Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 13, 2014

Recent trends in global competitiveness: Energy costs are an important new game changer

Since the financial crisis and Great Recession of 2008–09, there have been dramatic changes in the pattern of global competitiveness, which have eroded the competitive advantage of emerging markets and boosted that of the advanced economies—as well as changing the competitive rankings among some of the advanced economies. Some of these trends were in place before the recession, some were accelerated by the post–financial crisis adjustment process, and some (especially the unconventional oil and gas revolution in North America) occurred independently. While many factors affect competitiveness, productivity, labor costs and energy costs are arguably the most important.

Productivity and labor costs: The ultimate drivers of competitiveness With labor costs (still) accounting for the largest share of overall production costs around the world, the output per hour of workers (labor productivity) and the hourly cost of labor are ultimately what determine how competitive a country or an industry will be. Unit labor costs—the average labor cost per unit of output (measured as the ratio of productivity and hourly wages)—are perhaps the single best measure of competitiveness.

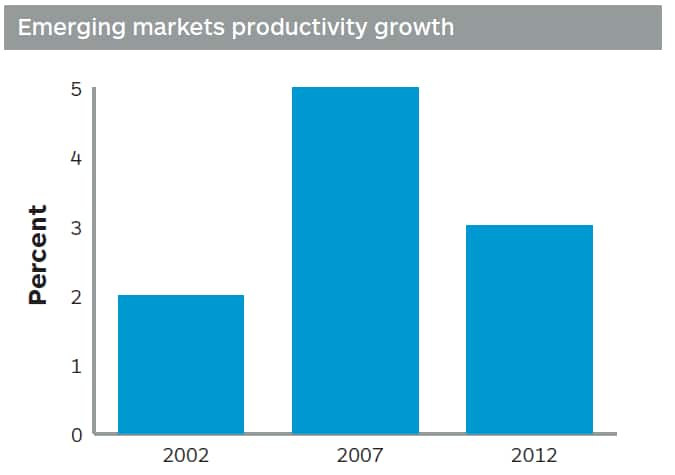

In the 1990s and 2000s, a combination of low wages and rapidly improving productivity boosted the competitiveness of many emerging markets and fueled a period of “hyperglobalization,” during which global sourcing and global supply chains flourished. Nevertheless, in the past five years some of these trends have reversed. Productivity growth in the emerging world has decelerated over the past decade even as wage inflation has remained high. Specifically, average annual productivity growth in the large emerging markets, which had risen from around 2% in the early 2000s to 5% right before the Great Recession, has steadily deteriorated since, to around 3.0% recently. Meanwhile, wage growth continues to be two to three times higher than in the advanced economies. This points to a fundamental deterioration in competitiveness.

At the same time, in the developed world wages have either been stagnant (in the United States) or have fallen (in Southern Europe), and productivity growth has held up fairly well. Specifically (and remarkably) US productivity growth never turned negative in the Great Recession, as it often does in recessions and as it did in Europe and Japan in 2009. Since then, average annual productivity growth in the OECD countries has rebounded to around 1.5%. These trends mean very subdued growth in unit labor costs and improving fundamental competitiveness in the advanced economies. Improvements in technology and in the efficiency of manufacturing processes have further shifted the balance away from the importance of low-cost labor and toward a higher-skilled workforce.

Energy costs—An important new game changer In addition to the recent fundamental changes in competitiveness, abundant and relatively cheap sources of energy (especially natural gas) in North America will continue to significantly improve the cost advantage of many manufacturing sectors in the region. Specifically, the unconventional oil and gas revolution means that natural gas prices in North America are roughly one-third of what they are in Europe and one-fifth of what they are in Japan and the rest of Asia. This alone is a huge competitive stimulus to some industries, such as chemicals. Plausible assumptions about increasing natural gas exports from North America to the rest of the world will not significantly erode this competitive advantage.

