Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 02, 2023

Scaling up renewable investments in India

Fighting back funding bottlenecks

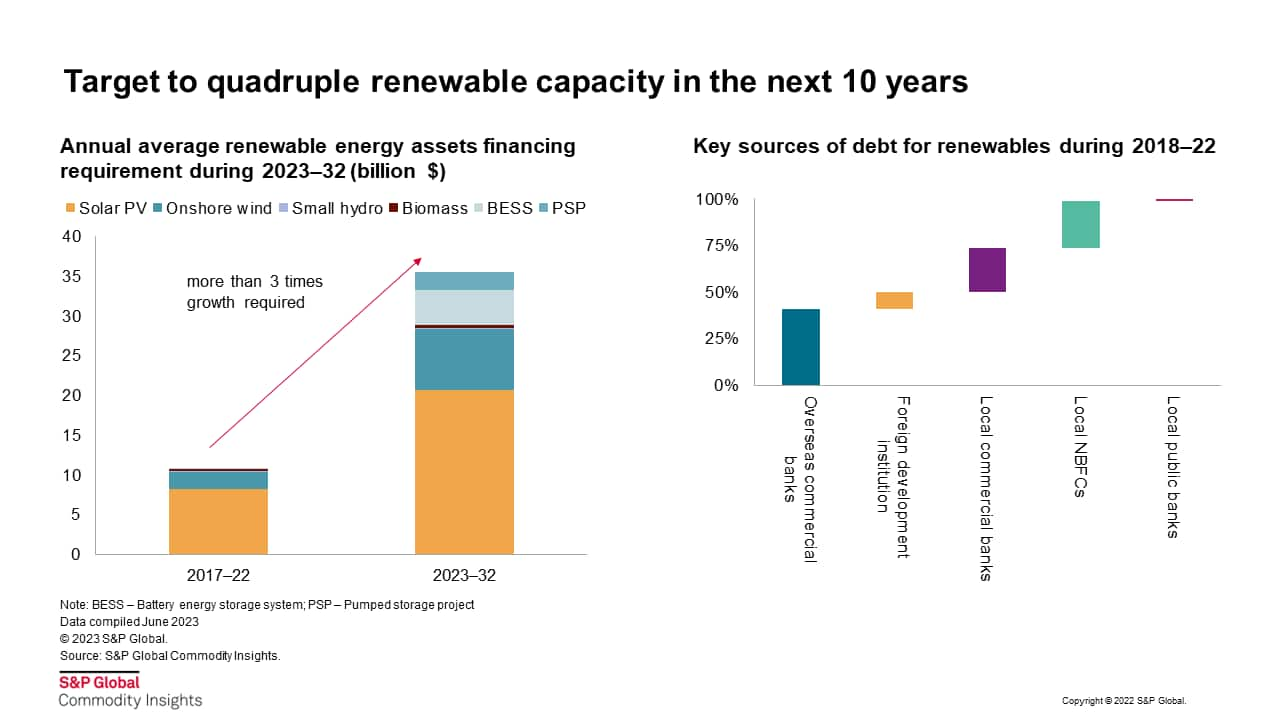

Renewable energy is a key pillar to meet India's climate goals, with a target to reach more than 500 GW of capacity by fiscal year (FY) 2032. India needs to more than triple its annual average investments for new renewable builds during the next decade, to more than $35 billion during 2023-32 from about $10 billion in annual average investments historically.

Renewable investments have recovered from the impact of the pandemic and subsequent supply chain hurdles, with about 40% growth in annual investments since 2017. However, India missed its renewable target of 175 GW for 2022 by about 30%, not only due to the challenges in execution of the pipeline and grid infrastructure expansion but also due to several financing bottlenecks. The achievement of climate goals will require not only a massive scale-up in financing through existing sources but also greater government and developmental bank support, along with public institutions and private sector investments in existing and emerging technologies. As India plans to further expand renewables with eyes on green growth, the question arises of how and who will finance it.

- Financing will need to come from multiple sources. Traditionally, local banks and non-banking financial companies (NBFCs) have been the largest contributors toward renewable energy lending. However, the share of local public banks has shrunk considerably, and foreign banks increased their financing of renewable projects during last 5 years. Regulatory reforms are required to increase the availability of financing, increase sectoral lending limits for local banks in addition to easing restrictions on overseas financing.

- Refinancing through green bonds emerges as an alternate, but market needs more. While India is the fourth-largest market by renewable energy installed capacity globally, it only tapped about 1% of the total green bonds issued ($2.2 trillion) during 2014-22. Meanwhile, the top three markets (the United States, mainland China and Germany) together raised more than 40% of the global green bonds' issuances during the same period. Asset credit rating enhancement through government or public institution guarantees is required to reduce the refinancing risks to enable access to overseas investors and climate funds.

- Developer track records, credibility of promoters and offtaker risks are key factors in financing decisions. Large portfolio owners have a higher likelihood of handling market risks better. Strategies include distributing assets across different counterparties, choosing offtakers with better credit scores, adopting a mix of renewable technologies, and using a different vintage of power purchase agreements (PPAs). Overseas equity investments in the renewable sector can help in bringing return expectations down for renewable IPPs which face high competition to win tenders. Access to international capital markets can be enabled through listing companies in overseas stock exchanges, selling operational assets or stakes in pipeline assets to foreign institutional investors, and pursuing yieldco options.

- Entry of public sector companies into green segment will push local investments up. Some of the leading public sector utilities have announced targets of more than 180 GW to be achieved in the time frame of the next five to 25 years from current installed capacity of less than 10 GW. Estimated investment required will be in the range of $100 billion-$200 billion but will need partnerships with experienced players and timely allocation of funds to capture this opportunity.

- Policy certainty will be key toward planning investments. India will also need appropriate carbon pricing to reduce carbon emissions to meet its net-zero goals. Carbon pricing will be an important policy tool to not only mitigate the impact of tightening trade policies around sustainability but also create new avenues for attracting capital toward green investments.

For more information on this research and its related service offering, please visit the Asia Pacific Regional Integrated Service page.

Ankita Chauhan, a principal analyst in the Asia Pacific Gas, Power, and Climate Solutions team at S&P Global Commodity Insights, covers research and analysis for the South Asian power and renewable markets, including India, Pakistan, Bangladesh, and Sri Lanka.

Posted 2 August 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscaling-up-renewable-investments-in-india.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscaling-up-renewable-investments-in-india.html&text=Scaling+up+renewable+investments+in+India+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscaling-up-renewable-investments-in-india.html","enabled":true},{"name":"email","url":"?subject=Scaling up renewable investments in India | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscaling-up-renewable-investments-in-india.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Scaling+up+renewable+investments+in+India+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fscaling-up-renewable-investments-in-india.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}