Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 19, 2021

Record Liquefaction at US LNG Facilities Faces a Spring Slowdown

Record LNG feed gas demand, courtesy of a strong Asian pull on LNG cargoes, has supported US natural gas demand this winter as above-normal temperatures slashed domestic residential and commercial space heating demand.

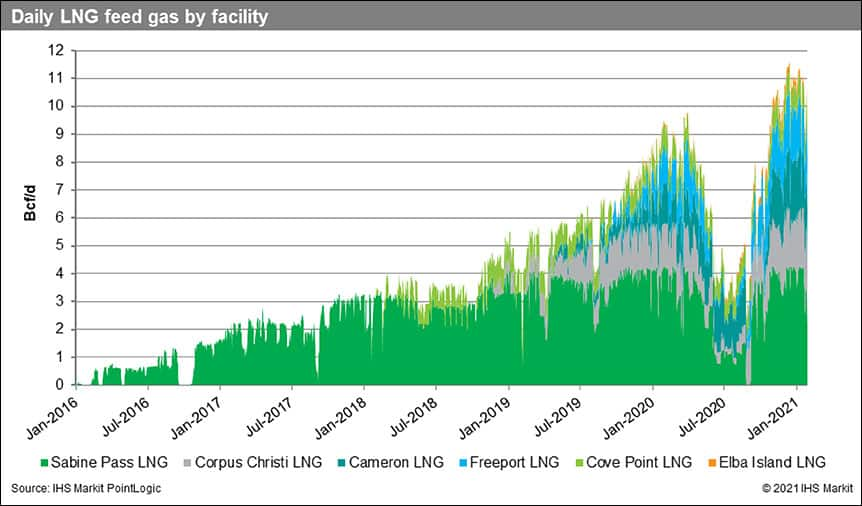

Feed gas deliveries averaged 11.0 Bcf/d in December and reached a daily peak at 11.6 Bcf/d on December 13 amid strong global gas prices, commissioning activity at Corpus Christi's train 3, and seasonal demand growth in export markets - Mainland China LNG demand was up by 35% year-on-year in December, for example (see Figure 1). Soaring spot prices continued into the start of 2021 as Northeast Asian spot LNG prices for February 2021 delivery reached $33.65/MMBtu in mid-January, a new daily record.

IHS Markit's expectation is that the global gas market will return to a state of oversupply this spring, similar to what took place in 2020, causing US LNG export capacity utilization to decline as it plays the role of global balancing mechanism once again.

In Europe this winter the diversion of cargoes to Asia and a particularly strong power market increased the call on natural gas storage withdrawals to balance the market. Inventories fell below the five-year maximum as a result, providing more storage capacity to fill this injection season. Despite the prospect of incremental spare storage capacity, we still expect storage injections to slow down at a certain point in the summer. The resulting pressure on European gas prices would render the market less attractive to US LNG off-takers.

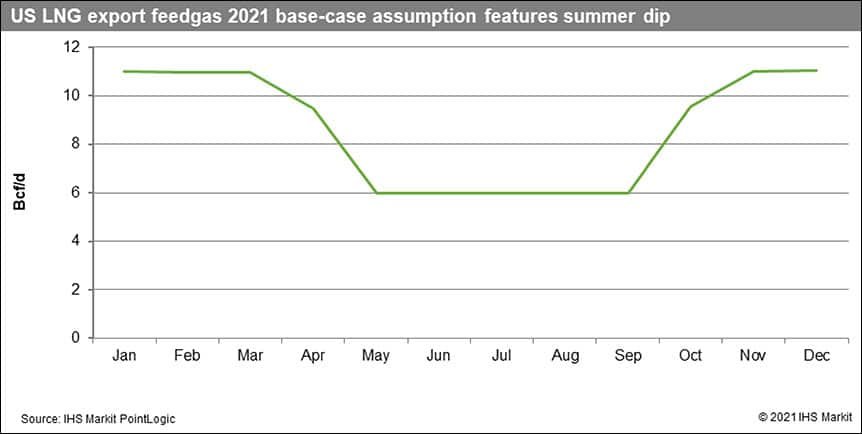

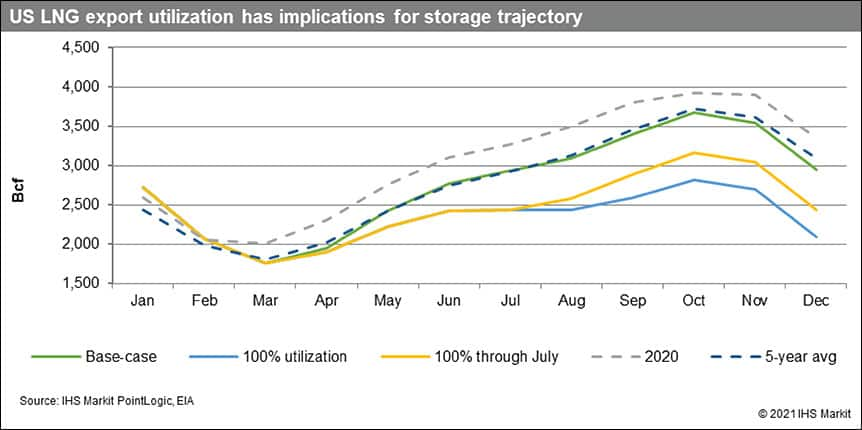

Our assumption is that US LNG facility utilization begins to soften in April, and by May, US LNG feed gas demand will be 45% lower than it is currently (see Figure 2). That low utilization will likely hold through September, leaving more gas at home and elevating end-October gas inventories to near the five-year average at a $2.70/MMBtu Henry Hub summer price level.

If, however, US LNG export utilization doesn't pullback as per our current view, either in timing or magnitude, the US storage injection trajectory could look very different. Lower inventories could support higher Henry Hub prices, particularly in the third quarter. It is possible that the global gas and LNG market may turn out to be tighter than expected this summer and present an upside risk to US LNG exports. Global LNG demand could be higher than anticipated, and there may be unforeseen LNG supply disruptions as occurred in 2020. Shipping constraints that have beleaguered global LNG supply chains this winter could lift amid an expectation for added LNG tanker tonnage this year. Most scenarios yield some degree of gain in US LNG export demand for the year, which, in turn, has implications for US storage injections (see figure 3). US gas inventories play a significant role in shaping Henry Hub price movements.

Keep on top of LNG demand, pricing and exports through our PointLogic solution.

Posted 17 February 2021 by Suzanne Edwards, Senior Research Analyst, IHS Markit

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecord-liquefaction-at-us-lng-facilities-face-spring-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecord-liquefaction-at-us-lng-facilities-face-spring-slowdown.html&text=Record+Liquefaction+at+US+LNG+Facilities+Faces+a+Spring+Slowdown++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecord-liquefaction-at-us-lng-facilities-face-spring-slowdown.html","enabled":true},{"name":"email","url":"?subject=Record Liquefaction at US LNG Facilities Faces a Spring Slowdown | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecord-liquefaction-at-us-lng-facilities-face-spring-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Record+Liquefaction+at+US+LNG+Facilities+Faces+a+Spring+Slowdown++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecord-liquefaction-at-us-lng-facilities-face-spring-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}