In addition, IHS estimates that low natural gas costs will contribute to a 10% drop in electricity costs in the near term in the United States. This, along with lower energy prices and feedstock costs, will help industries such as organic chemicals, resins, agricultural chemicals, petroleum refining, metals (such as iron and steel), and machinery—along with industries that use these products. Evidence of an ongoing “manufacturing renaissance” brought on by these strong competitive boosts includes the creation of millions of new jobs, the attraction of nearly $200 billion of new capital (including overseas capital) into the newly attractive industries, and a significant reduction of US energy imports and the US trade deficit. In a series of studies carried out over the past year, IHS has detailed the positive impacts on the US economy of the unconventional oil and gas revolution.

Unfortunately, some European countries (notably Germany) run the risk that their energy policies—designed to increase the share of renewable energy sources—are increasing costs and creating a competitive challenge for their manufacturing industries. Analysis by IHS shows that growth and jobs can suffer significantly when industries are subjected (owing to either policies or market forces) to such cost disadvantages.

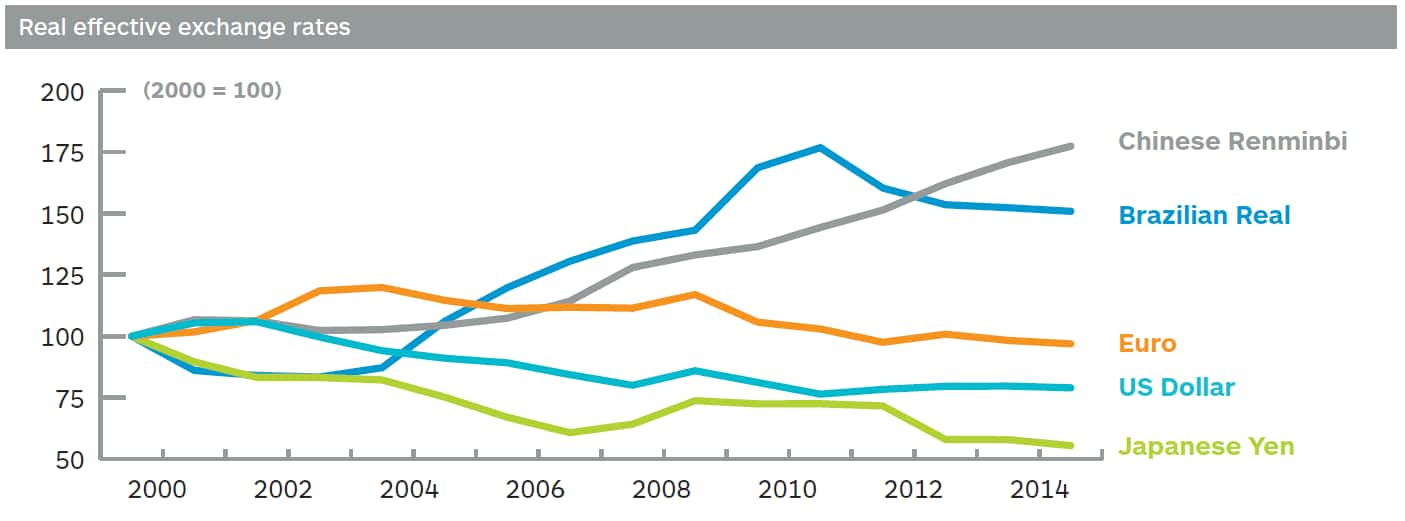

Exchange rates—Both a symptom and a cause When talking about competitiveness, many policymakers and businesses (especially in the emerging world) focus on exchange rates. This can be very misleading. To begin with, much of the discussion is about bilateral exchange rates (e.g., versus the dollar or the euro). Since countries trade with a large number of partners, multilateral, trade-weighted measures of exchange rates provide a more complete picture. Moreover, since competitiveness by these measures can be eroded either by currency appreciation or by higher (domestic) inflation, even these trade-weighted measures give only a partial picture. A more accurate measure of the impact of exchange rate movements on competitiveness is obtained by adjusting trade-weighted exchange rates for relative rates of inflation—what economists call a “real effective” exchange rate.

