Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 08, 2021

South Asia regional power market: Moving towards market-based electricity trade

The first Cross-Border Electricity Trade (CBET) commenced on the power exchange through the Day-ahead Market (DAM) between India and Nepal during April 2021. This is a significant achievement as it opens avenues for other countries in South Asia for electricity trade through market access.

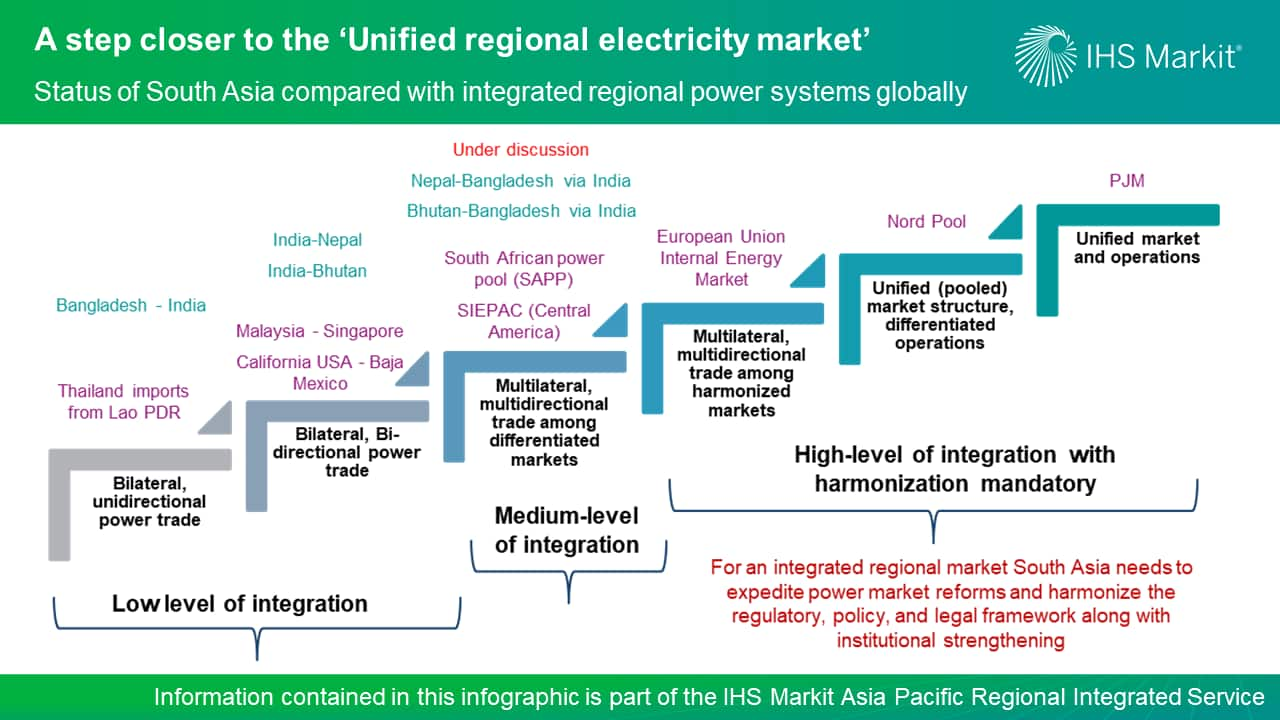

A step closer to the 'Unified regional electricity market.'

The ongoing bilateral and multilateral agreements have helped the South Asian countries in establishing and strengthening electricity trade. However, the operation of a regional DAM is promising and carves a way forward for the countries to strengthen cooperation and grid infrastructure. IHS Markit expects that as a next step, other countries—Bhutan and Bangladesh—are likely to trade electricity via exchange, which may grow to establish a sub-regional electricity market.

