Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 20, 2022

Thailand offering long-delayed offshore bidding round – can it revitalize domestic upstream business?

In an effort to revive domestic upstream activities and support national energy security, Thailand's Ministry of Energy announced on 7 April 2022 the 24th Thailand Petroleum Bidding Round, with three offshore blocks made available.

This is the first offshore acreage offering in the country since 2007, excluding the special auction for the expiring contracts of the Bongkot and Erawan fields (officially deemed as 22nd Bidding Round). The 21st Bidding Round, originally planned in 2011, was eventually cancelled after numerous delays caused by political and economic issues, the latest of which was related to the coronavirus disease 2019 (COVID-19) pandemic. A small offering for a single onshore block was conducted in 2021 and tagged as 23rd Bidding Round.

Unlike the 21st Bidding Round, which was expected to include six offshore blocks plus 17 onshore blocks, the government is now offering only three large blocks, all offshore. No new onshore blocks have been included in the latest bidding exercise because of environment and land utilization issues which may prevent E&P activities.

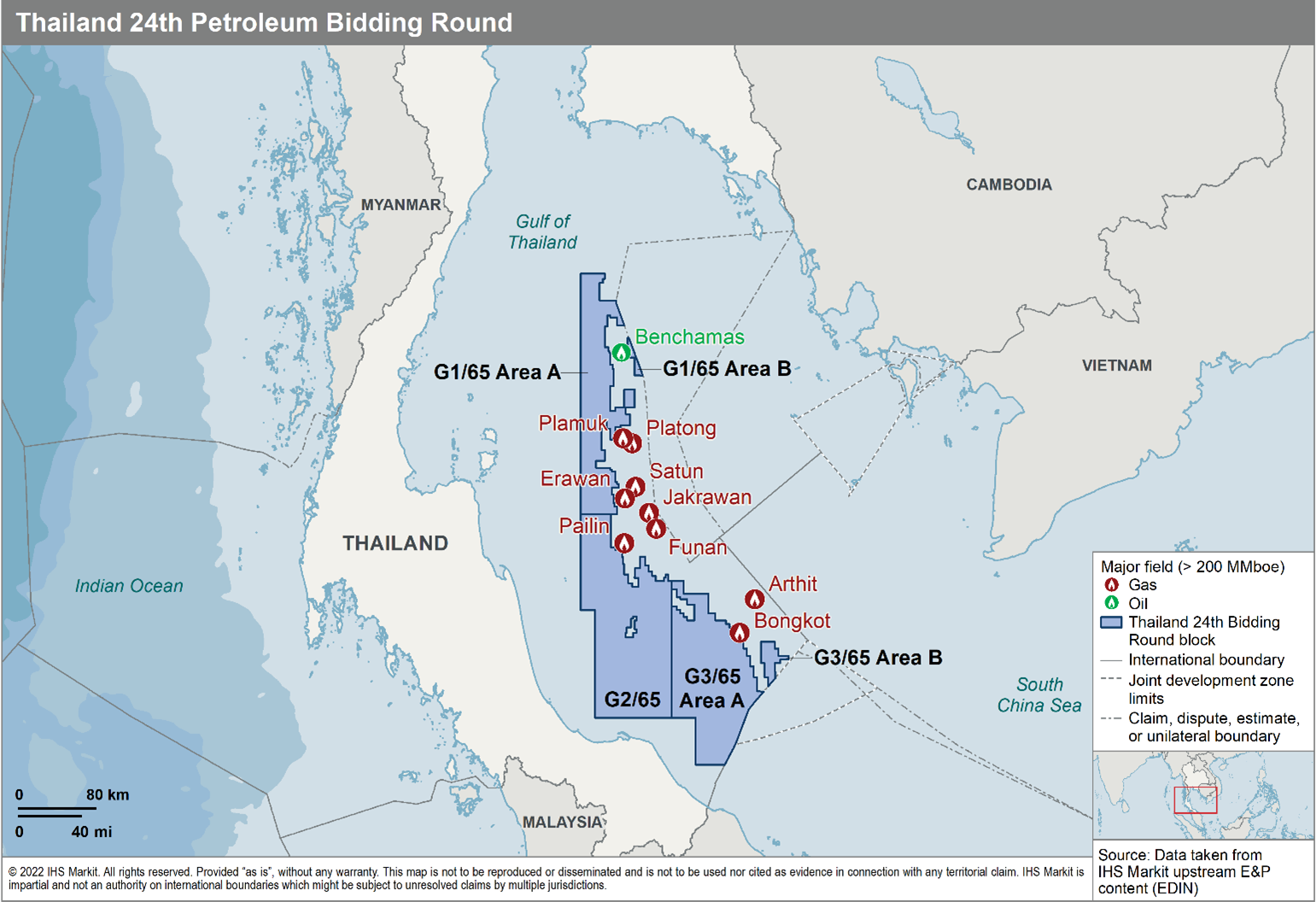

The new bidding blocks - G1/65, G2/65 and G3/65 - are situated in the Gulf of Thailand, a prolific yet mature petroleum province. The "G" in the block names indicates the geographic location in the Gulf of Thailand, while the "65" suffix refers to the current year 2565, corresponding to 2022 in the Thai calendar. Blocks G1/65 and G3/65 are split into two sub-blocks (Area A and Area B).

