Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 01, 2023

Recent Highlights from Global Power and Renewables Research: Carbon regulation, energy transition finance and power demand balance

The following provides a brief overview of selected reports in the Global Power and Renewables service recently published research. Learn more about our Global Power and Renewables Service and the reports featured in this post.

As the impacts of climate change become increasingly tangible, regulatory action and market dynamics are swiftly reshaping the global energy landscape. In the face of rising temperature and extreme weather events, governments worldwide are ramping up their greenhouse gas (GHG) regulations, steering carbon markets toward more ambitious mitigation commitments. Concurrently, the financial landscape is rapidly adapting to support an accelerating energy transition, leading to unprecedented growth in clean energy investments. As North America and Europe emerged from colder months, the onset of heat waves placed stress on energy systems in Asia. Reflecting on these momentous developments, 2023 emerges as a transformative year, marked by evolving regulations, investment trends and energy market dynamics.

The following reports provide a deep dive into these critical issues, illuminating the intricate pathways of our global energy transition journey.

Evolving global greenhouse gas regulations and carbon markets

In response to the mounting challenges of climate change, governments worldwide are undertaking revisions of their greenhouse gas (GHG) regulations, thereby emphasizing the growing significance of rigorous climate policies. According to the client report US EPA releases long-awaited GHG regulations for fossil fuel-fired power plants, as per the recently released GHG regulations by the US Environmental Protection Agency (EPA), the projection suggests a reduction of 617 million metric tons of carbon dioxide (MMtCO2) between 2028 and 2042 from both new and existing fossil fuel-fired units. As this regulation will provide support for emissions reductions that would ordinarily be driven by economic factors, S&P Global Commodity Insights forecasts an acceleration of retirement and replacement with combustion turbine capacity or battery storage in coal-fired capacity. Details of the rule and power market implications can be accessed in this report: EPA's proposed GHG regulations for power plants — An accelerated role for hydrogen and carbon capture?.

In tandem with these policy developments, carbon markets have transformed significantly. The need for effective carbon pricing mechanisms has never been more apparent as they are critical in driving investment toward low-carbon technologies and practices. This has prompted a wave of design and reform initiatives across the globe's carbon markets, as policymakers grapple with the task of aligning market mechanisms with the urgency of climate action.

