Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 13, 2020

The low oil price environment: A speed bump for China’s LNG heavy-duty trucks in 2020

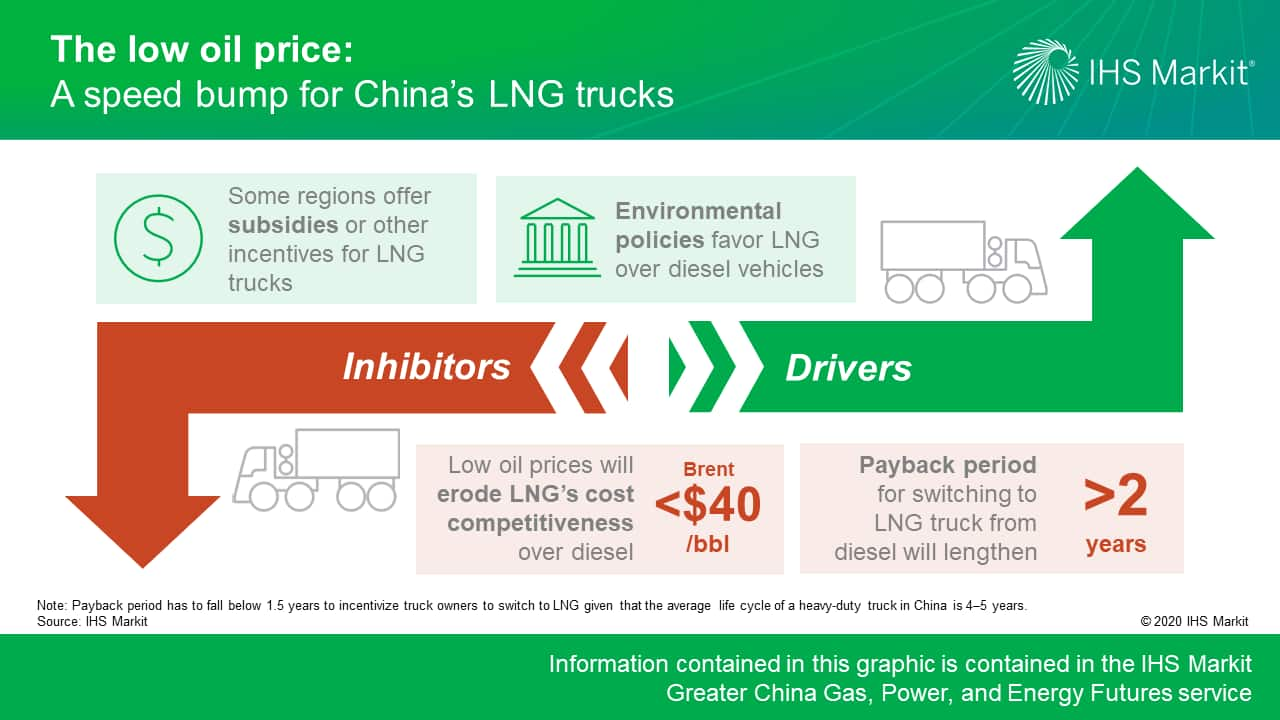

Figure 1: The low oil price: A speed bump for China's LNG trucks

LNG's cost competitiveness over diesel has contributed to the rise of heavy-duty vehicles (HDV) powered by LNG fuel in China. Although LNG HDVs sell at a higher price compared with diesel ones, fuel cost savings can pay back this difference within a relatively short period of time. The typical payback period to incentivize LNG HDV purchasing is 1.5 years, given that the average life cycle of an HDV in China is 4-5 years.

When oil prices are high, truck owners can be tempted to make the switch, such as during 2017-19 when the Brent crude oil price averaged $65/bbl, resulting in a period of robust sales. In 2020, even with the recent agreement of oil production cut, we expect the global oil price will be depressed under the impact of the coronavirus disease 2019 (COVID-19) pandemic, keeping the average Brent oil price below $40/bbl. At this low oil price, the economic advantage of LNG over diesel is threatened, and we expect LNG HDV sales to slow.

Depressed oil prices will affect the economics of LNG HDVs across China—even in gas-rich regions like Northwest China where LNG wholesale rates are among the lowest nationwide. With oil prices this low, and LNG wholesale rates at the current level, the payback period will exceed two years in all regions—above the 1.5-year threshold below which truck owners have traditionally been persuaded to make the switch.

Regardless of the elongated payback period, some truck owners will continue to purchase LNG HDVs depending on business operations. Some municipalities and ports have banned diesel vehicles within city and port limits. There have also been examples of subsidies to discount costs of a new truck or waivers of highway tolls for LNG trucks.

But for those whose decision to purchase an LNG truck hinges on the payback period, we expect the impact of low oil prices to be temporary. Once oil prices recover past the $50/bbl mark, LNG trucks will regain their economic advantage. In the long term, China's environmental policies will also continue to support cleaner-burning LNG in the transportation sector. Given our overall positive outlook for LNG HDVs, current oil price is just a temporary challenge—a speed bump.

Learn more about our coverage of the Greater China energy market through our Greater China Gas, Power, and Energy Futures service.

Megan Jenkins is a Senior Research Analyst covering Greater China's gas and LNG analysis.

Posted 13 May 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-low-oil-price-environment-a-speed-bump-for-chinas-lng-hdv.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-low-oil-price-environment-a-speed-bump-for-chinas-lng-hdv.html&text=The+low+oil+price+environment%3a+A+speed+bump+for+China%e2%80%99s+LNG+heavy-duty+trucks+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-low-oil-price-environment-a-speed-bump-for-chinas-lng-hdv.html","enabled":true},{"name":"email","url":"?subject=The low oil price environment: A speed bump for China’s LNG heavy-duty trucks in 2020 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-low-oil-price-environment-a-speed-bump-for-chinas-lng-hdv.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+low+oil+price+environment%3a+A+speed+bump+for+China%e2%80%99s+LNG+heavy-duty+trucks+in+2020+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-low-oil-price-environment-a-speed-bump-for-chinas-lng-hdv.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}