Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 18, 2020

The impact of the oil price collapse on APAC upstream FID’s

We have spent a lot of time in recent years adjusting to the oil price crashes seen in 2008 and 2014. We were just getting ourselves nicely adapted to the "new normal" of oil prices in the $50-$70 range and the early 2020's was shaping up to be when we all started to get back to work. There were a number of significant and key final investment decisions (FID's) being lined up in the APAC region that would have provided a much-needed boost to service companies and the industry as a whole.

Then our twin black swans arrived, with simultaneous shocks on both the demand and supply side of oil markets.

- The first black swan event was on the demand side in the shape of the coronavirus disease 2019 (COVID-19). The initial outbreak, with its epicentre in Wuhan, China, had a significant impact on China's oil demand but was more limited globally. However, with a global pandemic now declared by WHO, the on global demand impact can expect to be far larger and there remains significant uncertainty to the scale and duration of the impact.

- The second black swan event was on the supply side, when the Vienna alliance (OPEC + selected non-OPEC) broke down due to diverging views of the oil market, the perspective of US unconventional production and the impact of COVID-19. Following which, Saudi Arabia increased oil output, offering deep discounts to customers. The resulting price war has led to a collapse in oil prices to levels not seen since the global financial crisis of 2008. Again, the full scale and duration of this event is not understood.

It is not just the oil markets that have had a significant shift, global gas markets have also seen massive change. COVID-19 saw anticipated demand from China disappear, resulting in the spot LNG cargoes trade below US$3/MMBTU. The global impact of the COVID-19 pandemic is still to play out but global gas demand has already been impacted and the scale is set to grow as economies slow.

Oil company reactions

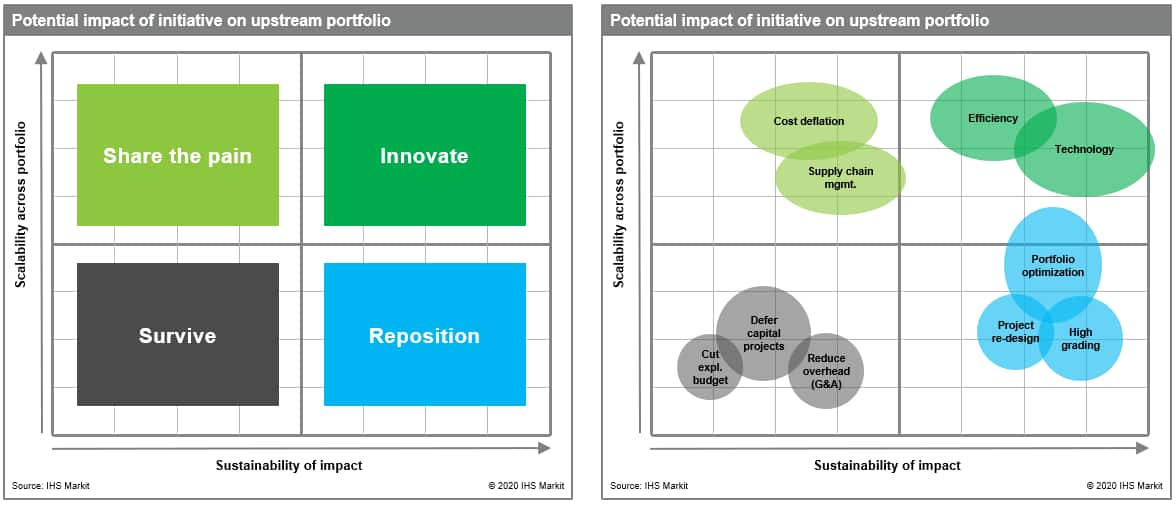

We don't have to look too far back to understand the short-term reaction of oil companies to lower oil and gas prices. However, as central banks are discovering, there is only so much more that can be done when you are still enacting measures in response to the last crisis. Figure 1, below, shows some of the typical reactions we saw in response to the 2014 oil price crash.

Figure 1:Company strategies in response to low oil

prices and impact on their upstream portfolios.

For this article, we want to focus on the short-term impact, which is very much the bottom-left quadrant. The immediate reaction of oil companies is to review any discretionary spend, with a view to it being suspended or deferred. Then, once the dust settles, there are three main reasons that the projects will be further delayed:

- The economics no longer stack up for the project.

- The project partners may struggle to fund, or access funding, for the developments.

- The partners may see M&A as a better proposition than funding new developments, especially if distressed companies can be acquired at a discount.

