Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 03, 2021

Storms and Omicron loom large over crude and refined product markets

Crude oil markets

- Extreme weather shut down the Trans Mountain pipeline this November, creating a warning signal for Canadian crude prices as Alberta storage is already at high levels.

- The US SPR sale will be the largest ever and conducted in parallel with releases by other major energy-consuming nations. Our balances show that the stock release will contribute to a stabilization of US commercial crude oil inventory levels

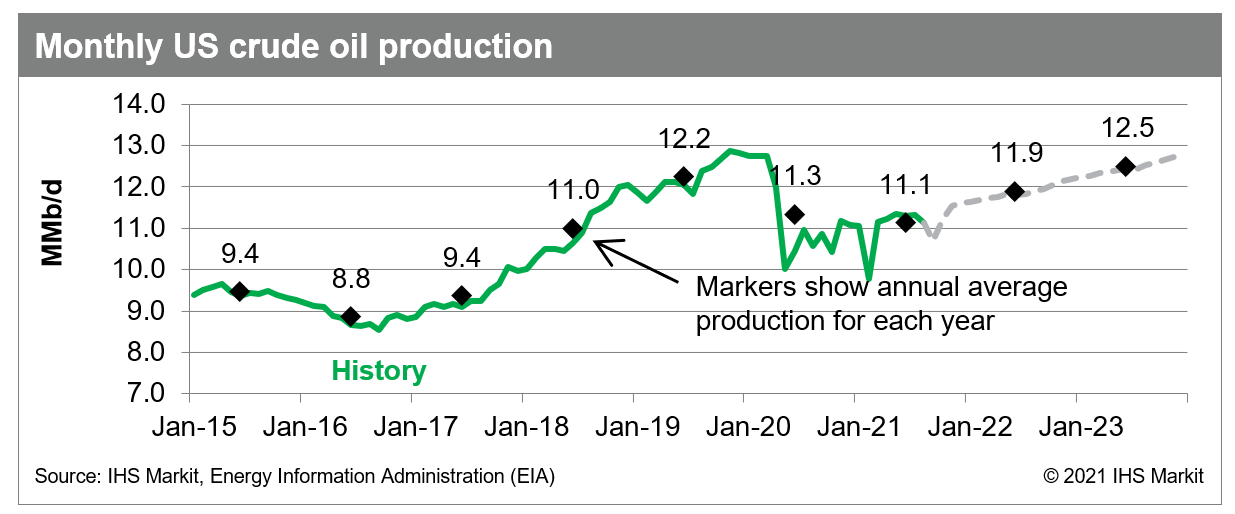

- US Midwest/Midcontinent light, sweet crude supply remains tight. Refineries are at nearly full utilization while supply outside of the Permian Basin remain stagnant to declining. This potentially sets the stage for a resumed drawdown of PADD 2 inventories, which could put pressure on the Brent-WTI spread to narrow and keep more crude supply from being exported.

Figure 1: Monthly US Crude Oil Production

Refined product markets

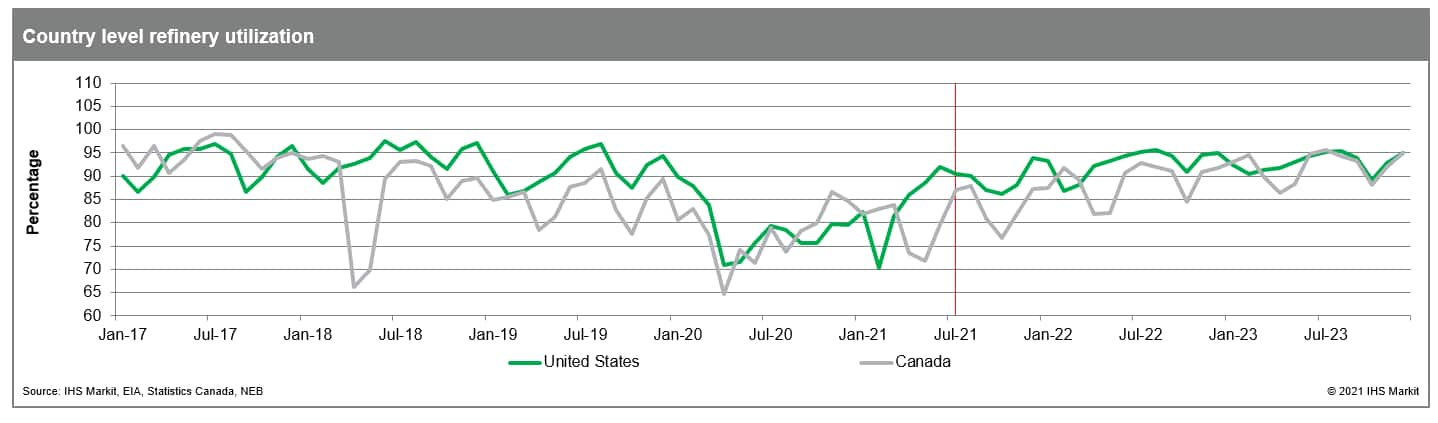

- Phillips 66 Alliance shutdown removes 255,000 b/d of refining capacity from the US Gulf Coast. Refinery utilization was already forecasted to be at maximum during the summers of 2022 and 2023 so this shut-down should modestly tighten the US refined product balance.

- Gasoline and distillate cracks spreads have weakened from their October levels as refiners exited the fall maintenance season though low product stocks, continued demand recovery and the shutdown of Alliance refinery are providing some countering support.

- Persistently high retail gasoline prices may dampen demand recovery. Over the last month, Brent prices have reached their highest levels since 2014, and retail gasoline prices have followed, also achieving multi-year highs. Some of the negative impact we typically see from elevated prices may be offset by pent-up demand and less price sensitivity for road travel coming out of a pandemic. For now, our gasoline demand outlook has been reduced by about 1% for both 2022 and 2023, but we continue to monitor the situation.

- Surging TSA passenger traffic supports strong jet fuel demand outlook, but the Omicron variant remains an unquantified risk at this point. The Omicron driven flight bans from southern Africa only have a nominal impact to US jet fuel demand. Our outlook assumes no further restrictions are imposed

Figure 2: Country level refinery utilization

This blog post is based on content from our monthly crude oil markets update as well as from our monthly refined product markets update.

Schedule time with our experts for more detailed analysis on oil markets.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstorms-and-omicron-loom-over-oil-supply-and-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstorms-and-omicron-loom-over-oil-supply-and-demand.html&text=Storms+and+Omicron+loom+large+over+crude+and+refined+product+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstorms-and-omicron-loom-over-oil-supply-and-demand.html","enabled":true},{"name":"email","url":"?subject=Storms and Omicron loom large over crude and refined product markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstorms-and-omicron-loom-over-oil-supply-and-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Storms+and+Omicron+loom+large+over+crude+and+refined+product+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstorms-and-omicron-loom-over-oil-supply-and-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}