Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 16, 2021

The Alpha Dogs of Alpha Olefins

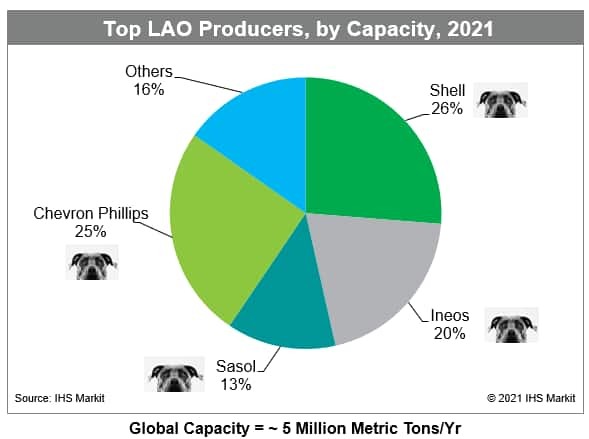

ExxonMobil's new linear alpha olefins (LAOs) 350 KMTA plant is apparently on-track to start up in 2022 in Baytown, TX. This got me thinking about how unusual this development is. Why? Because the LAO business is perhaps the most closely held business in the entire petrochemical industry being dominated by only four key players (the alpha dogs): Shell Chemical, Ineos, Chevron Phillips Chemical, and Sasol. This concentration is clearly shown on the pie chart below. Not sure that, with their new plant, ExxonMobil will quite qualify as an alpha dog but clearly their bite in capacity share will be significant.

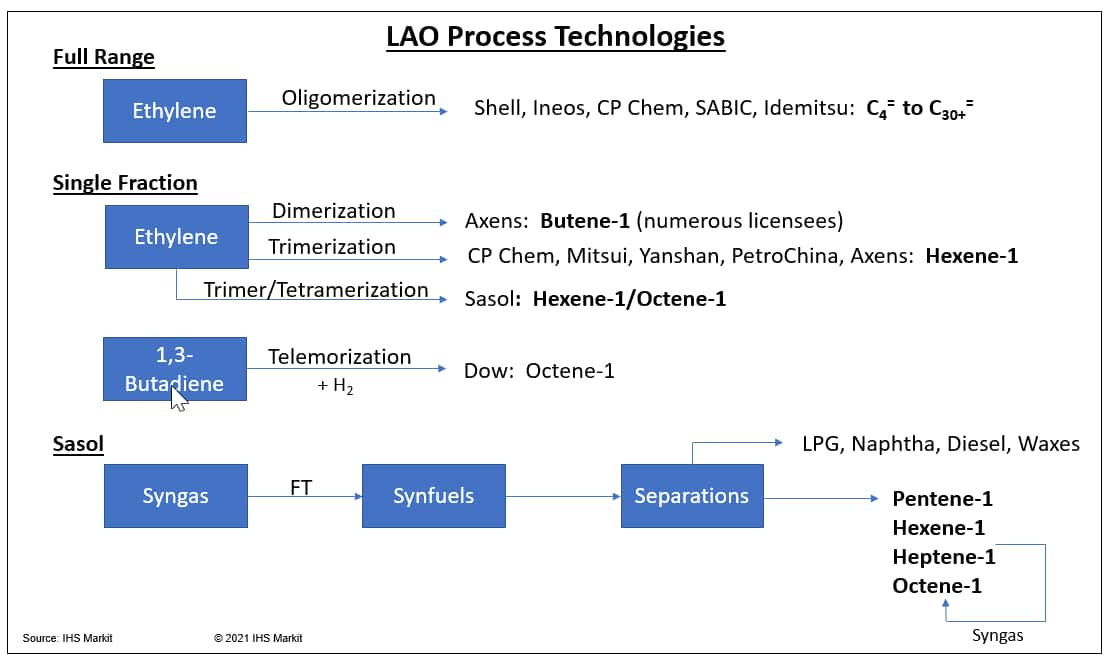

Although the business is dominated by only a handful of players, there is an astounding variety of process technologies employed commercially. These approaches can generally be segmented into three "breeds" of LAO technology:

