Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 01, 2021

Solar PV module industry in 2020: Acceleration of manufacturing concentration and a new annual shipment record

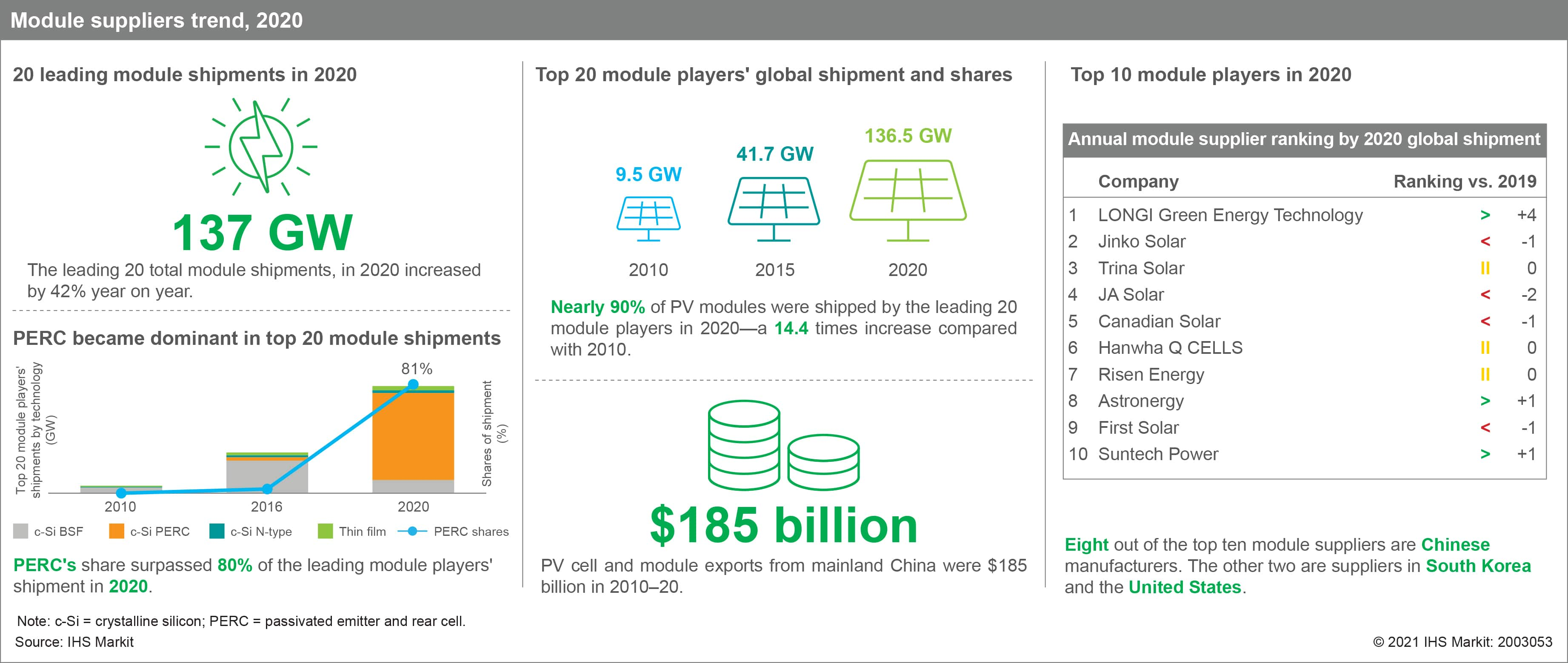

Despite the COVID-19 pandemic, the solar PV industry had another record year with 142 GW of installations. On the manufacturing side, there was an acceleration of consolidation and concertation among module players. The shipments of the Top 20 players reached 136 GW, an equivalent to 90% of total shipments in 2020 and a staggering 42% y-o-y increase. The module node has been traditionally the least concentrated within the supply chain, but very aggressive capacity expansions from leading players have changed this situation. Among the top 10, eight of these suppliers are located in mainland China, with two suppliers' headquarters located in South Korea and in the United States.

The entrance of LONGi to the top of the ranking, as the company with most shipments in 2021 (24.5 GW), is the most important change in the rankings this year. Jinko Solar and Trina Solar continue in the Top 3 for one more year and Suntech re-entered the Top 10.

At the technology level, PERC technology reached 81% of the shipments of the Top 20 players from less than 10% in 2016, which shows the rapid technological shift that the industry has achieved in just five years while the global manufacturing capacity more than tripled in the same period.

For 2021, IHS Markit projects a continuation of the existing concentration trend within the Top 20 players, and especially within the Top 10 manufacturers and another year of module shipment record despite the current challenges around high module costs and freight disruption in most international markets. Freight costs have increased 3-4 times for shipments from China to Europe or to the United States and long-lead times continue to be the norm. The freight situation is not expected to dramatically improve in the second half of the year.

Our recently published PV Module Supply Chain Tracker Q1 2021 forecasts that PERC technology will further consolidate its dominance this year in both mono and bifacial modules although, in the current high-price PERC environment, we are seeing a growth in demand for multicrystalline BSF, a technology that was being phased out, and that has seen its demand and prices increase in some utility markets (e.g. India, Middle-East) and rooftop applications. The IHS Markit view is that this increase in demand and prices for BFS multi is a short-lived phenomenon triggered by extraordinarily high PERC prices and multicrystalline will continue its phasing out in 2022, remaining a product for some niche markets. Clients can access the PV Module Supply Chain Tracker Q1 2021 here.

IHS Markit's Clean Energy Technology service provides an answer to all those questions and more content can be found in the PV Suppliers Tracker Q1 2021 (client link here) and in the upcoming Solar PV and Energy Storage Market Workshop 2021 in-person customer event that will be held in Shanghai, China on 4 June 2021.

Holly Hu is a senior research analyst within the Clean Energy Technology team at IHS Markit.

Edurne Zoco is an executive director within the Clean Energy Technology team at IHS Markit.

Posted on 1 June 2021.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsolar-pv-module-industry-in-2020-acceleration-of-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsolar-pv-module-industry-in-2020-acceleration-of-manufacturing.html&text=Solar+PV+module+industry+in+2020%3a+Acceleration+of+manufacturing+concentration+and+a+new+annual+shipment+record+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsolar-pv-module-industry-in-2020-acceleration-of-manufacturing.html","enabled":true},{"name":"email","url":"?subject=Solar PV module industry in 2020: Acceleration of manufacturing concentration and a new annual shipment record | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsolar-pv-module-industry-in-2020-acceleration-of-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Solar+PV+module+industry+in+2020%3a+Acceleration+of+manufacturing+concentration+and+a+new+annual+shipment+record+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsolar-pv-module-industry-in-2020-acceleration-of-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}