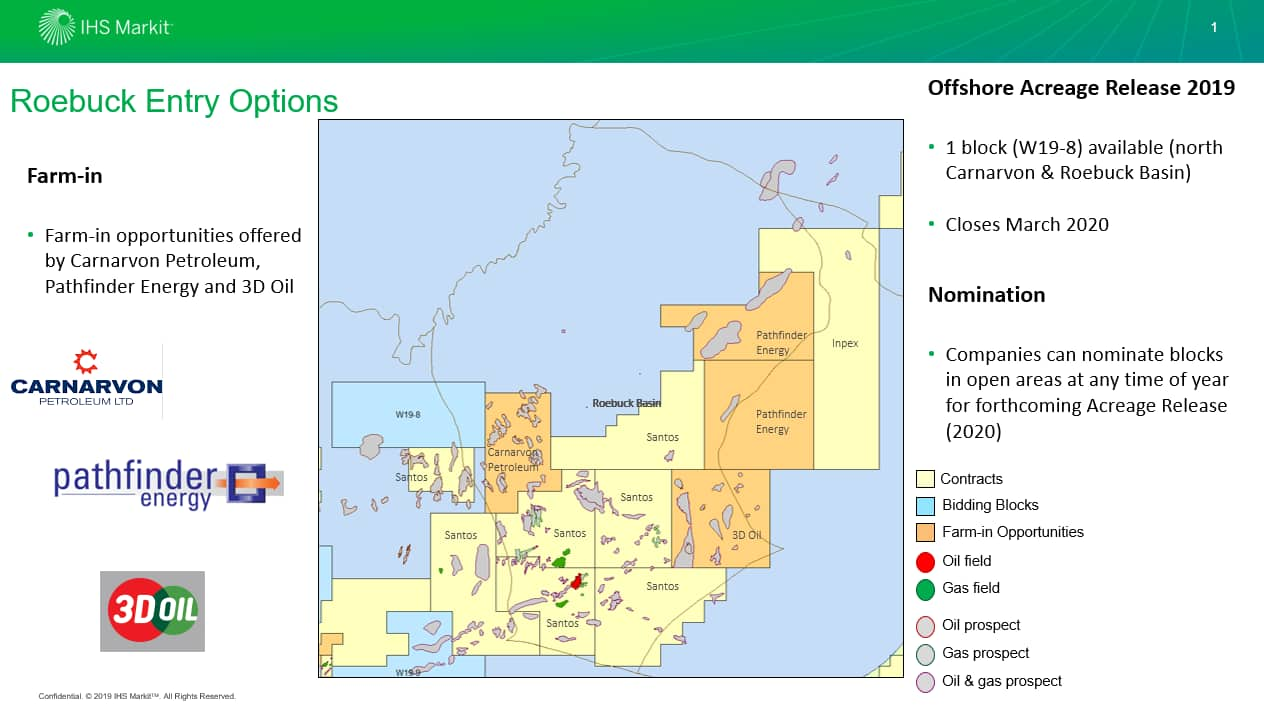

Entry into acreage in Australia is via three main avenues: bid round application, farm-in or company acquisition/merger. The Roebuck Basin is no different and these are the main paths for companies looking to enter the basin.

Bid round acreage in the Roebuck is opened as part of the Federal Offshore Acreage Release, which is opened annually across a range of basins and water depths. As of late 2019, one block is available within the Roebuck Basin; W19-8 eastern portion lies in the basin, with the remainder within the North Carnarvon. The block covers 6,853 sq km and is well covered by 2D and 3D seismic, but contains no wells. Bidding closes on 5 March 2020.

As well as bidding in the acreage offers, companies can also nominate acreage to be included in the next round. This process has been recently streamlined, as part of changes to make the whole acreage release more efficient; for the nominations, companies can now submit at any time, for blocks to be included in the next round. All nominations are considered, but nomination of an area does not guarantee its inclusion in the round. Companies are not required to bid for areas they nominated, though the government does indicate that "nominations should demonstrate a genuine intent to start activities in the immediate term".

Farm-in opportunities are on offer across a range of assets, with varying interest available, within the majority of basins in Australia. In the Roebuck Basin, three companies are offering farm-in opportunities: Carnarvon Petroleum, 3D Oil and Pathfinder.

Figure 4- Roebuck Entry Options and Opportunities

Dorado Development Scenario

The Dorado discovery sits about 150km North West of Port Hedland, in the Commonwealth waters offshore Western Australia. The field sits in a water depth of about 90 m.

The final field development plan will depend heavily on any change in reserves due to the analysis of the two appraisal wells, Dorado-2 and Dorado-3, that were drilled in the second half of 2019. The likely development would be undertaken in two phases, the first would focus on the commercialization of the liquids and the second on the gas, providing the Western Australia gas market will support the development.

The liquids phase will likely be based on an FPSO development, with wellhead platforms or subsea trees, the nearby Phoenix and Phoenix South fields may also be developed during this phase. During this phase the oil would be processed and stored on the FPSO and the gas would be reinjected. This phase may take FID as soon as 2020, dependent on appraisal results, FEED work and normal financial considerations.

At current reserve levels, the liquids phase should meet the economic requirements for development. The economics will be depending on the required well count and any integration of facilities onto the FPSO for the potential gas development.

Figure 5- Dorado Development Scenario

Learn more about our upstream oil and gas insights.

William Plamptonis a Principal Technical Researcher, at IHS Markit.

Frances Hulbertis an Associate Director Australasia & Indian Sub-Continent Upstream Research

Robert Chambers is an Associate Director Asia Pacific Upstream Valuation.

Posted 6 November 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.