- Full range

- Single fraction

- Sasol syngas based

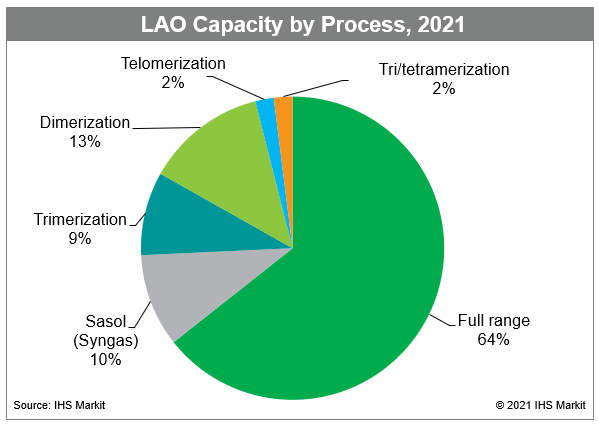

As shown on the pie chart below, the bulk of the LAO business is based on so-called full range technology wherein ethylene is oligomerized to a range of alpha olefins, from C4 to C30+ olefins. The big three practitioners of this approach are Shell, Ineos, and CP Chem. While all three of these companies' approaches are grouped as full range technology, a closer look (which is outside the scope of this blog) would reveal differences as each company's ratio of LAOs produced vary in carbon number, % linearity, and % alpha versus internal olefins. Other, smaller operators of full range technology include SABIC and Idemitsu. The ExxonMobil LAO plant coming on-line next year is a full range plant. End-uses for LAOs is quite varied and include comonomers for HDPE/LLDPE (C4-C8), detergent alcohols (C12-C14), polyalphaolefins for synthetic motor oil (C10-C14) and oil field chemicals (C14-C20). (And by the way, simply based on a quick scan of these end-uses, it is easy to see why ExxonMobil would want to become involved in full range LAO technology as they are active in all the cited end-use applications.)

The good news about full range technology is that for the price of one plant, a wide range of products are made. The bad news is that for the price of one plant, a wide range of products are made. It can be good or not so good. In my training course, Understanding the Global Petrochemical Industry, I call this the "Tyranny of Multi-product Processes". The challenge is that to make such approaches economically successful, the markets for all the products produced must be growing at about the rate at which they are made. If not, the profitability of the entire plant may be penalized. The fastest growing segment within the LAO family by far has been the polyethylene comonomer group: butene-1, hexene-1, and octene-1, outpacing the demand for the other higher alpha olefins. This recognition led to the development of single fraction technologies.

Single fraction approaches are based on targeting the comonomer range alpha olefins, specifically either butene-1, hexene-1, or octene-1. Axens' AlphaButol process is designed to selectively dimerize ethylene to butene-1. There are numerous licensees of this process and ethylene dimerization now composes a larger share of butene-1 production than full range processes provide (It should be noted that butene-1 from steam cracker-based C4 streams is still by far the largest source of butene-1 but this source is not included in this analysis). In the mid-1990s, CP Chem developed a homogenous catalyst capable of selectively trimerizing ethylene to hexene-1 and now operate three on-purpose hexene-1 plants. Later, Mitsui, Yanhsan, and PetroChina developed their own versions of this trimerization technology and now each operate small hexene-1 units. Axens, as a companion technology to AlphaButol, now offer AlphaHexol, an ethylene trimerization process and will supply this technology to a new project in Russia- Baltic Chemical Plant LLC. And, in an extension of trimerization technology, Sasol started up a plant in 2014 in Lake Charles that trimerizes and tetramerizes ethylene to a mixture of hexene-1/octene-1. Lastly, Dow developed a unique approach that combines two equivalents of 1,3-butadiene to afford octene-1.

The Sasol approach perhaps can be classified as full range and/or single fraction. To avoid this discussion, I have classified it separately. Sasol recognized that valuable chemicals, including both odd and even alpha olefins, were made in their synthetic fuels production. Thus, Sasol developed technology for extracting and purifying LAOs from their fuels stream. And as there is no real market for odd-numbered heptene-1, Sasol does a bit more chemistry and converts heptene-1 to additional octene-1.

Take a brief "paws" to consider this information, and if you want additional detail about how the LAO business fits into the overall ethylene business, check out some of our training courses on the IHS Markit's Learning Center at:

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-alpha-dogs-of-alpha-olefins.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-alpha-dogs-of-alpha-olefins.html&text=The+Alpha+Dogs+of+Alpha+Olefins+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-alpha-dogs-of-alpha-olefins.html","enabled":true},{"name":"email","url":"?subject=The Alpha Dogs of Alpha Olefins | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-alpha-dogs-of-alpha-olefins.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Alpha+Dogs+of+Alpha+Olefins+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-alpha-dogs-of-alpha-olefins.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}