Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 20, 2021

Southeast Asia power market was challenged by unprecedented event

It has been nearly a year since the COVID-19 pandemic crashed Southeast Asian (SEA) power market. Unfortunately, the market has yet to revive, and it is now being offered with low carbon market opportunities, which adds volatility to the power market's growth.

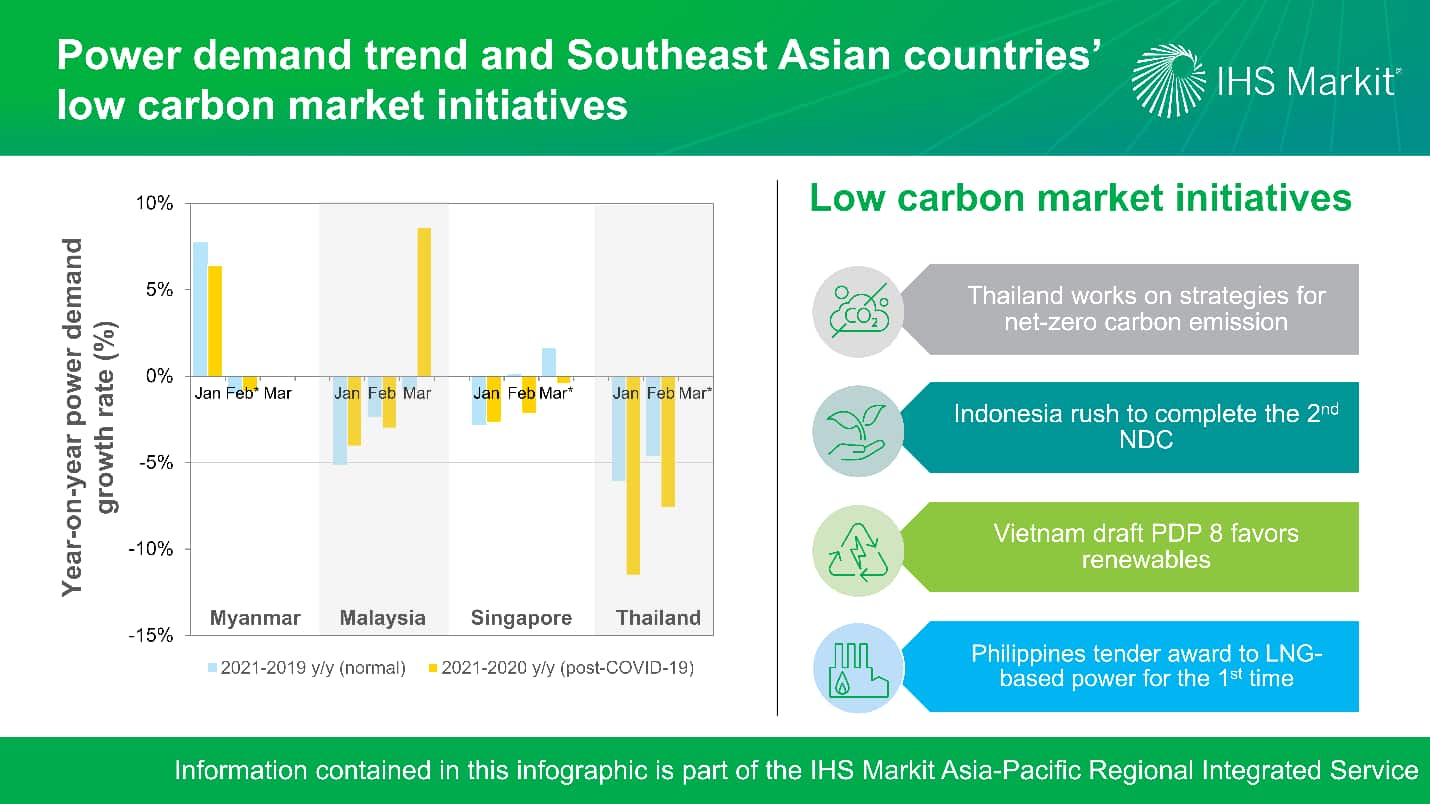

According to published power market data, the power demand still showing a sluggish recovery in first quarter (Q1) of 2021, compared to the same period of last year. The figure below illustrates the year-on-year (y/y) power demand growth rate between 2021-2019 (now-to-normal scenario) and 2021-2020 (now-to-COVID-19 scenario). As the average power demand growth rate in Q1 was compared between two scenarios, it was found that only Myanmar experienced power demand growth of 3.3% y/y and 2.8% y/y, respectively. While Malaysia suffered a 2.8% y/y decline as compared to normal scenario, it also saw a 0.5% y/y increase when compared to the post-COVID-19 scenario. Meanwhile, the power markets in Singapore and Thailand are yet to recover, with declines of 0.4% y/y and 5.3% y/y for normal scenario; and dipped further down to 1.8% y/y and 9.5% y/y for post-COVID-19 scenario, respectively.

