Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 02, 2016

Probabilistic & Sensitivity – Examining the domain of probable forecasts and reserves

Probabilistic and Sensitivity analysis is one of the workflows available in IHS Harmony™. The purpose of this feature is to give greater insight into the domain of possible and likely forecasts and reserves. Probabilistic and Sensitivity analysis is set up to be used in conjunction with our analytical models. Currently, Probabilistic and Sensitivity analysis has been paired with all of Harmony’s commonly used analytical models (IHS RTA and IHS CBM) and the Pseudo Steady State (IHS CBM) model. We believe this feature represents an important enhancement of Harmony’s analysis capabilities, and we are planning even greater evolution of this module moving forward.

Probabilistic Analysis

When we talk about probabilistics, we are stating that there is uncertainty in something. For example, there could be uncertainty in the results of a calculation caused by inaccuracies in the inputs used. With respect to reservoir modeling, this means that we cannot be sure that the calculated forecasts and reserves are the true representation of what exists, and not simply one of many possibilities. The probabilistic simulation in IHS Harmony aims to give users an understanding of this uncertainty. Before we can explain how this is useful, let us briefly describe what is going on behind the scenes.

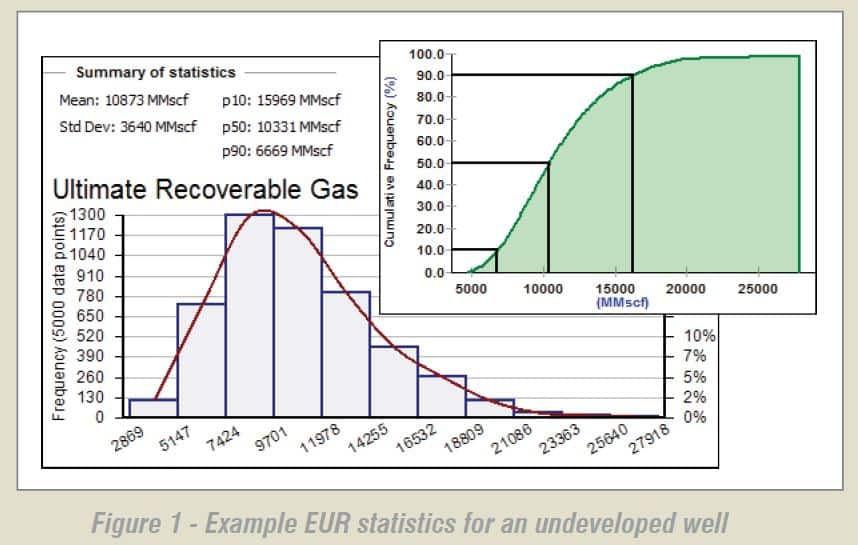

The probabilistic simulation in IHS Harmony is a multi-step process. The first step is to define probability distributions for a set of modelling parameters. From there, multiple runs are performed. Each run randomly samples values for the modeling parameters based on the probability distributions, and calculates a discrete forecast and reserves estimate. Once complete, the results are aggregated together, and the data is statistically analyzed.

Let's say you are interested in drilling a new well. At this point, you have no means of analysing the reservoir to determine its characteristics, but based on analysis of offset data, you may have some statistical results to work with. You can apply this information using probabilistic analysis to estimate probability distributions of key parameters. This could include statistics on permeability, fracture half-length, initial pressure, reservoir dimensions, and more. This data is then applied to a Monte Carlo simulation to generate a set of statistical outputs. Rather than getting a single deterministic forecast (as you would get by running a model on its own), you get a stochastic result including a set of possible forecasts along with distribution plots for in-place volumes and reserves. Based on the parameters entered, IHS Harmony calculates and displays the P10, P50, and P90 forecasts, which can help you in your decision whether or not to drill this new location.