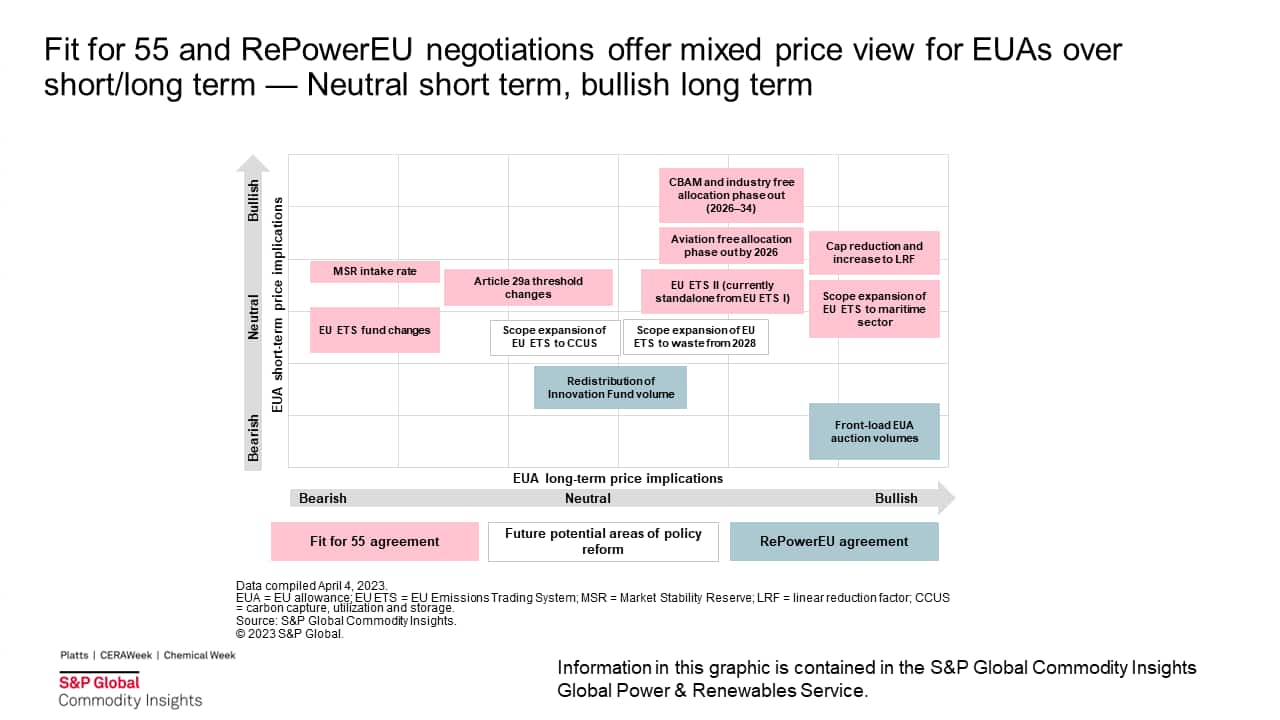

In Europe, the recently concluded negotiations on revisions to the carbon market and the new Carbon Border Adjustment Mechanism (CBAM) offer a mixed price view for carbon prices over the short or long term, according to our recent Dusseldorf Energy Briefing: Expansion and reform of carbon markets — Helping drive the energy transition but with challenges.

In China, the carbon offset market is growing rapidly. According to In the time of net-zero: China's evolving role in carbon offset markets, heightened domestic climate ambitions will increase consumption of offset credits and reduce China's available supply of carbon offset credits to the international market. China is likely to shift from the supply side to the demand side in the global carbon offset market.

In India, the Ministry of Power (MOP) released a draft on the Carbon Credit Trading Scheme (CCTS) with the aim to establish a framework for the Indian carbon market (ICM), according to How can India improve on its draft carbon market framework to build stakeholder confidence? As the market design is at an early stage, S&P Global Commodity Insights suggested that the current market design could benefit from increasing participation, improving coordination, clarifying norms and incentivizing credit exports.

Globally, evolving power market designs and supply mix lead to changing carbon intensity of grids. S&P Global Commodity Insights shows the evolution of grid emissions by market quantitatively overtime in expert video How carbon intensive is your electricity?

Financing and investing in a fast-transitioning energy world

In this high-stakes low-carbon race against time, capital allocation decisions will shape our future energy landscape. Policymakers' commitments and regulatory changes can set the stage, but it is the flow of finance and investment that will truly determine the pace and scale of the energy transition.

How will global investments in clean energy evolve to 2030? provides a quantitative analysis of how investments in clean energy are set to rapidly expand globally. In this brief video, S&P Global Commodity Insights forecast global capital expenditure in zero-carbon technologies to surpass $700 billion annually during the next seven years — about 35% more than was spent in 2022.