The below analysis is not a comprehensive list of all projects and, for now, we have focussed on projects in Australasia and SE Asia.

Australasia FID's

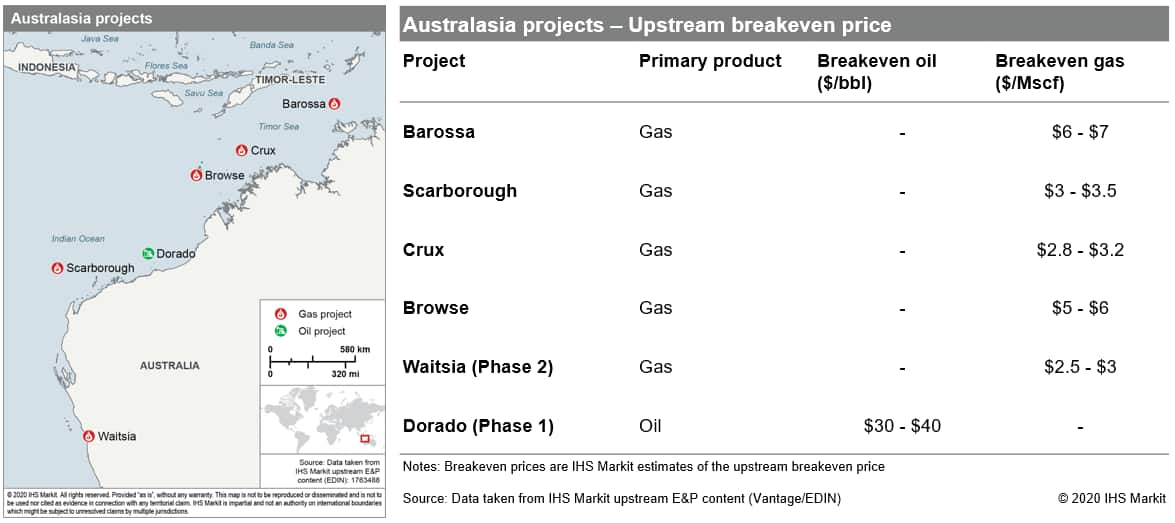

2020 was going to big a big year for Australia, with a lot of the upstream CAPEX being sanctioned on the basis that they would be providing feedstock gas as backfill to existing LNG liquefaction plants and even some to support new liquefaction trains. In addition, we have onshore gas projects targeting the domestic market and an exciting new liquids play. Figure 2, below, shows some of these key projects, followed by some commentary on each project.

Figure 2: The economics of LNG backfill projects in

Australia will be challenged by the low LNG prices and

demand.

- Barossa (to Darwin LNG): the development of the Barossa field will provide feedstock for the Darwin LNG plant, currently supplied by the Bayu-Undan field which is nearing the end of field life. FID for the Barossa project had been expected in Q1 2020. However, in their 2019 annual report, released in February 2020, Santos announced a delay in the planned FID date to Q2 2020, citing the need to close the deal to acquire the assets from ConocoPhillips prior to sanction. However, it was also acknowledged that the marketing of the gas was proving challenging in the current market. The news this week was more positive, with Santos announcing that it had agreed to sell a 25% interest in Darwin LNG and Bayu-Undan to SK E&S, helping to better align the Barossa partners.

- Scarborough (to Pluto LNG T2 + NWS LNG): the development of the Scarborough field will provide feedstock for a new (2nd) train at the Pluto LNG plant, with additional gas also supplied to the Karratha gas plant (NWS LNG) through a planned interconnector pipeline. The project was going to be the flagship FID for Woodside in 2020 but is increasingly looking likely to be delayed due to challenges in marketing the gas. In addition, Woodside have openly stated their desire to farm-down their interest in Scarborough and Pluto train 2 to about 50%. Whilst they have stated this is not a prerequisite for FID, it certainly increases the chances of a delay.

- Crux (to Prelude FLNG): the development of the Crux field will provide feedstock to the Prelude FLNG facility. Shell have been progressing towards the award of the EPIC contracts for the Crux jacket and topsides, both of which had been expected in 2020. There has yet to be any news on the potential for delaying the project.

- Browse (to NWS LNG): the development of the Browse field will provide feedstock for the Karratha gas plant (NWS LNG), backfilling as production from currently producing fields decline. The project had been earmarked for FID in 2020 but has already been delayed to 2021. The economics of the project are being challenged by the potential tolling fee through the NWS LNG plant, with the Browse partners and NWS LNG partners struggling to come to a viable agreement.

