Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 24, 2023

Scarborough: A refresher for Australia's major gas development still on track for 2026

It's been nearly 18 months since Woodside's high profile Scarborough gas project took Final Investment Decision (FID) back in November 2021, a milestone which had been delayed due to COVID-19. Since FID, and the impacts of COVID progressively waning, it has all gone a little quiet on the project whilst the region has its attention occupied by other high-profile developments.

With drilling expected to begin in the second half of this year at the LNG project, which is also integral to the future domestic supply and demand balance in Western Australia, this blog will aim to provide a refresher of this key project as it approaches planned first gas in 2026, and assess if there is perhaps a developing story of too many eggs in one basket at Scarborough.

Scarborough 101

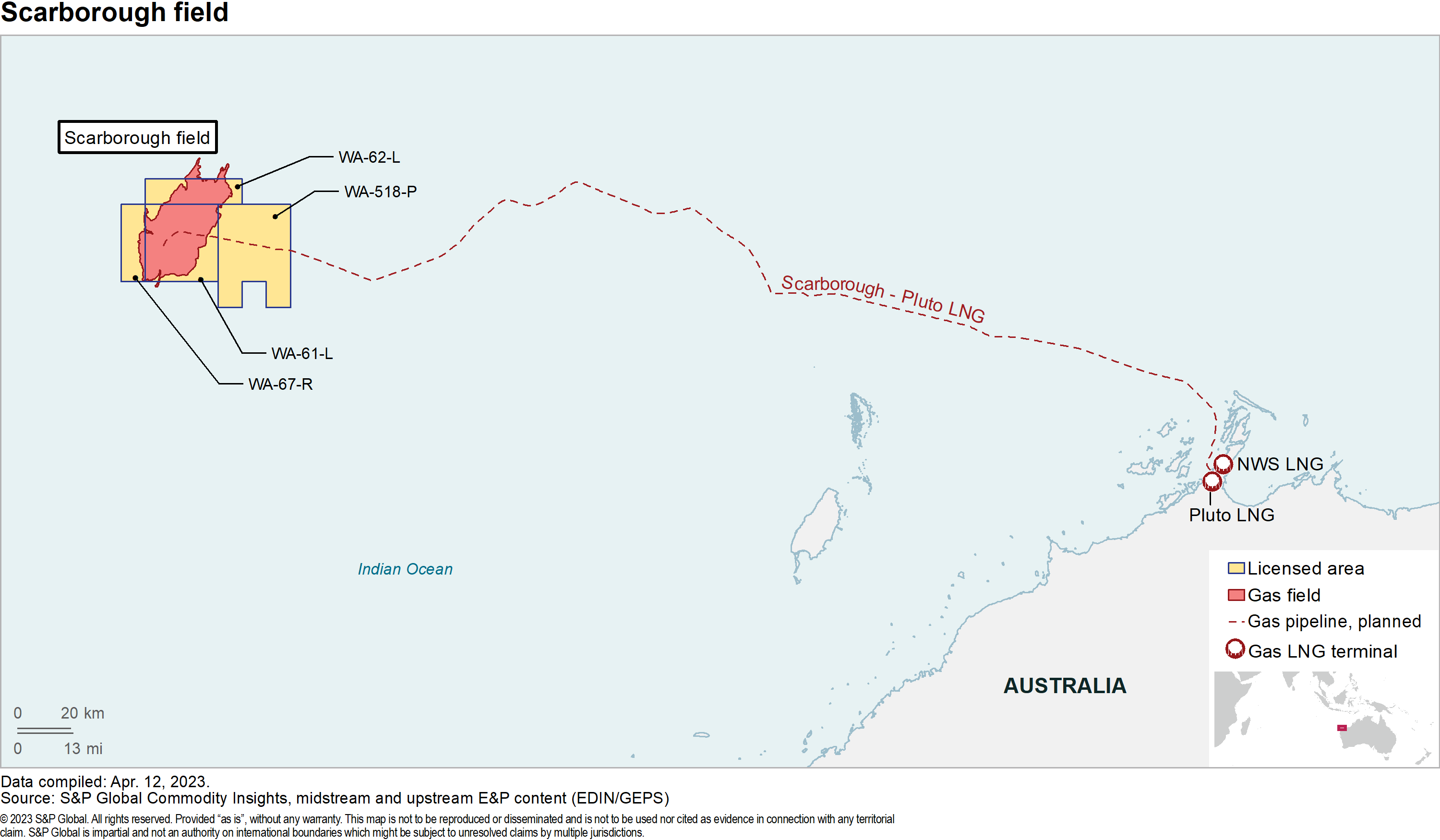

The Scarborough gas field was discovered in 1979 and is currently located offshore in production licences WA-61-L and WA-62-L within Australia's North Carnarvon Basin. Woodside Energy Group hold 100% ownership and operatorship, after the company's high profile merger with BHP in 2022. The field over its history has had its doubters on commerciality, but in November 2018, the Scarborough resource volume increased by 52%. Volume increases followed completion of integrated subsurface studies, which used full waveform inversion (FWI) 3D seismic reprocessing (improved reservoir image quality and increased reservoir sand distribution) and updated petrophysical interpretation (increased net sand proportion and gas saturations after wireline and core data review). As of December 2021, best estimate of technically recoverable gas was 11.9 Tcf.

This vast amount of dry gas was discovered by Scarborough 1 in 1979, and then subsequently appraised from 1996 through to 2012 by seven further wells. The reservoir at Scarborough is the Lower Cretaceous Barrow Group, made up of multiple sand units within turbidite fan complexes as part of a large, simple broad, low relief north east trending anticline.

Development Plan

The Scarborough gas, which notably is 0.1% CO2, will tie back to the Pluto LNG facility located onshore Western Australia on the Burrup Peninsula. With Scarborough set to supply ~8 MMtpa of LNG, it exceeds the existing capacity at the Pluto facility and so an additional train, Pluto Train 2 via a brownfield expansion, was sanctioned. Train 1 is set to process up to 3 MMtpa, with Train 2 processing 5 MMtpa. The development also has a domestic commitment of 225 TJ/d.

The following new offshore elements form part of the Scarborough development under the outlined planned timelines:

- Initially eight subsea, high rate gas wells tied back to a floating production unit (FPU), with McDermott holding the contract for the FPU. 13 wells are planned over the field's life. Valaris will drill the wells which is expected from 2H 2023.

- 435 km trunkline for field tie back - Europipe will supply the pipe, with Saipem to install. Installation expected from 2023.