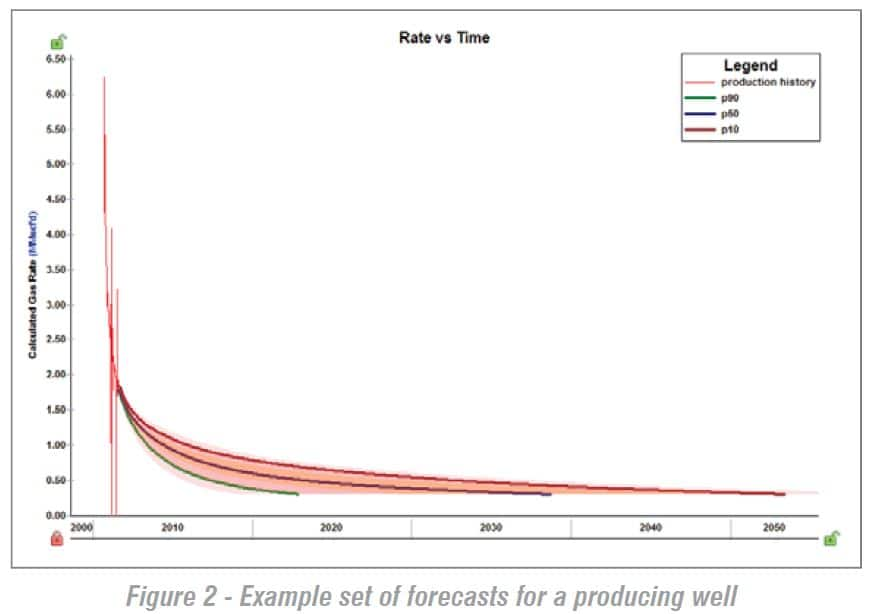

In another scenario, you might be analyzing an existing well with known production history. You are trying to determine the likely forecast by performing a history match using one of IHS Harmony’s RTA models. History matching is inherently non-unique, and so in a similar fashion as above, you can use Probabilistic analysis to define probability distributions for certain model parameters. However, on its own, this would not be sufficient. Let's say you find a set of parameters that give your model a good history match. If you change any of these parameters (by, for example, running a Monte Carlo simulation), you will lose your match. To account for this, we have incorporated the use of Automatic Parameter Estimation (APE) within the simulation. Let's show an example of how this can work. For a Horizontal Multifrac Composite model, if you assign a probability distribution to the fracture half-length, then permeability cannot be randomly sampled while still preserving the history match.

Instead, the appropriate value for permeability is determined using APE. For each run in the simulation, a value for fracture half-length will be randomly sampled as per the probability distribution you have entered, and then APE will determine a corresponding value for inner zone permeability to ensure you still have a good history match. This makes it possible for you to obtain a full set of possible scenarios, each with a good history match. This automated process is akin to a reservoir engineer matching the same production history hundreds of times, using a different reservoir description each time. It must be noted, however, that if the entered distributions stray too far from what might exist, APE cannot always converge to get a good match. Just as with the example above, you will be presented with the P10, P50, and P90 forecasts and the distributions for in-place volumes and reserves.

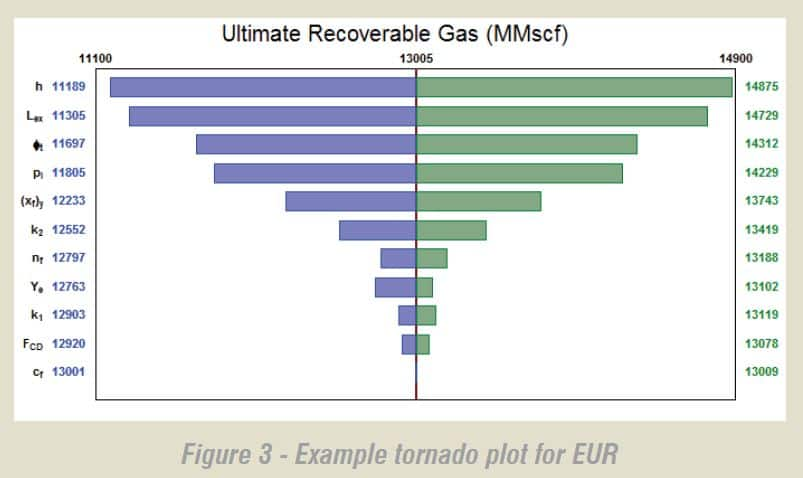

Sensitivity

Sensitivity is a tool for determining which parameters of a model have the greatest impact on its results. It does this by investigating the effect of each parameter, one at time, while leaving all others constant. Each parameter must have a base value and a domain for which to investigate. The base values are all used together to determine the base case result and then the parameters are investigated one at a time, once at the low end and once at the high end of their domain, leaving all other parameters at their base values. The result is a set of data for in-place volumes and reserves which can be used to determine the parameters to which the model is most sensitive. The data can be presented either in the form of a Tornado Plot or Spider Chart. Each of these offers a unique visual representation that allows you to quickly pick out the most sensitive parameters.

Let us look again at a scenario in which you are interested in drilling a new well. You set up a base case model using your best guess at the modelling parameters and would like to move forward with a Probabilistic simulation. However, you are not quite sure which model parameters to focus on. If you first perform a Sensitivity analysis on this model, you can quickly determine the most important parameters. Those parameters to which the model is most sensitive will require the most attention in determining their distribution parameters. If, for example, the model is very sensitive to net pay and you have entered an unrealistically high standard deviation for it, you will see far more variance in results generated during Probabilistic simulation than you should. On the other hand, there are parameters that will barely affect the model at all. It might be best not to put any effort into determining statistics for these, and simply keep them constant at your best guess. This information will be quickly apparent from a Sensitivity analysis.

What’s Next?

In the future, Probabilistic and Sensitivity analysis will likely be paired with the hybrid model in IHS Harmony. Current development is geared toward general enhancements, such as clipboard functionality and exporting result data, enhancing the efficiency of the probabilistic workflow. We welcome you to provide your feedback and suggestions to help us better understand your needs and offer a more comprehensive product.

Dave Anderson & Bob Best, Fekete Associates Inc.

Posted 3 March 2016

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frpe-risk-sensitivity-examining-the-domain-of-probable-forecasts-and-reserves.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frpe-risk-sensitivity-examining-the-domain-of-probable-forecasts-and-reserves.html&text=Probabilistic+%26+Sensitivity+%e2%80%93+Examining+the+domain+of+probable+forecasts+and+reserves","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frpe-risk-sensitivity-examining-the-domain-of-probable-forecasts-and-reserves.html","enabled":true},{"name":"email","url":"?subject=Probabilistic & Sensitivity – Examining the domain of probable forecasts and reserves&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frpe-risk-sensitivity-examining-the-domain-of-probable-forecasts-and-reserves.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Probabilistic+%26+Sensitivity+%e2%80%93+Examining+the+domain+of+probable+forecasts+and+reserves http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frpe-risk-sensitivity-examining-the-domain-of-probable-forecasts-and-reserves.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}