PV installation forecast in China lowered in 2019 but global forecast of 129 GW in 2019 remains unchanged

On October 29th, the China National Energy Administration (NEA) released cumulative connection data for the first nine months of 2019 of 15.99 GW, which includes 52% DPV and 48% of ground mount projects. This represents a decrease of 54% Y-o-Y for the first three quarters. Numbers for Q3 2019 were lower than anticipated in China confirming what IHS Markit PV Market Trend Survey - China (report available to Connect™ subscribers) announced in its October edition, which indicated that a large part of the Q3 2019 PV demand had been postponed to Q4. Participants still forecast a large increase in demand in Q4 (+134%) but are increasingly pessimistic about the total size of the Chinese market this year (-10% from September edition).

The Q3 2019 data reported from the NEA was the lowest quarterly connection number since 2017. One of the most significant datapoints is that the residential sector was the main driver of demand in the third quarter. IHS Markit anticipated the total 2019 residential installations would surpass the quota, and with the latest published data, we are now forecasting over 5 GW of residential installations this year in China.

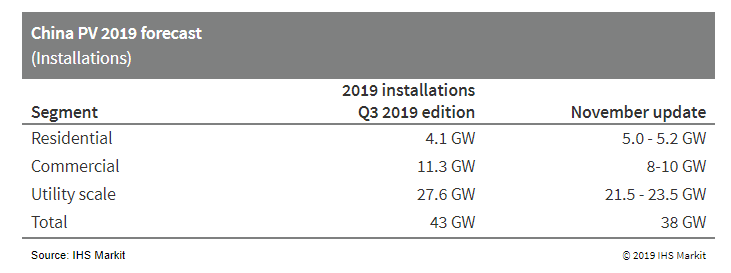

IHS Markit is still confident that Q4 2019 will be the largest quarter in China this year. However, delays in the market demand increasing and the lack of hard deadlines for large ground installations have made us review our installation forecast for China 2019 and resulted in downward adjustments of 5 GW. Our data does not refer to connection data, which will be less than IHS Markit installation forecast due to the 1-3 average month delay connecting utility scale PV in China and as a result connection could be below 30 GW in China this year.

Figure 1: China PV 2019 forecast

There are several reasons why the China installations be lower in 2019:

- Policy delay: The delayed confirmation of several has generated extreme uncertainty across manufacturers and developers and a prioritizing of international markets.

- Component costs are expected to decrease in H1 2020.

- Demand from International markets is stronger than ever and prices in overseas markets are higher than in the domestic market which forces manufacturers to prioritize international orders.

- Change of major development players and investment

moneymoving to wind. While analyzing

quarterly power investment trend in China, wind investment growth

rate has significantly increased in the first three quarters of

2019.

IHS Markit still forecasts 129 GW of global installations this year and 24% solar market growth Y-o-Y. Our current assumption is that this 5 GW decrease in demand in China will be balanced out by faster than anticipated growth in some other international markets. These markets could include the Netherlands, Spain, Germany, Italy, Turkey, or Ukraine. Furthermore, there is a considerable upside market potential in the APAC region outside of China, several South American markets, as well as in South Africa.

So, what is the impact on the supply chain? International markets are maintaining stable demand and we do not anticipate the delay in Chinese installations to have any additional price impact on international markets this quarter. Price pressure in China, especially for multicrystalline products that are facing an increasingly lack of interest in the market, means Chinese manufacturers still have a large capacity for cells for this technology (we are forecasting an acceleration of monocrystalline penetration next year).

In summary, Q2 2020 was already anticipated to be a difficult quarter for the module supply chain with lower global demand and increased capacity. Lack of visibility for strong global demand in Q2 2020 and additional capacity of cells and modules to be ramped up in H1 2020 will impact the entire supply chain and initiate another cycle of margin compression.

Visit our website for more information on solar and energy storage.

Edurne Zoco is a Research Director for Solar & Energy Director for IHS Markit.

Posted 8 November 2019