Myanmar's power demand rebounded in January, with increment of 7.7% y/y (normal) and 6.4% y/y (post-COVID-19), signaling a strong recovery from the COVID-19 pandemic. However, the military coup on 1 February had an adverse effect on power demand. The power market data up to 7 February indicate a negative effect on power demand, showing decline of 1% y/y (normal) and 0.9% y/y (post-COVID-19). As the Myanmar's military declared a one-year state of emergency, the future of the power market looks bleak.

In Malaysia, average power demand rose by 0.5% y/y (post-COVID-19) in Q1 of 2021. Malaysia's power market experienced weak demand in the first two months of 2021, with declines of 4% y/y and 3% y/y, respectively, but rebounded to 8.6% y/y in March. This demonstrated a recovery in power demand from the worst of the COVID-19 first outbreak. However, the power market was still a long way from recovery, in which it still recorded an average 2.8% y/y (normal) declined. Although the King declared a state of emergency from 11 January to 1 August, it seems to have had little impact on the country's economic activities.

Singapore, on the other hand, is seeing steady rise in power demand in Q1 of 2021, with a 1.8% y/y (post-COVID-19) decline. Over the first two months, the power demand remained stable, declining at a rate of 2.7% y/y and 2.1% y/y, respectively. Following March 2021, the y/y fall in power demand was narrowed to 0.4% y/y, signaling that the country was on track to recovery. Nonetheless, as compared to normal scenario, Singapore's power market just fell by 0.4% y/y. This suggests that the country was soon recovering from COVID-19 pandemic. Furthermore, as the country with the highest COVID-19 vaccination rate in SEA region, it was expected to quickly regain momentum in power market growth.

Meanwhile, Thailand's power market remains gloomy, with average power demand dipping by 9.5% y/y (post-COVID-19) in the Q1 of 2021. Because of the latest COVID-19 outbreak in January 2021, a more stringent COVID-19 control measure was enforced, causing economic activity to slow. The normal scenario comparison still held an overall 5.3% y/y decline, indicating the power market was crashed hardly even before the pandemic. March power market data was still unavailable, but they are estimated to be stay below pre-COVID-19 lockdown levels owing to the country's poor economic outlook.

Low carbon market initiatives

Climate change awareness is growing in the SEA region, with the aim of combating climate change and reducing greenhouse gas (GHG) emissions. In Thailand, the authorities in energy and environmental development are teaming up in March 2021 to establish long-term strategies heading for net-zero carbon emissions. And Indonesia is in the process of completing its second NDC and plans to submit it in April 2021.

Furthermore, the recent announced Vietnam's third revision of draft power development plan (draft PDP 8) for 2021-30 continues to prioritize renewables while gradually reducing coal -fired plants. By 2030, wind and solar capacity combined with account for 28% of the national total, doubled by 14% planned in PDP7 revision.

For the first time, the Philippines' Meralco awarded a new 20-year power supply contract to an LNG-based power plant. The move to integrate LNG into the country's energy mix represents a shift away from coal toward gas, to comply with the recent moratorium on new greenfield coal-fired power plants. The winner's historically low levelized costs of electricity (LCOEs - 20% less than reserve price at PHP 5.2559/kWh) signaled a potential price cut by using LNG as power.

Lastly, the Myanmar's power expansion plan has falters in the wake of the military coup, which unlikely to have immediate effect on current power supply-demand balance but has already appeared on ongoing power projects. This included delays and canceling awarded solar projects, as well as suspending or canceling of planned hydro and gas-fired power projects. The political chaos in Myanmar will force the country's power development course to rely more on indigenous resources.

Conclusion

The Myanmar's power market was being challenged by unprecedent event, casting doubt on power development prospects. However, the power demand in Malaysia and Singapore had begun to recover. Despite a gloomy future for Thailand power market, the COVID-19 pandemic has not hindered the government's efforts to decarbonize. The latest move by the Philippines and Vietnam showed the countries favor to gas and renewables in their energy mix. Overall, this could be a significant turning point for clean energy development in SEA region, motivated by energy security concerns and emerging opportunities in the low carbon market.

To learn more about Asia Pacific energy research, visit our Asia Pacific Regional Integrated Service page.

Choon Gek Khoo is a Research Analyst with the Climate and Sustainability group at IHS Markit.

Cecillia Zheng is an associate director with the Climate and Sustainability team at IHS Markit.

Posted on 20 April 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsoutheast-asia-power-market-was-challenged-by-unprecedented-ev.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsoutheast-asia-power-market-was-challenged-by-unprecedented-ev.html&text=Southeast+Asia+power+market+was+challenged+by+unprecedented+event+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsoutheast-asia-power-market-was-challenged-by-unprecedented-ev.html","enabled":true},{"name":"email","url":"?subject=Southeast Asia power market was challenged by unprecedented event | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsoutheast-asia-power-market-was-challenged-by-unprecedented-ev.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Southeast+Asia+power+market+was+challenged+by+unprecedented+event+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsoutheast-asia-power-market-was-challenged-by-unprecedented-ev.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}