Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 18, 2020

Pressure mounts to allow new players to procure renewable power in South Africa

Small-scale customers in residential and commercial segments, as well as industrial consumers and municipalities, are exerting pressure on South Africa's government to review the options for enabling independent power generation, particularly from renewable sources.

Rising electricity tariffs amid high risks of discontinued power supply from the main grid have spurred a number of private consumers to look for self-consumption alternatives and enhance their power security at times when the utility is unable to provide this service.

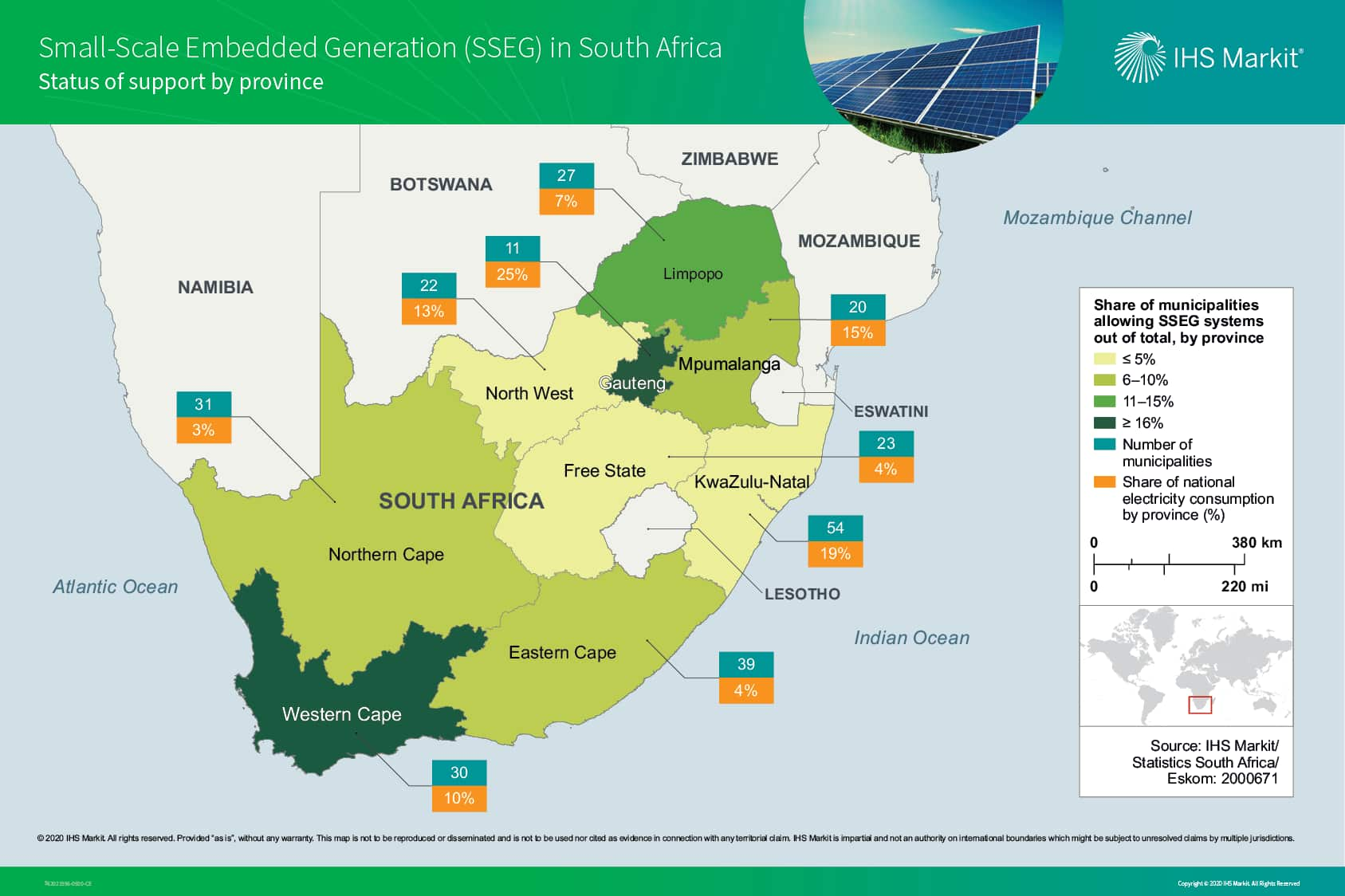

Over the past year, small steps have been taken to complete the regulatory framework for Small-Scale Embedded Generation (SSEG) of up to 10 MW, as well as the regulatory framework governing non-utilty procurement of larger projects. Changes are enabling participation beyond the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), but implementation of larger self-generation systems is still challenging, particularly among industrial customers.

Solar PV, in particular offers the most attractive option as its costs have declined steadily and small PV systems have been the preferred option for self-consumption among residential and commercial consumers, as well as for larger systems meeting industrial demand, such as mining. However, the economic recession caused by the COVID-19 pandemic will likely delay the ramp-up of distributed systems in the near term.

Declining technology cost drives attractiveness of PV solutions

IHS Markit simulated the cost of transitioning to a PV system for a high-income residential customer and a large commercial customer in Cape Town, one of the municipalities in Western Cape that allows SSEG and has distinct embedded tariffs.

Under the Cape Town embedded generation regime, a hybrid customer pays higher network charges than if supplied by the grid only. However, being partially supplied by the PV system, a hybrid household customer's monthly consumption level is very likely to sit at the low-consumption band, thus paying a lower energy tariff per unit. This result suggests that reduced dependence on grid power in the context of declining PV costs could make the PV-based self-consumption option increasingly attractive.

The economics improve when the end customer is a commercial player such as a shopping mall. In this case, the hybrid option is below grid parity owing to cost benefits of economies of scale and more attractive financing options for the investor.