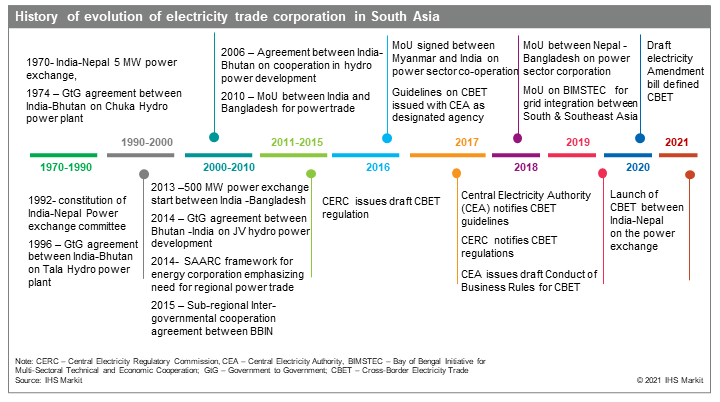

South Asia has a long history of electricity trade, although it remained limited to intergovernmental negotiated bilateral contracts.

In the South Asia region, primarily four countries—Bangladesh, Bhutan, India, and Nepal (BBIN)—constitute the majority of the CBET. The current contracted capacity is about 4 GW with annual trade volumes of 15-18 TWh. Besides the current bilateral and commercial agreements between the countries, trilateral cooperation is being discussed between India and Thailand via Myanmar and among Bangladesh, Nepal, and Bhutan via India. The contracts are primarily intergovernmental agreements signed through price negotiations.

The DAM offers immense opportunities to the participant nations owing to its operational flexibility and transparent price discovery mechanism.

The spot market, or DAM, provides smaller countries in the region access to a larger market like India; offers operational ease and flexibility to participants as they do not need to lock in for the long term and are allowed to balance positions on a short-term basis; helps mitigate financial risk; and lastly allows for price transparency and efficient price signals to attract investments.

The spot market will enable countries to optimize resources to achieve efficiency and environmental benefits owing to complementarities in the demand-supply conditions.

The load shapes of the countries in the region vary and complement each other (daily, monthly, and seasonally). Furthermore, South Asian countries suffer from power shortages, given limited fossil fuel resources and underdeveloped hydro and renewable potential. The regional DAM thus provides ample opportunities for the South Asian nations to trade electricity as it gives appropriate signals for optimal utilization of the existing capacity by exploiting the diversity in demand and complementary resources.

IHS Markit expects that with the strengthening of regional grid, the interconnection capacity expected to grow four-fold by 2040 from the current approximate 5 GW.

The operation of a regional DAM is a promising and carves a way forward for the countries to strengthen cooperation and grid infrastructure.

