Unconventional reserves estimation with IHS Harmony™

Conventional Reserves Estimation

Traditionally, reserves have been evaluated using Arps decline curves, assuming boundary dominated flow. In conventional oil or gas well analysis, this meant a hyperbolic exponent b-value), ranging from 0 to 1, could accurately forecast a well future production. As we have moved towards tighter unconventional play production, the assumption of boundary dominated flow for the majority of the production history is no longer valid. The practice of empirically curve-fitting a single segment decline however, still continues. The evaluator simply uses a higher b-value to fit the production data. These higher exponents produce much longer forecasts that are then truncated to exponential decline at a terminal decline rate. Typically, a single value for a terminal decline rate will be used for an entire field that does not necessarily have any theoretical basis or consideration of well spacing.

When faced with limited well production data in an unconventional field, creating a type well (i.e. expected average well performance) is standard practice. Similarities in reservoir pressure, geology, and fluid composition are honoured, but this methodology does not account for any volumetric limitation, and ignores the observed variability in reservoir description and its resulting impact on production.With the traditional assumptions of Arps decline no longer being met, it should not come as a surprise that the results obtained through this analysis lead to more significant errors. IHS Harmony™ with IHS RTA offers a modern approach to reserves evaluation that is more reliablefor unconventional resource applications. The approach incorporates rate transient analysis(RTA) and advanced modeling to obtain a better fundamental understanding of the physicalinfluences on long-term productivity − thereby providing more reliable forecasts.

Our Approach

The method used in RTA’s unconventional module focuses on analyzing the reservoir signal orflow regime, understanding the recovery mechanism, and quantifying the contacted in-placevolume. This is combined with knowledge of the completion and well spacing to determine anexpected ultimate recovery (EUR) based on a physical model.

Analysis at a glance:

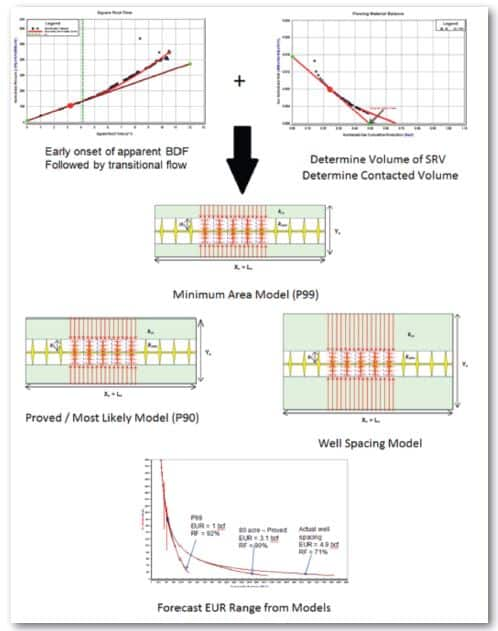

The flow regime is investigated using a square-root time plot. Observation of a straight linesuggests transient linear flow with departure from this line indicating a transition in flowregime or boundary-dominated flow. For wells in transient flow, the flowing material balanceis used in identifying a ‘minimum’ hydrocarbon volume in-place (i.e. the contacted volume todate). These two analysis methods provide the framework for developing an analytical modelthat can be used to history match performance data, validating the reservoir description, andproviding its associated expected ultimate recovery (EUR). Additional models with alternatereservoir descriptions can then be considered to capture the uncertainty in fracture networkand reservoir geometries to bracket the possible outcomes in the production forecast.

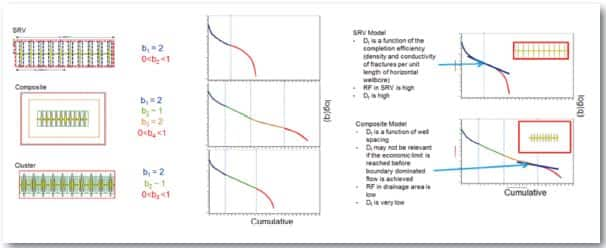

Relating the analysis back to decline, values of b and Dt are implicit to the analysis basedon a combination of operating, completion, and reservoir characteristics. The relationshipbetween b and Dt and the reservoir model is shown in the diagram below

The detailed analysis of over 200 wells in the Eagle Ford, 40 wells in the Bakken, and50 wells in the Montney has been conducted with the above process in IHS Harmony™.Additionally, this method has guided the analysis of hundreds of other wells in consultingprojects, workshops, and client support. While there has been significant variability inwell performance between plays (and between wells within the same play), this approachhas proven to be broadly applicable and customizable to the specific well performanceobserved. Applying this methodology across large numbers of wells has allowed bulk wellperformance parameter comparisons that would not be otherwise possible; results whichhave influenced change to field development and well operations of some of the mostrapidly developing unconventional plays in North America.

Summary

Accepted reserve evaluation and reporting practices have not progressed to keep pace with unconventional reservoir development technology. The practice of understating the uncertainty, and neglecting reservoir characteristics, is resulting in unrealistic reserves estimation. The additional cost of a more detailed well analysis is becoming more manageable due to advancements in software, and the increasing availability of high quality well data. This upfront investment is paying off through improved reservoir characterization earlier in the life of the well, better understanding of well / completion performance, and ultimately increasing the reliability of production forecasting.

Krystina Edwards, Principal Technical Analyst, IHS

Posted 30 July 2015

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.