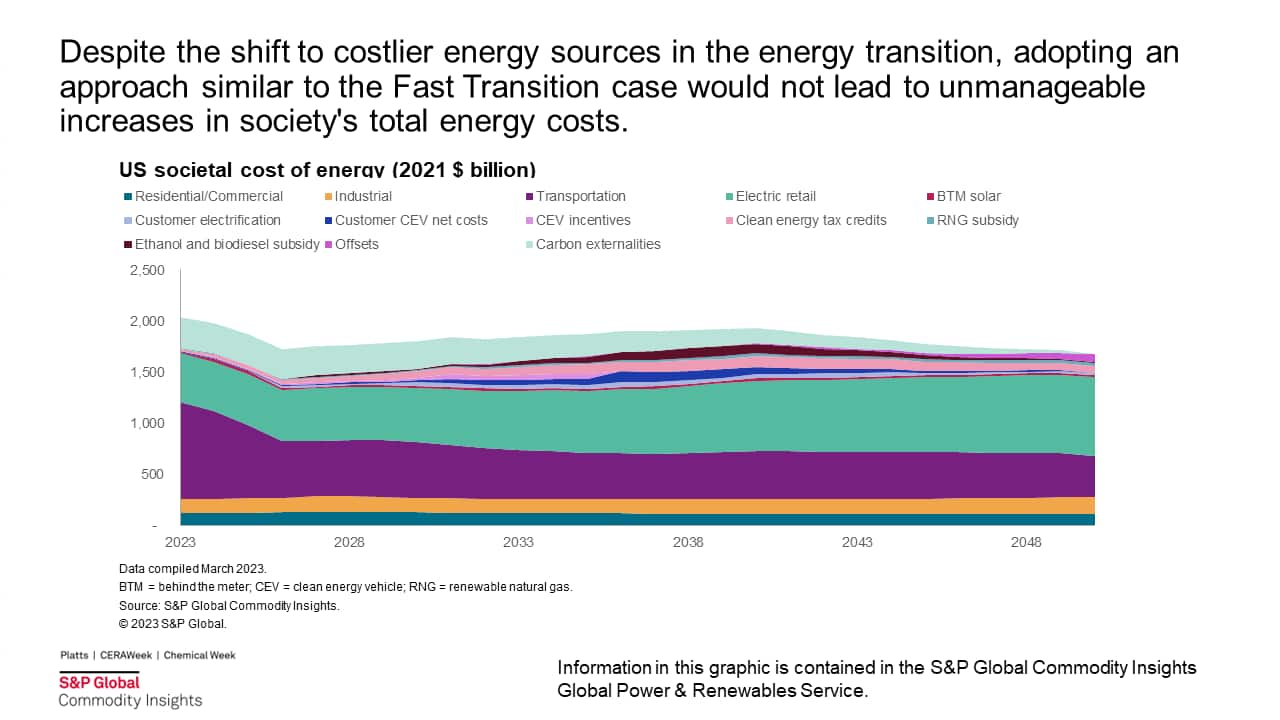

The debate in the US economywide transition to net-zero is revolving around the cost of energy transition. Irrespective of whether we factor in the price of carbon externalities, or the reality of shifting toward more expensive energy sources, the overall societal cost resulting from the energy transition will not pose a significant barrier to its progression, according to The US energy transition: How much will it cost?

In the United States, utility companies also have strong ongoing growth plans through the medium term, mostly focusing on regulated business lines, according to North American power: While operating profit of utilities increased, rising costs dampened operating margins in 2022. While existing generation capacity for the peer group is centered on fossil fuels, planned future additions are heavily focused on renewables, pointing to a further shift in the generation mix toward these technologies.

In Latin America, almost all countries in the region have announced and are envisioning a share of the future global hydrogen market. Despite the numerous policies and announcements, not all countries are well prepared for scaling up hydrogen projects, according to Leaders and laggards in Latin America green hydrogen race, Countries that have better renewable resources, close port infrastructure to renewable generation, access to finance and government ambitions are better positioned in implementing green hydrogen projects.

In Asia, corporate power purchase agreement (CPPA) activity slows in the first quarter of 2023, according to Asia Pacific renewable corporate power purchase agreement — Q1 2023. Despite the slowdown of deals, a record level of new corporations signed their first CPPA in the region.

Thermal ups and downs with power demand and supply dynamics

Coming out of the 2022-23 winter, many energy markets around the world are displaying a reassuring configuration of low demand and sustained supply, reflecting in prices. Seasonal normal weather conditions will deliver stable year-on-year demand. But at times of extreme weather conditions, the balance between supply and demand becomes a complex dance, impacted by a host of factors including fluctuating fuel prices, renewable energy generation and evolving consumption patterns.

The European gas and power market has reflected historically high surplus gas storage, low power prices, low demand, improved infrastructure and sustained LNG supply, according to the recent presentation Dusseldorf Energy Briefing: European gas and power market short-term dynamics — Is the crisis over?. Despite the short-term comfort, following a winter of unseasonably low snowfall, hydro generation remains uncertain and demand-side response will be a crucial tool to help balance the power and gas markets.

In the long term, Europe will witness more than doubled power demand to 2050, driven by electrification of transport and residential sectors. According to S&P Global Commodity Insights Düsseldorf Energy Briefing, April 2023: European long-term gas and power outlook, power will gradually take center stage as Europe decarbonizes, while the natural gas supply and demand balance become more volatile.

In Asia, gas-fired power generation has exhibited remarkable stability over the past five years, until the heat wave hit the region recently. According to the client report Asia's gas-fired power generation remains remarkably stable, significant year-on-year variations within individual markets have typically been counterbalanced by changes in other Asian markets, leading to an overall stable regional output. Recently, however, this equilibrium has been disrupted as several Asian countries have experienced heat waves and droughts owing to El Niño, necessitating a surge in power generation to meet increased demand. Detailed insights into the power demand and generation in Japan, Bangladesh, Vietnam and Malaysia during these extreme weather events can be found in the following reports:

- Japanese power demand scenario with higher-than-normal temperatures for Q3

- Bangladesh shuts its largest coal-fired power plant amid heat wave

- Vietnam's heat wave increases power demand

- Peninsular Malaysia's coal-fired power generation maxed out

Learn more about our Global Power and Renewables research.

Qingyang Liu is a research analyst with the Global Power and Renewables team at S&P Global Commodity Insights.

Posted on 1 August 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-highlights-from-global-power-and-renewables-research.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-highlights-from-global-power-and-renewables-research.html&text=Recent+Highlights+from+Global+Power+and+Renewables+Research%3a+Carbon+regulation%2c+energy+transition+finance+and+power+demand+balance+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-highlights-from-global-power-and-renewables-research.html","enabled":true},{"name":"email","url":"?subject=Recent Highlights from Global Power and Renewables Research: Carbon regulation, energy transition finance and power demand balance | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-highlights-from-global-power-and-renewables-research.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Recent+Highlights+from+Global+Power+and+Renewables+Research%3a+Carbon+regulation%2c+energy+transition+finance+and+power+demand+balance+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frecent-highlights-from-global-power-and-renewables-research.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}