Consumers still prefer the security of grid connection and are likely to remain on the central network despite the inherent fixed grid charges that vary according to customer class. Battery storage could increase reliability, but costs are still prohibitive for an average South African resident.

Large industrial consumers also claim the right to produce their power

Self-generation assets are deemed essential for local industrial producers whose operations were heavily affected by load shedding before COVID-19. Industrial and mining companies are more keen to develop utility-scale projects (above 5 MW) owing to higher power needs' and thus, the ability to benefit from economies of scale, particularly when leveraging capital from their balance sheet.

The latest IHS Markit forecast estimated that this system category is projected to amount to net capacity additions of almost 3 GW of PV and about 5 GW of onshore wind through 2030, as well as an additional 11 GW of utility PV and more than 15 GW of wind capacity between 2030 and 2050. Although the engine of these new additions will continue to be the REIPPPP, if a regulation that enables direct PPA sales is implemented, initiatives by commercial and industrial clients as well as municipalities could facilitate faster implementation of renewable projects.

To learn more about our renewable energy research, visit our Global Power and Renewables service page.

Silvia Macri is a principal researcher with the IHS Markit energy global power and renewables group.

Raul Timponi is an associate director at IHS Markit who specializes in global power markets.

Posted 18 September 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpressure-mounts-to-allow-new-players-to-procure-renewable.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpressure-mounts-to-allow-new-players-to-procure-renewable.html&text=Pressure+mounts+to+allow+new+players+to+procure+renewable+power+in+South+Africa+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpressure-mounts-to-allow-new-players-to-procure-renewable.html","enabled":true},{"name":"email","url":"?subject=Pressure mounts to allow new players to procure renewable power in South Africa | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpressure-mounts-to-allow-new-players-to-procure-renewable.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pressure+mounts+to+allow+new+players+to+procure+renewable+power+in+South+Africa+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpressure-mounts-to-allow-new-players-to-procure-renewable.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}