- Waitsia (Domestic gas): the Waitsia gas field came onstream in August 2016, with the initial phase having an output of about 10TJ/day with FID on an expansion project to double the output taken in July 2019. However, a full field development could see the production increase ten-fold from the expanded capacity. We had seen the key challenge to a full development being the ability to find a suitable buyer in the domestic Western Australia market. However, if the above projects (and their domestic market obligation) get further delayed, this could open a window of opportunity for a full Waitsia development and even to other onshore gas projects in the Perth basin. However, it is likely that domestic demand will also take a hit as a result of the global economic slowdown.

- Dorado: a lot has been written about the discovery and potential development of the Dorado field. The initial development of the Dorado field is based on commercializing the liquid resource within the field. The target FID date for the initial development is 2021, so Santos and Carnarvon can progress the project and even enter FEED, as planned in Q2 2020, without over-committing capital to the project. However, decisions will have to be made in early 2021, with a decision dependent heavily on how the oil market changes over the next 6-9 months.

SE Asia FID's

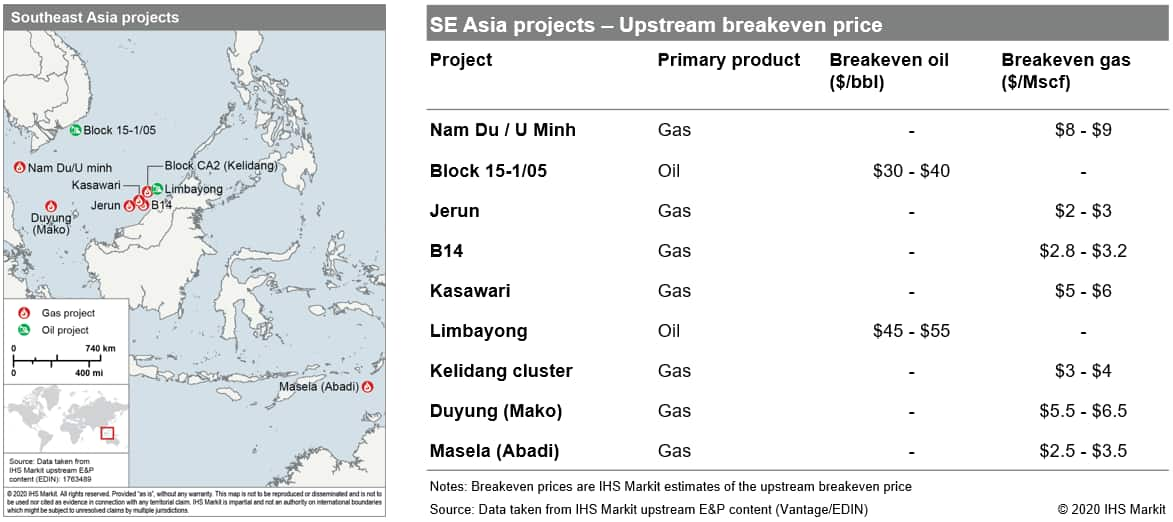

SE Asia has been plagued by above-ground challenges that has been causing uncertainty and challenging potential FID's. These factors have been wide ranging and have included: the handling of expiring production sharing contracts and concessions, significant changes to fiscal terms, inter-country and intra-country disagreements on revenue sharing and changes in governments. Through all of this, oil companies have continued to progress projects towards FID, even if the numbers were limited. Figure 3, below, shows some of the key projects that were expected to take FID in the next 12-24 months, followed by some commentary on each project.

Figure 3: Even the limited expected FID's are now looking

challenging.

- Block 46/07 & Block 51 (Nam Du / U Minh): the development of the Nam Du and U Minh fields in Vietnam will supply the domestic market through a tie-in to the PM3-Ca Mau export pipeline. FID had been pending government approval, which was expected in early 2020. This didn't arrive and Jadestone has stated that any potential spend on the project will take into account the current macro environment. Whilst the project would deliver gas at a fixed price (not tied to oil price), which helps with the price risk, we no longer expect the project to take FID in 2020.

- Block 15-1/05 (Lac Da Vang): the three oil fields within the block: Lac Da Vang (LDV), Lac Da Trang (LDT) and Lac Da Nau (LDN) were to be developed as a cluster, with the gas also commercialized into the domestic market. The Outline Development Plan (ODP) was approved in September 2019 and Murphy had been indicating that the LDV field development could take FID in 2020. Murphy have reacted to the collapse in oil prices by announcing CAPEX cuts of 35% and we would expect this development to be delayed.