The offered blocks have been explored since the 1970s, with approximately 30 wells drilled in block G1/65, 15 wells in block G2/65 and 20 in G3/65. Several hydrocarbon discoveries have been made in each block. Some of the discoveries were previously issued production licenses which expired without any development taking place, likely due to the marginal volumes. These finds could be potentially tied-in to available nearby infrastructure, or developed as standalone projects if supported by further exploration success.

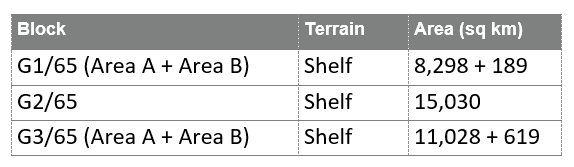

The available blocks are listed in the table below.

Figure 1: Available blocks in the Thailand bid round

A data room is available in Bangkok from 9 May 2022 to 2 September 2022. Data packages containing well reports and seismic data for each block can also be purchased from the Department of Mineral Fuels (DMF). Bids are to be submitted between 5 and 16 September 2022, and winners are expected to be announced in February 2023. The bidding proposals will be evaluated primarily on the basis of the proposed work program, in addition to the bidder's financial and technical profile. Any awarded block will receive an initial exploration period of six years, extendable for up to three years. The production period will be for 20 years with the possibility of a single 10-year extension. A royalty fee of 10% of the total production will be payable to the government. Minimum signature bonus for each block will amount to USD 3 million.

A key change since the last bidding round is the introduction, along with the existing concession system, of new Production Sharing Contract (PSC) terms, under which the new blocks are offered. Some of the key features introduced by the PSC system include a cost recovery mechanism (up to 50% of gross annual petroleum production) and after-tax profit split up to 50% for the contractor.

The commitment expenditure for the newly offered blocks is relatively modest, with a minimum amount of USD 1.5 million for 2D/3D seismic work and USD 5-7.5 million for exploration drilling in each block. Interested companies, however, might be looking to propose higher commitments to improve the competitiveness of their bid.

The offered acreages are close to major producing fields and the area has a well-known geology. Likewise, infrastructure and gas markets are readily available, therefore any exploration success could be monetized in a fairly short time frame. All of these factors should be considered as positives towards attracting new investments with a relatively low-risk proposition.

In contrast, involvements by International Oil Companies (IOCs) in Thailand have been recently challenged when the expiring concessions for the key Bongkot and Erawan fields, previously operated by Chevron, were auctioned off and eventually awarded to PTTEP, the upstream arm of National Oil Company PTT PLC. At the same time, oil and gas production from existing fields in the country is declining due to natural depletion and there are no new significant projects in the development pipeline.

Will Thailand be able to reverse the trend and revamp its declining upstream activities? With rising energy prices amid post-pandemic recovery, the government is hoping to attract new players to boost exploration and increase domestic hydrocarbon reserves. Recent awards from bidding rounds in Indonesia and Malaysia suggest that foreign investments in oil and gas may be coming back into the region, but also show that Thailand is facing stiff competition among regional peers for E&P dollars, at a time when many IOCs are looking to prioritize high-quality assets aligned with energy transition plans.

Figure 2: Thailand 24th Petroleum Bidding Round

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthailand-offering-longdelayed-offshore-bidding-round.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthailand-offering-longdelayed-offshore-bidding-round.html&text=Thailand+offering+long-delayed+offshore+bidding+round+%e2%80%93+can+it+revitalize+domestic+upstream+business%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthailand-offering-longdelayed-offshore-bidding-round.html","enabled":true},{"name":"email","url":"?subject=Thailand offering long-delayed offshore bidding round – can it revitalize domestic upstream business? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthailand-offering-longdelayed-offshore-bidding-round.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Thailand+offering+long-delayed+offshore+bidding+round+%e2%80%93+can+it+revitalize+domestic+upstream+business%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthailand-offering-longdelayed-offshore-bidding-round.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}