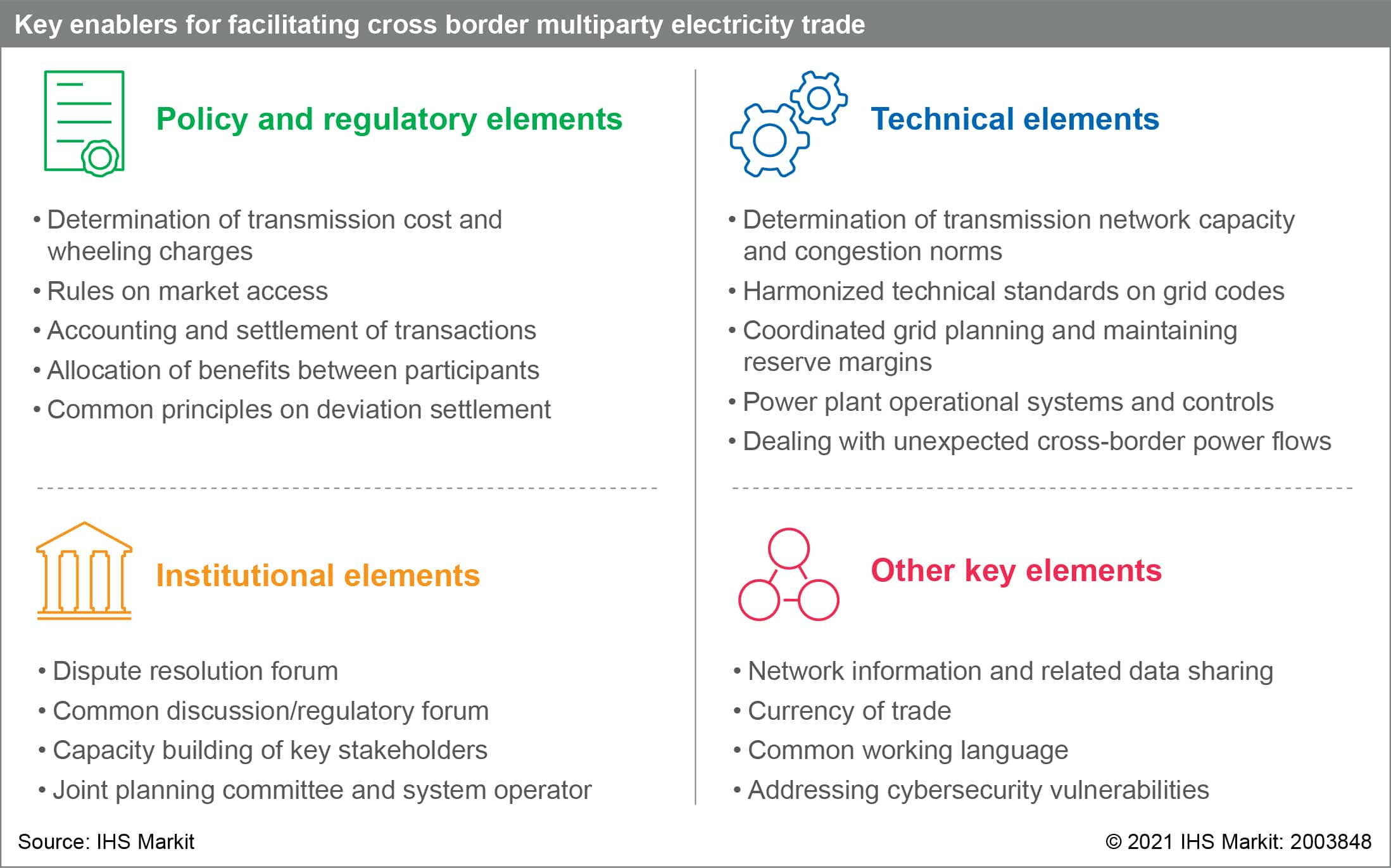

To boost the regional integration, the countries need to form a regional cooperation framework which would direct each country on action plans for promoting regional trade. For example, currently India stands at a cusp where India could invest in adopting either EU style model (decentralized market structure) or a US style model (Centralized market structure). As seen in majority of the regional markets, a decentralized structure is more favorable for regional grids as it allows respective countries to (i) maintain their control over their respective electricity grid and planning process, (ii) Isolate grids in case of emergency situations, (iii) enable higher coordination and exchange of information, (iv) align goals and synergize - gradually, (v) not compromise on existing contracts, and (vi) focus on reforming their own power systems. Although this comes at the cost of sub-optimal utilization of resources in the region but builds confidence in mutual cooperation. Further, a decentralized structure can be seen as an intermediary step to reach a more homogenized market.

Apart from strong political and social will, countries need to adopt complementary national energy policies, harmonize regulatory processes, initiate regional planning, and focus on power market development.

Learn more about our Asia Pacific energy research and insight.

Ashish Singla is an associate director with the Climate and Sustainability team covering research and analysis on Power and Renewable for South Asian countries at IHS Markit.

Rashika Gupta, Ph.D., is a Senior Director on the APAC Climate and Sustainability team at IHS Markit, leading the power and renewables research for the South Asian countries.

Posted on 08 September 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsouth-asia-regional-power-market-moving-towards-marketbased.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsouth-asia-regional-power-market-moving-towards-marketbased.html&text=South+Asia+regional+power+market%3a+Moving+towards+market-based+electricity+trade+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsouth-asia-regional-power-market-moving-towards-marketbased.html","enabled":true},{"name":"email","url":"?subject=South Asia regional power market: Moving towards market-based electricity trade | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsouth-asia-regional-power-market-moving-towards-marketbased.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+Asia+regional+power+market%3a+Moving+towards+market-based+electricity+trade+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsouth-asia-regional-power-market-moving-towards-marketbased.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}