- MLNG Feedstock projects: 2020 was going to be a key year to decide on the development of a number of new feedstock projects for the MLNG plant in Bintulu, Sarawak, including the Jerun, B14 and Kasawari fields. The development of new feedstock projects had already been complicated by the introduction of a sales tax by the Sarawak state government and, given that all of the projects will be exposed to oil-indexed LNG prices, we can expect their development to be further challenged.

- Limbayong: the Limbayong project had been touted as a key potential development for Petronas in 2020, with an FPSO tender expected in Q1 2020. Our upstream valuations team already had a conservative view for the potential development of the project owing to the challenging nature of the reservoir. Our conservatism will only increase with the collapse in oil prices.

- Block CA2 (Kelidang cluster): the development of the Kelidang Cluster, offshore Brunei, was key to providing backfill supply to the Brunei LNG plant. We had already delayed our development timeline on the project owing to disagreements between the project partners and Brunei LNG over the optimal production rates and we do not expect the project to be sanctioned in the near-term.

- Duyung PSC (Mako): the development of the Mako field in the Duyung PSC offshore Indonesia had been progressing towards FID, with the partners targeting 2020. The gas production would feed into the West Natuna Transport System, giving access to markets in Indonesia and Singapore. Conrad had announced that they had signed a Heads of Agreement (HOA) with a regional buyer for all future gas production, with the buyer believed to be Singapore based. A spanner was thrown into this plan when, in February 2020, the Indonesian Energy and Mineral Resources Ministry announced that it would stop gas exports to Singapore in 2023. The project may still be able to find a buyer for the gas in Indonesia, but the achievable price may not be as high.

- Key expired and expiring Indonesian PSC's: much has been written about the handling of expiring PSC's in Indonesia as well as the change in Fiscal regime to gross split. Pertamina has taken over/will be taking over a number of key producing contracts including the Mahakam Offshore PSC and the RokanPSC. These projects are critical to domestic production and require significant capital investments to maintain and/or grow production.

- Masela PSC (Abadi): the development of the giant Abadi gas field in the Bonaparte basin was covered in my last blog post. The challenges highlighted in marketing the LNG will only have been amplified by current market conditions and the potential for delays has grown.

Impact on M&A activity in APAC

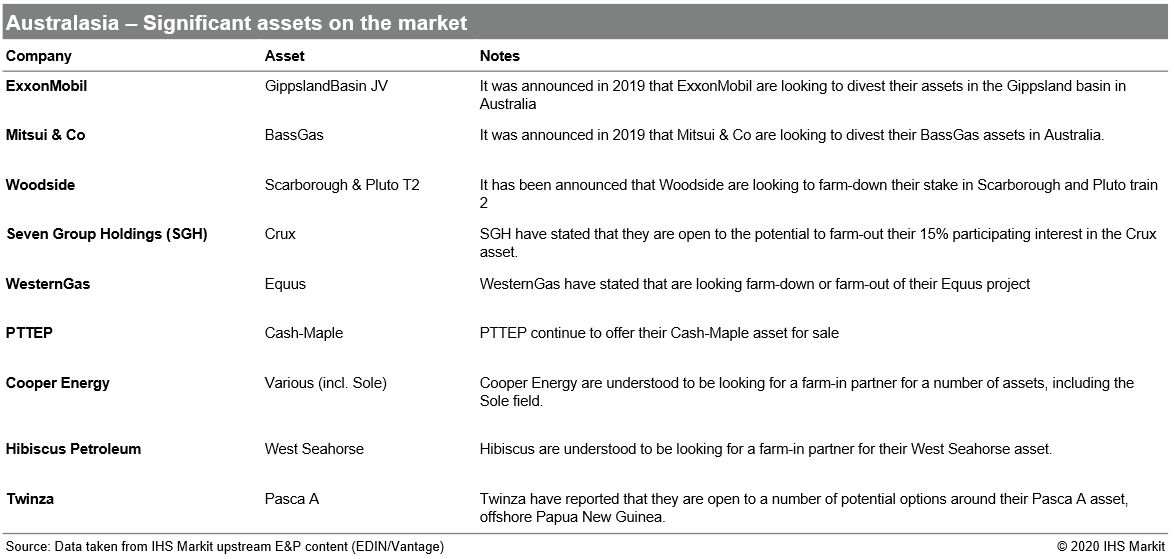

The price uncertainty will make it even more difficult to find willing buyers for APAC assets that are on the market and we may even see some announced, but incomplete, deals be renegotiated and potentially fail.

