Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 25, 2013

Reasons for Optimism in the Tuscaloosa Marine Shale, Unconventional Tight Oil

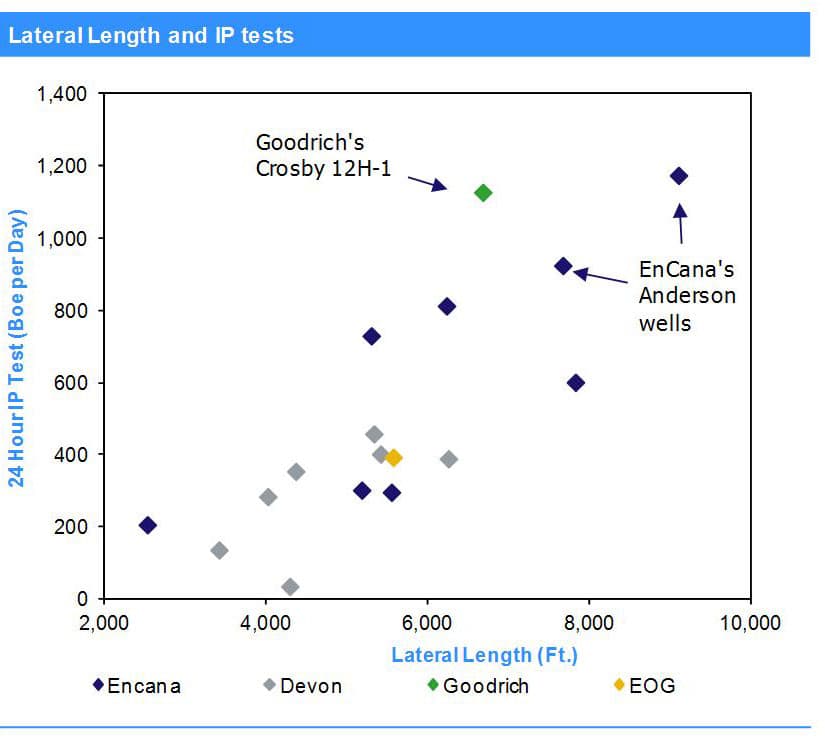

Long and strong beats short and weak Admittedly, early well results in the Tuscaloosa Marine Shale were not very good. In fact, they were uneconomic. However, the industry has persevered and recent results have been encouraging. Early drilling results came in at around 400 b/d on average for a peak monthly rate. But during the second half of 2012 and early 2013, Encana Corp and Goodrich Petroleum reported results about twice as good from the Anderson 18H, Anderson 17H, and Crosby 12H wells. Analysis of the well completion methods in the play by IHS Herold confirms Goodrich Petroleum's explanation for the improvement: wells drilled with longer laterals with more and stronger hydraulic fracturing applications (as measured by amount of proppant) are responsible for delivering stronger well results.

Commerciality declaration premature Our analysis indicates that these improved wells are economic. The downside at this point is that the three wells are a very small sample, and therefore more drilling success is needed before we can feel comfortable declaring the Tuscaloosa Marine Shale is an economically viable play. We would also like to see a longer production history from those existing good wells to increase our confidence in our type curve analysis and a better understanding of decline rates. The industry is currently projecting estimated ultimate recoveries (EURs) of between 400,000 and 800,000 barrels per well in this play. Our analysis comes closer to the 400,000 to 600,000 barrel range, with the bottom being marginally economic at best.

Figure 1 Tuscaloosa Marine Shale Lateral Lengths and IP Test Rates Source: IHS Herold

High oil content the main attraction The Louisiana State University Basin Research Institute study concluded that the Tuscaloosa Marine Shale could hold upwards of 7 billion barrels of recoverable oil. The play is located in Louisiana and Mississippi, so the oil production priced is off of Louisiana Light Sweet pricing, which in recent times has received a generous premium to WTI. We believe the size of the oil prize and premium pricing should provide sufficient incentive for the industry to continue to explore this challenging opportunity. The formation's geological relationship to the successful Eagle Ford Shale in neighboring Texas is yet another reason exploration managers can be encouraged to stick with the play longer than they might otherwise.

Plenty of catalysts in 2013 The existing sweet spot is limited by the three top wells to Amite and Wilkinson counties in Mississippi. Obviously, to approach the 7 billion barrels of potential the sweet spot in the play will have to be greatly expanded. The industry will be actively exploring the play this year, and several interesting wells are either drilling or permitted. These include but are not limited to Goodrich's Smith well and Encana's two Anderson appraisal wells. Success with the this year's drilling should go a long way to a commerciality decision in the existing sweet spot, which would be material to Encana and a potential game changer for Goodrich.

Entry opportunities still exist Devon Energy is offering for sale its 300,000 net acres prospective for the Tuscaloosa as we reported in IHS Herold. Anadarko is selling an Austin Chalk package that also has Tuscaloosa potential. And while Goodrich is not currently looking for a JV partner, management has suggested that this might be the strategic direction the company takes in 2014, following further de-risking of the play in 2013. Any potential transactions would be important benchmarks for the play.

Posted 25 June 2013

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freasons-for-optimism-in-the-tuscaloosa-marine-shale-unconventional-tight-oil.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freasons-for-optimism-in-the-tuscaloosa-marine-shale-unconventional-tight-oil.html&text=Reasons+for+Optimism+in+the+Tuscaloosa+Marine+Shale%2c+Unconventional+Tight+Oil","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freasons-for-optimism-in-the-tuscaloosa-marine-shale-unconventional-tight-oil.html","enabled":true},{"name":"email","url":"?subject=Reasons for Optimism in the Tuscaloosa Marine Shale, Unconventional Tight Oil&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freasons-for-optimism-in-the-tuscaloosa-marine-shale-unconventional-tight-oil.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reasons+for+Optimism+in+the+Tuscaloosa+Marine+Shale%2c+Unconventional+Tight+Oil http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freasons-for-optimism-in-the-tuscaloosa-marine-shale-unconventional-tight-oil.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}