While there has been much talk in recent years of “currency wars” from the finance ministers of some of the large emerging markets, the currencies of most of these economies have been appreciating relative to those of the developed world for some time—since 2000, on a real effective basis. This has little to do with quantitative easing by the US Federal Reserve, the European Central Bank, and the Bank of Japan since 2008 and much more to do with the simple fact that, compared with advanced economies, the emerging markets have been growing faster and their inflation and interest rates are higher. Moreover, the “panic taper” and ensuing capital flight from emerging markets, which began in May 2013, has caused a precipitous drop in some currencies (notably the Brazilian real, Indian rupee, Indonesian rupiah, South African rand, and Turkish lira) and has reversed some of the earlier appreciation—and created a different set of headaches (including rising pressures on inflation and interest rates).

Nevertheless, appreciating exchange rates can be major competitive challenge. The most effective ways for countries to deal with such challenges is by improving the fundamental drivers of their competitiveness rather than employing measures such as capital controls and currency intervention, whose impacts tend to be limited and short-lived.

Ease of doing business—Even more important when competitiveness is being eroded Competitiveness also has many other dimensions, including nonpecuniary ones. These encompass quality of infrastructure, regulatory and tax frameworks, enforceability of contracts, red tape, barriers to competition, subsidies, corruption, and other factors. The World Bank has tried to measure these in an “ease of doing business” index. By this measure the developed economies are much more business friendly (competitive) than their emerging market counterparts. For example, in its 2014 survey the World Bank ranks the United States, United Kingdom, Germany, and Japan in the top 30 countries in terms of ease of doing business. On the other hand, none of the large emerging markets is ranked above 90. That said, the business environment in many of the world’s most advanced economies can also be challenging—including the risks associated with litigation and regulation in the United States, onerous tight labor laws in Europe, and barriers to competition in Japan.

When the global economy was booming and emerging markets were viewed positively (both as growth locomotives and as strong competitors), many companies were willing to tolerate a more challenging business environment in the developing world. However, with growth in the emerging economies slowing and their competitiveness eroding, this tolerance is being severely tested.

The challenges ahead The dramatic changes in competitiveness over the past few years have mostly favored the developed world (and North America in particular). There is no room for complacency in these markets, however, and the pressure to boost productivity and rein in costs will remain relentless. The advanced economies will need to ease up on wage compression (which only has short-term competitiveness benefits) and focus instead on technology investments, which will both improve workforce productivity and develop new business opportunities. Meanwhile, the challenge for the emerging world may be even greater— notwithstanding that these countries may continue to offer growth and sourcing opportunities for multinational corporations. To sustain the strong growth rates these economies enjoyed in the decade of the 2000s, they will have to enact sweeping (and politically challenging) reforms to boost productivity, keep costs in check, and reverse their deteriorating competitiveness. The race for global economic advantage has become much tougher— and countries will have to run harder just to stay in place.

IHS Chief Economist, Nariman Behravesh, will be a participating speaker and panel leader at CERAWeek 2014. The 33rd annual premier energy industry event will be March 3-7 at the Hilton Americas—Houston. Additional CERAWeek content will be available on Twitter.

Posted 13 February 2014

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-trends-in-global-competitiveness-energy-costs-are-an-important-new-game-changer.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-trends-in-global-competitiveness-energy-costs-are-an-important-new-game-changer.html&text=Recent+trends+in+global+competitiveness%3a+Energy+costs+are+an+important+new+game+changer","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-trends-in-global-competitiveness-energy-costs-are-an-important-new-game-changer.html","enabled":true},{"name":"email","url":"?subject=Recent trends in global competitiveness: Energy costs are an important new game changer&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-trends-in-global-competitiveness-energy-costs-are-an-important-new-game-changer.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Recent+trends+in+global+competitiveness%3a+Energy+costs+are+an+important+new+game+changer http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-trends-in-global-competitiveness-energy-costs-are-an-important-new-game-changer.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}