There have been a number of significant assets in APAC, either in production or nearing FID, that have been announced for sale in the last 12-18 months or are anticipated to be on the market. Figure 4, below, highlights some of these assets in Australasia:

Figure 4: Significant assets on the market in

Australasia.

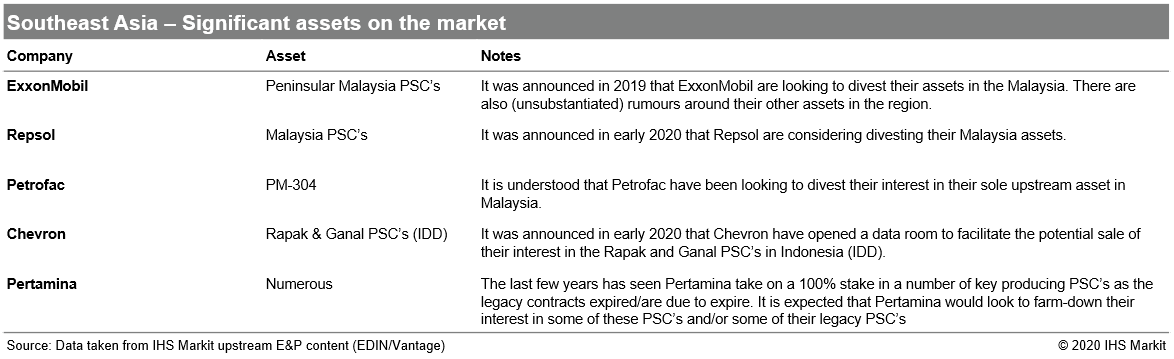

And Figure 5, below, covers the significant assets in Southeast Asia:

Figure 5: Significant assets on the market in

Southeast Asia.

We had already seen a challenge in both Australasia and Southeast Asia with a lack of buyers. Given the shift in market conditions, we would expect that finding buyers for any of these assets will now prove very difficult. Even if a potential buyer can be found, it will be very unlikely that the buyer and seller will be able to agree on a price, unless a contingent payment structure can be agreed.

On the second point, the major deals that we see as pending completion in Australasia and Southeast Asia are:

- ConocoPhillips sale to Santos of their North Australia assets (Darwin LNG, Bayu-Undan, Barossa and Poseidon) for US$1.39 billion + contingent payments, together with the planned subsequent Santos sale to SK E&S of a 25% stake in Darwin LNG and Bayu-Undan assets for US$390 million. To be clear, we have seen no indication that this deal will be impacted.

- Total sale of Block CA1 in Brunei to Shell for US$300 million. This deal had already been put at risk due to the suspension of the Malaysia-Brunei unitization framework agreement by the Malaysian side, which disputed the revenue share between the Geronggong-Jagus East field in Brunei and the Gumusut-Kakap field in Malaysia. This deal will not be able to complete until the above is resolved and the change in oil prices would likely bring the two parties back to the negotiating table.

- Coro Energy's farm-in from Conrad Petroleum of 15% interest in the Duyung PSC (Mako field) for US$4.8m in cash and shares. Again, we do not see any reason why this deal won't complete.

Finally, it can also be expected that a number of new opportunities, individual assets or entire companies. could emerge as oil companies become challenged by a lack of cashflow. As my favourite Warren Buffet quote says, "Only when the tide goes out do you discover who's been swimming naked", and the tide has gone out a long, long way.

Where now?

Sadly, we have again been dealt the card that says, "go directly to jail, do not pass go, do not collect $200". It will be a while before we get to the "new, new normal" and we will have to see where we are at that point. For now: be sensible, stay safe and look out for each other.

Want to discuss a project with our team of experts? Contact us for a conversation.

Robert Chambers is a Director for Upstream Asset Valuations at IHS Markit.

Posted 18 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-impact-of-the-oil-price-collapse-on-apac-upstream-fids.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-impact-of-the-oil-price-collapse-on-apac-upstream-fids.html&text=The+impact+of+the+oil+price+collapse+on+APAC+upstream+FID%e2%80%99s+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-impact-of-the-oil-price-collapse-on-apac-upstream-fids.html","enabled":true},{"name":"email","url":"?subject=The impact of the oil price collapse on APAC upstream FID’s | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-impact-of-the-oil-price-collapse-on-apac-upstream-fids.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+impact+of+the+oil+price+collapse+on+APAC+upstream+FID%e2%80%99s+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-impact-of-the-oil-price-collapse-on-apac-upstream-fids.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}