- Subsea infrastructure such as 45 km of rigid flowlines, six flexible flowline risers, 42 km of umbilicals and eight trees. Offshore work to occur from 2H 2023. Subsea Integration Alliance to supply the subsea umbilicals, risers and flowlines.

- Low CO2 gas, but the FPU will also have a battery storage system to reduce emissions on the topsides.

Woodside previously reported in May 2020 that due to the excellent reservoir sands at the field, production rates of up to 250 MMcf/d of gas per well were to be allowed for, with the field also expected to have pressure support via an extensive aquifer. Due to the shallow depth below the mudline and predicted strong water drive, newly drilled wells will be a combination of horizontal and high angle, with maximum lengths of -2,500 m.

FID for the project was taken in November 2021, as well as key approvals from the Commonwealth-Western Australia Joint Authority in April 2022. First LNG is planned for 2026.

Too much pressure on Scarborough?

Although the focus of the project is for LNG export overseas, as mentioned, Scarborough has a domestic gas commitment of 225 TJ/d (~212 MMcf/d). This commitment is very much relied upon in the future supply and demand mix for the State, and is hoped to provide a surplus for the remainder of the decade after the field comes online. However, given recent reports of flagship projects in Australia not going to plan, such as environmental approval issues at Barossa, the general environmental approval backlog, the late reserve downgrade at Waitsia and the production issues at Varanus Island and Blacktip, there is perhaps too much pressure on Scarborough to perform from day one or to come online when expected, especially with any knock-on effect of the environmental approval issues. It has to be said, any delay would definitely underline the importance of the recent unexpected resurgence of the Perth Basin to support the State, with it already expected to provide supply into the 2030s.

Scarborough does appear to be a world class asset, especially given its low CO2 content, but one thing which is a definite is the importance of continued investment in new resources both onshore and offshore, with adhered to domestic reservation to make sure no one is caught short against gas demand.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscarborough-refresher-for-australias-major-gas-development.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscarborough-refresher-for-australias-major-gas-development.html&text=Scarborough%3a+A+refresher+for+Australia%27s+major+gas+development+still+on+track+for+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscarborough-refresher-for-australias-major-gas-development.html","enabled":true},{"name":"email","url":"?subject=Scarborough: A refresher for Australia's major gas development still on track for 2026 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscarborough-refresher-for-australias-major-gas-development.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Scarborough%3a+A+refresher+for+Australia%27s+major+gas+development+still+on+track+for+2026+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscarborough-refresher-for-australias-major-gas-development.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}