Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 06, 2014

Strategies assure water availability for unconventional operations

Selecting the best strategy to assure water availability derives from the analysis of water availability in the area of interest, new treatment and recycling technologies and issues related to the fresh water or brine use and transportation. A failed strategy poses risks of poor drilling and completion operations, a halt to operations, and the resulting large capital losses.

In our continuing coverage of water availability and water management in unconventional resource plays, we discuss additional strategies to assure water availability.

Water is a critical component in the drilling and completion process for unconventional oil and gas wells, and disruptions in access to water supplies pose a significant operational and financial risk to operators.

While the United States is typically considered a relatively water-rich country, many areas face increasing drought risk, especially in the western half of the country. Water supply is a highly localized problem, with competition for water resources for domestic, agricultural, commercial and industrial use managed at the state, and increasingly, local levels. Oil and gas operators in high-activity unconventional plays can face unique water resource availability problems, competition for access, restrictive regulation, and negative local community sentiment around water use.

Water used for oil and gas development is equal to only 0.2 percent of water used for agriculture on an annual basis in the United States, but oil and gas water use can account for up to 30 percent of total water use in some water-stressed counties in Texas. In such areas, where operators face high competition for and low availability of water resources, they may have to rely on more expensive sources of water in order to ensure a reliable supply.

More expensive sources include deep freshwater aquifers, brine aquifers producing higher salinity water, and drought-tolerant water supplies farther away from well sites that can require significant infrastructure investments to access such as lengthy pipelines. These more expensive options can raise the total cost of water supply and management by as much as 50 percent. Alternatively, operators can choose to source water by reusing flow back fluid and produced fluid from their own operations.

While increased water management costs are a burden to oil and gas companies, the risk to operations and well productivity from water stress is much more impactful. If water supply chain disruptions prevent well drilling and completion, the delays can be costly. Also, if the operator has to use less than the water than specified in the completion design, the productivity of a well can be compromised and production lost.

In its second-quarter 2012 earnings, Devon Energy reported significant losses to production as a result of using smaller-sized frac jobs because of regional drought conditions in Texas. At times of water stress, the financial risk of operational delays and production losses measured in billions of dollars. Given the risks from water stress, it is critical for operators to understand the water stress indicators such as drought and lower water tables as well as water demand requirements for the industry at the individual play level in order to implement water management strategies that avoid or mitigate the consequences. Implementing operational best practices and investing in water-related infrastructure are equally important to offset water risk in onshore exploration and development activity.

Play-Level Water Stress Risk

The total water resources available for unconventional operations depend on water availability and competition for water use. Assessing these factors at the play level helps operators determine how much water is likely to be accessible for oil and gas operations. In areas with high total water resources where current demand is less than 20 percent of total resources-that is, areas that are not water stressed-it is unlikely that operators will routinely face challenges sourcing water. In areas that are water stressed, a State's regulatory system is critical to determining how operators can access water resources.

In many western States that have a prior appropriation system for surface water and sometimes also groundwater resources, only the most senior rights holders are allocated water during times of shortages. Typically, senior water rights are held by farmers and are difficult and expensive for new oil and gas operators to obtain. This means that operators in these areas should look to alternative methods such as using brine aquifers or purchasing leftover water sources from municipalities and farmers.

Droughts occur because of natural variations in weather patterns and can affect areas that are not typically water stressed. For example, summertime droughts have caused the Susquehanna River Basin Commission in the Marcellus Shale region to restrict withdrawals to oil and gas operators even though the area is not typically water stressed. Droughts, however, are usually more frequent and more devastating in areas that are routinely water stressed.

Moreover, droughts pose the greatest risk to operators' water supply chains because of the inherent supply uncertainty. While annual water stress can help an operator choose a water source that is likely to be secure, the natural volatility that causes droughts can lead to unexpected and costly disruptions in an operator's supply chain for water as a key resource.

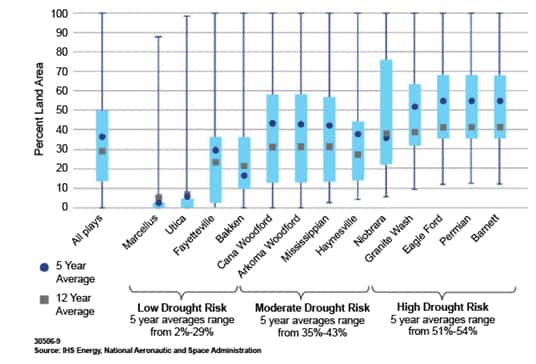

An analysis of drought data from the National Oceanic and Atmospheric Administration (NOAA) to assess play-level water stress, combined with data on completion activity, shows that 79 percent of completion activity is taking place in areas that have faced moderate or high drought risk over the past 10 years. Figure 1 shows the land area in 13 high-activity unconventional plays impacted by drought.

>Water availability is one side of the equation. In future posts we will look at water demand projections, alternative supply sources, and freshwater pipeline infrastructure investment.

Posted 6 June 2014

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrategies-assure-water-availability-for-unconventional-operations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrategies-assure-water-availability-for-unconventional-operations.html&text=Strategies+assure+water+availability+for+unconventional+operations","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrategies-assure-water-availability-for-unconventional-operations.html","enabled":true},{"name":"email","url":"?subject=Strategies assure water availability for unconventional operations&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrategies-assure-water-availability-for-unconventional-operations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strategies+assure+water+availability+for+unconventional+operations http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstrategies-assure-water-availability-for-unconventional-operations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}